Why Most Breakouts Fail

Smart Money Uses Breakouts for Liquidity

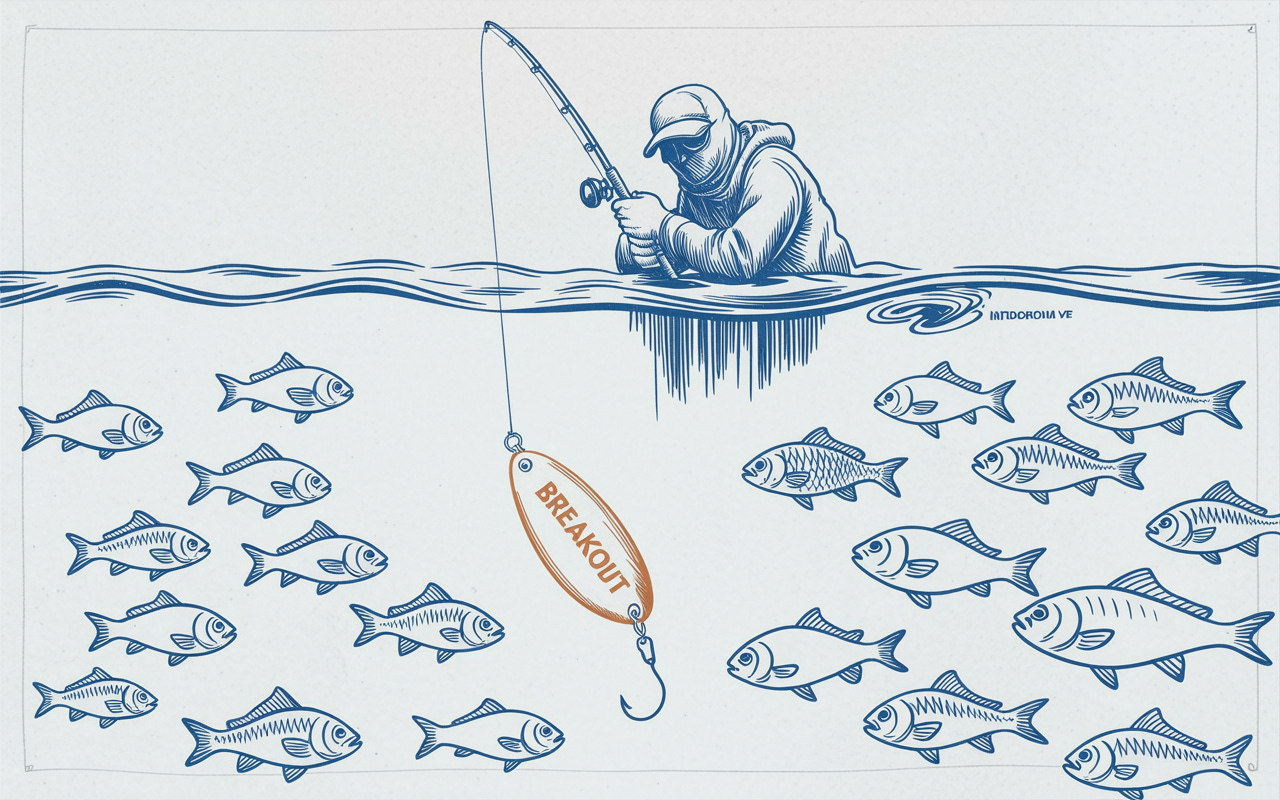

Every trader dreams of catching the perfect breakout. The chart looks clean, momentum is building, and volume spikes confirm the move. Yet, a few hours later, the breakout fails and you get frustrated.

Most breakouts fail because for 3 reasons:

1. Smart Money Uses Breakouts for Liquidity

When a market approaches a key level (such as a prior high or a round number) traders anticipate a breakout. Buyers and sellers both put their orders around that level.

So once price touches that level, those orders all trigger together creating a short-term burst of liquidity that institutions take advantage of.

This is why you see quick movements and increased volume around key levels.

Institutions know retail traders love breakout levels so they use those moments to offload inventory or build positions in the opposite direction.

For example, if institutions have been accumulating shares quietly within a range, they may let the breakout occur and then sell into that strength.

Likewise, during downtrends, funds may let price break support to trigger panic selling and then accumulate shares at better prices.

The breakout serves their purpose: it creates liquidity for large orders to execute without visible footprints.

2. Breakouts Often Occur in Overextended Conditions

By the time price is pushing through a key level, it’s usually been trending hard already. Momentum traders pile in, RSI readings spike, and the short-term move becomes overbought.

That means the breakout happens after most of the move has already occurred. Momentum exhaustion sets in which is the worst possible time to enter.

The market then mean-reverts to digest the prior move, punishing late buyers and rewarding those who fade extremes.

3. Breakouts Often Occur When The Stock is Crowded

A crowded trade happens when too many people are making the same trade at the same time.

Even the Best “Breakout Traders” Only Win Half the Time

Even the most disciplined and experienced breakout traders in the world (I’m talking about the ones that have won trading championships) admit that only about 45% of their trades actually work.

That statistic surprises most beginners, but it reveals breakout trading isn’t about being right often; it’s about making more when right than you lose when wrong.

The edge comes from position sizing, risk control, and timing exits, not from predicting every breakout perfectly.

A 45% win rate can be highly profitable if the average winner is 4 times the size of the average loser.

How to Trade Breakouts More Intelligently

Wait for Retests: The highest-probability breakouts often retest the breakout zone. Buying the pullback to support instead of the initial breakout filters out false moves.

Trade in Context: The breakout should align with a higher-timeframe trend and overall market trend.

Avoid Obvious Levels: Breakouts from overly visible chart patterns (triangle, wedge, double top) attract too many participants and becomes overcrowded.