Polymarket's Insider Trading Problem Is Getting Worse and Nobody Cares

Prediction markets were supposed to be the future. A decentralized, market-driven way to forecast events more accurately than polls, pundits, or even the experts. Polymarket, the largest of these platforms, has been celebrated for correctly calling elections, geopolitical events, and economic decisions before the mainstream media caught on.

But the insider trading is becoming impossible to ignore: they’ve become one of the easiest and most consequence-free ways to profit from insider information in the history of financial markets.

The Super Bowl Halftime Scandal

On February 8, 2026, roughly 17 hours before kickoff of Super Bowl LX, an anonymous account appeared on Polymarket. The account was brand new. It had been created the day before. It traded nothing except Super Bowl halftime show contracts. And it proceeded to correctly predict 17 out of approximately 20 available bets on what would happen during Bad Bunny’s performance.

The account wagered over $19,000 that Lady Gaga would appear as a guest performer. It dropped nearly $14,000 predicting Ricky Martin would show up. It placed roughly $36,000 across additional contracts predicting which artists would and would not take the stage.

Statistically, this kind of accuracy across that many independent binary bets is almost impossible through luck or educated guessing.

A separate account was identified that appeared to know Bad Bunny’s actual setlist in advance, placing targeted bets on individual songs shortly before they were performed. That account was also less than 24 hours old and traded exclusively in halftime-related contracts.

Meanwhile, someone else had slammed $500,000 on Lady Gaga appearing before there was any public confirmation she’d be performing. One analyst called the activity around the Super Bowl halftime show “the most egregious and largest-scale insider trading in prediction markets ever,” estimating that insiders may have collectively profited between $2 million and $3 million across multiple platforms.

Polymarket did not publicly comment on any of it.

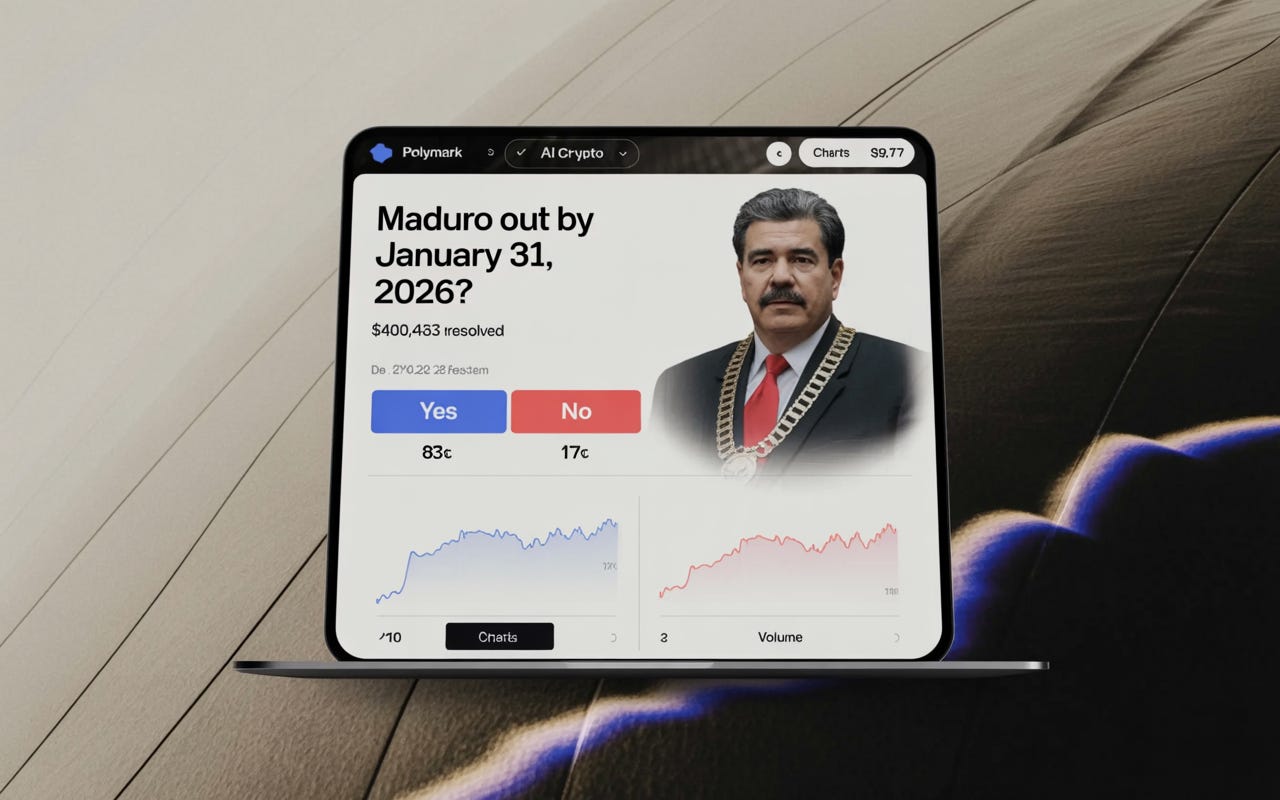

The Venezuela Scandal

The Super Bowl wasn’t even the incident that kicked off the current wave of scrutiny.

A cluster of newly created Polymarket accounts placed large, precisely timed wagers predicting that Venezuelan President Nicolás Maduro would be removed from office. One account turned roughly $32,000 into over $400,000 in less than 24 hours because just hours after the bets were placed, the U.S. military launched an operation that resulted in Maduro’s capture.

Nobody has been able to identify who placed the bet. Blockchain analysts noted the trader was cashing out through U.S. crypto exchanges, suggesting they weren’t even trying to hide. U.S. authorities have remained silent on whether the trade involved someone with access to classified military information or was simply an extraordinarily well-timed wager.

The Israeli Military Scandal

During the 12-day war between Israel and Iran in June 2025, an account known as “ricosuave666” placed multiple high-stakes bets on specific military actions, including which day Israel would launch strikes against Iran. The account earned over $150,000 in profits with remarkable accuracy. It then went dormant for six months before resuming activity in early 2026.

The implications go far beyond financial fraud. As former SEC Commissioner Joseph Grundfest warned, these bets can actually endanger military personnel because adversaries monitoring prediction market movements could potentially detect operational plans before they’re executed.

Think about that for a moment. A platform originally designed to aggregate collective wisdom has become a mechanism through which classified military operations could be telegraphed to enemies, all because someone wanted to make a quick profit.

Why the Stock Market is Safer

Here’s where the comparison to traditional financial markets becomes instructive. In the stock market, insider trading is illegal under SEC rules. Is enforcement perfect? Far from it. The SEC was arguably been less effective than ever last year. But the mere existence of the SEC, the threat of prosecution, the reality of prison sentences, all of these create a deterrent that keeps most people from acting on material non-public information. The penalties are severe enough and the enforcement apparatus visible enough that the vast majority of people who come across inside information never trade on it.

Prediction markets have no equivalent deterrent. None.

Polymarket operates on blockchain infrastructure, allowing pseudonymous participation through crypto wallets. Users can create accounts in minutes with minimal identity verification. There is no SEC equivalent watching for suspicious trading patterns. There is no federal insider trading statute that clearly applies to prediction market contracts. And the platforms themselves have shown little appetite for aggressive self-policing.

Kalshi, Polymarket’s main competitor, recently announced it had implemented features to restrict insider trading and built out an internal integrity monitoring team. That’s a start. But Polymarket itself has been largely silent, not responding to press inquiries, not publicly acknowledging the pattern of suspicious trades, and not announcing any meaningful enforcement actions.

The regulatory picture is further complicated by the political environment. The Trump administration has been openly friendly to prediction markets, dropping Biden-era legal challenges against both Polymarket and Kalshi. Donald Trump Jr. serves as an advisor to both platforms. His venture capital fund has invested in Polymarket.

Rep. Ritchie Torres introduced legislation in January 2026 to crack down on public officials profiting from prediction markets, but nobody expects it to move quickly. Meaningful regulation could take years to materialize, if it ever does.

Prediction markets are peer-to-peer. Unlike a casino where you’re betting against the house, on Polymarket you’re betting against other users.

Every dollar an insider makes comes directly out of the pocket of someone who didn’t have the same information advantage.

The pattern that’s emerging is not subtle. Freshly created accounts appearing hours before major events, placing large concentrated bets with near-perfect accuracy, then going dormant. And it’s not limited to a few isolated incidents.

Every one of these incidents represents a transfer of wealth from regular users to people exploiting privileged information.

Until prediction markets develop meaningful insider trading protections, whether through regulation, platform-level enforcement, or both, every regular user placing a bet on Polymarket should understand what they’re really signing up for. You’re not participating in a fair market. You’re sitting at a poker table where some players can see your cards, and there’s no one in the room who’s going to do anything about it.