Stop Being the Sucker in Crowded Trades

crowded trades happen when too many people are making the same trade at the same time

One of the biggest differences between professional hedge funds and retail traders is how they handle crowded trades.

What Makes a Trade “Crowded”

A crowded trade happens when too many people are making the same trade at the same time. It might be everyone buying tech stocks, everyone shorting a particular currency, or everyone piling into the same “safe haven” asset during a crisis.

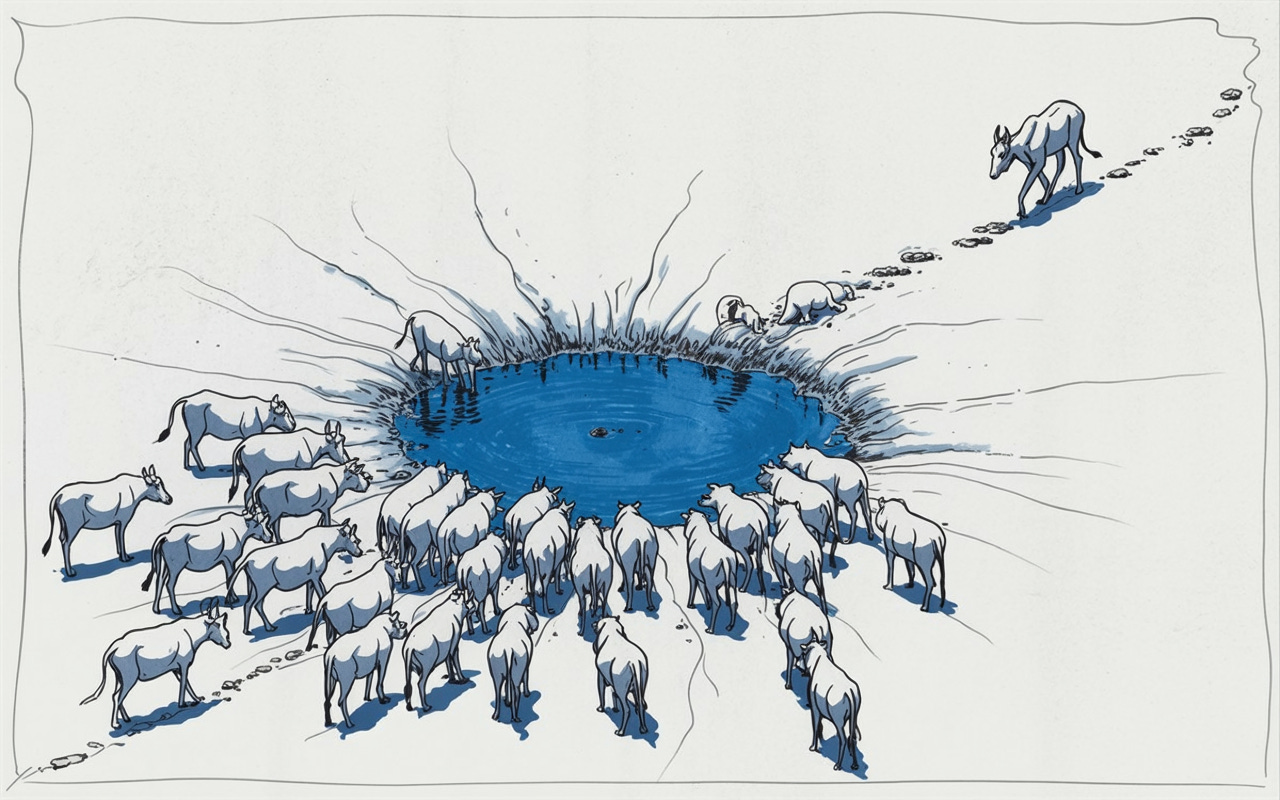

The problem with crowded trades isn’t that the underlying idea is wrong. The problem is that when too many people are positioned the same way, any reason to exit creates a stampede for the door. And since everyone is trying to get out at the same time, prices move violently against the position.

Think of it like a crowded theater when someone yells “fire.” It doesn’t matter if there’s actually a fire or not because the crowd rushing for the exits creates its own disaster. In trading, the crowd trying to exit a position creates its own price collapse, regardless of whether the stock is good or not.

How Hedge Funds Spot Crowded Trades Early

Professional hedge funds have several advantages when it comes to identifying crowded trades before they become dangerous. They have access to data that retail traders never see and sophisticated analytics that track money flows across different strategies. Such data gives them early warning signs of crowding. When they see unusual concentration in specific trades, they know to be cautious about following the crowd.

Why Retail Always Arrives Late to the Party

Retail traders typically learn about “good trades” through financial media, social media, or investment newsletters. By the time a trade idea reaches mainstream retail channels, it’s often already crowded with institutional money.

The information flow works like this: one institution identifies an opportunity, starts positioning, other institutions notice and follow, the trade becomes profitable, financial media picks up the story, and finally retail traders hear about it and want in. But by that point, the easy money has been made and the risk of a crowded trade unwind is at its highest.

Social media makes this problem even worse. When a trade idea goes viral on X or Reddit, it’s almost guaranteed to become crowded quickly. The viral nature of social media creates massive, overcrowded positioning in very short timeframes.

Profiting From the Reversal

The market will always create new crowded trades because human psychology and the structure of information flow haven’t changed.

Understanding crowded trades can actually create opportunities for retail traders who are willing to think contrarily. When everyone is positioned one way, the setup for a reversal becomes very attractive for those willing to bet against the crowd.

Hedge funds regularly profit from crowded trade reversals by positioning against popular trades when the risk-reward becomes favorable. While this requires careful timing and risk management, it can be extremely profitable.

The key is identifying when a trade has become so crowded that any negative catalyst could trigger a massive unwind. This usually happens when positioning is extreme, leverage is high, and the trade has attracted significant retail and media attention.