The Powerful Idea of Volatility Trading

Find mispricings. Wrap convexity around it.

Volatility trading centers on a powerful idea: identify where volatility is mispriced, isolate that exposure, and then wrap a convex trade around it. And the only instrument that allows you to do it cleanly is options.

What Is a Convex Trade?

In simple terms, a convex trade is one where your upside potential expands faster than your downside.

Most traders hold linear positions, like stocks, where a 1% up move gives you a 1% profit. Convex trades, on the other hand, gain compounding value as movement increases.

For example When VIX doubles from 15 to 30, the options on VIX don’t just double, they can 20x. Those options have convexity.

Options are the Engine Behind Convex Trades

Options provide tradable prices on volatility expectations.

When our indicators give us a signal about a possible volatility mispricing, we wrap that idea in an option framework that turns that idea into nonlinear payoff.

Sometimes, even small changes in volatility can lead to outsized profits due to the non-linear nature of option pricing.

But most retail traders miss this. They use options as directional bets. They use them to predict where SPX or TSLA will go next. That’s not volatility trading.

Volatility traders don’t ask, “Will the market go up or down?”

They ask, “Is the market underpricing or overpricing potential movement?”

2 Examples of a Convex Trade

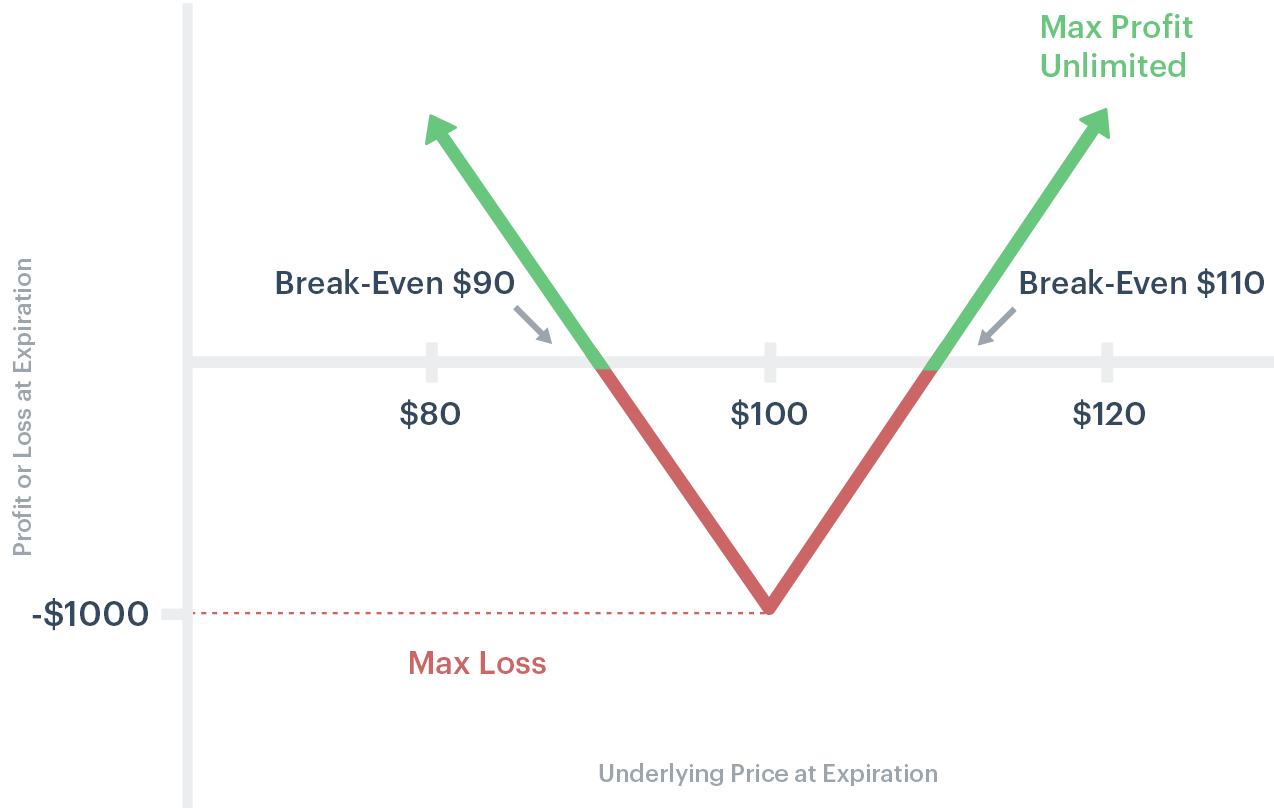

Long Straddle

Setup: Buy an at-the-money (ATM) call and put with the same strike and expiration.

Profits from large moves in either direction. The payoff is V-shaped, convex on both sides.

Long Strangle: Same but cheaper

Setup: Similar to a straddle but with out-of-the-money (OTM) calls and puts (different strikes).

Cheaper premiums mean wider break-even points.

Convexity shines on extreme moves.

At CI Volatility

There’s an infinite number of ways to wrap options around an idea. The simple long straddles or strangles above are just the entry-level examples.

CI Volatility’s approach often involves multi-leg, cross-asset structures designed to shape the exact convex exposure we want.

Sometimes that means combining index volatility with single-name skews, or linking equity vol to commodity vol. Other times, it involves layering spreads across different expiries.

That’s why volatility trading, when done correctly, is closer to engineering than speculation.

The market rewards those who can think beyond simple direction.

Anyone can buy or sell stocks.

Few can wrap convexity around it.