How High Would the VIX Spike if China Invaded Taiwan?

The Black Swan of 2026

If China launched a full-scale invasion of Taiwan, the VIX would likely experience a massive spike, potentially reaching 60-80+ in the short term, reflecting extreme market uncertainty and panic selling.

Why Such a Dramatic Spike?

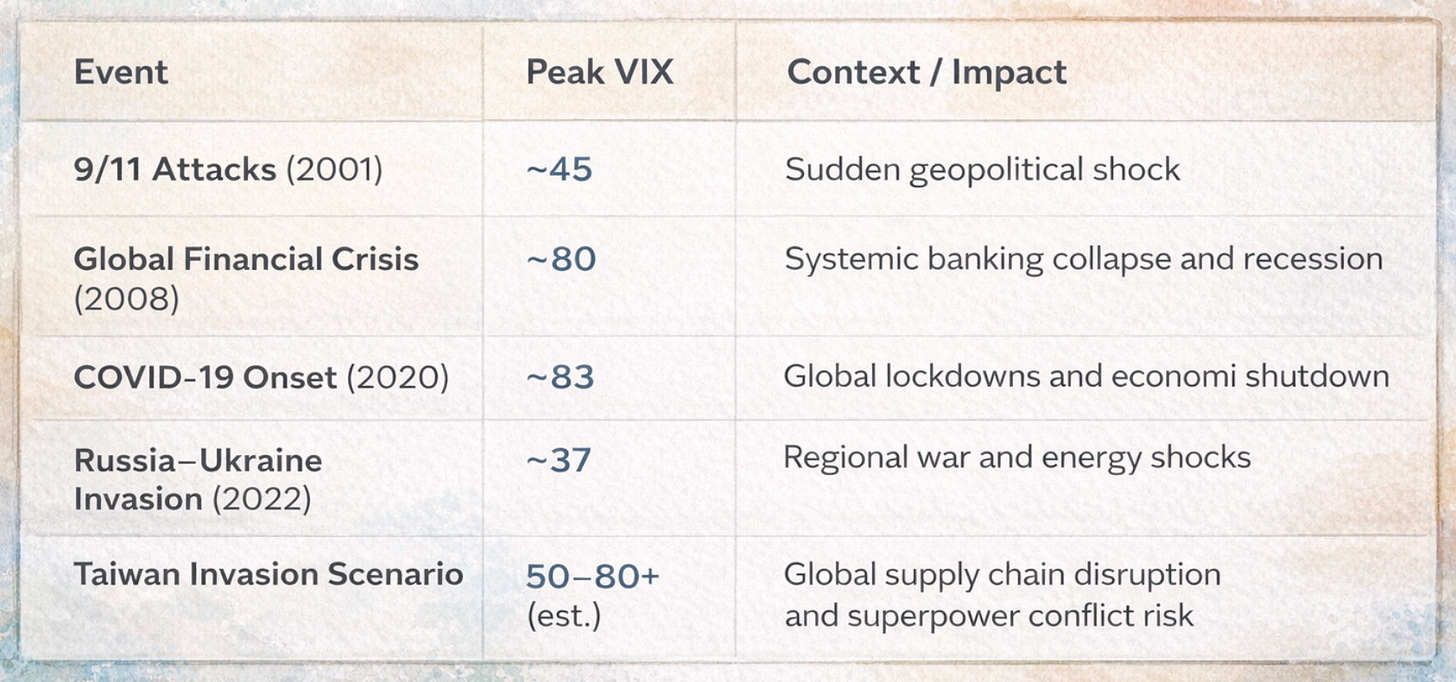

A Taiwan invasion would be a global economic shock far exceeding recent crises like Russia’s invasion of Ukraine (VIX peaked around 37). Key factors include:

Semiconductor supply chain collapse: Taiwan produces ~90% of advanced chips; disruption could halt production in autos, electronics, and tech, leading to trillions in lost output.

Global trade and financial turmoil: Bloomberg Economics estimates a $10 trillion hit to world GDP (~10% of global output), with immediate effects from sanctions, shipping disruptions in the Taiwan Strait, and investor flight to safety.

Escalation risks: Potential U.S./allied intervention, cyber attacks, or broader conflict would amplify fear.

Historical Comparisons for Context

Portfolio Implications for 2026

While the probability of a Chinese invasion of Taiwan probably remains low in 2026, we simply don’t know. This is precisely why investors should consider building convexity into their portfolios heading into 2026. Low-cost, asymmetric protections that perform modestly in calm markets but provide significant upside during extreme stress.

Interesting piece, especially the comparison to the Ukraine invasion VIX peak at ~37. The semiconductor angle is probaly the most underpriced risk here tbh. Back in early 2020 when I was trading vol around supply chain disruptions, even minor shipping delays could spike realized vol significantly. A 90% disruption in advanced chip production wouldn't just be an equity market issue but would cascade through credit markets given how many companies are levered to tech capex cycles. The 50-80 range seems reasonable as a floor, not a cieling.