The Insider Trading Epidemic of 2025

2025 saw several high-profile cases where unusual trading activity preceded major public announcements, leading to widespread suspicions of insider trading. These often involved significant stock or options moves timed closely with non-public information becoming public.

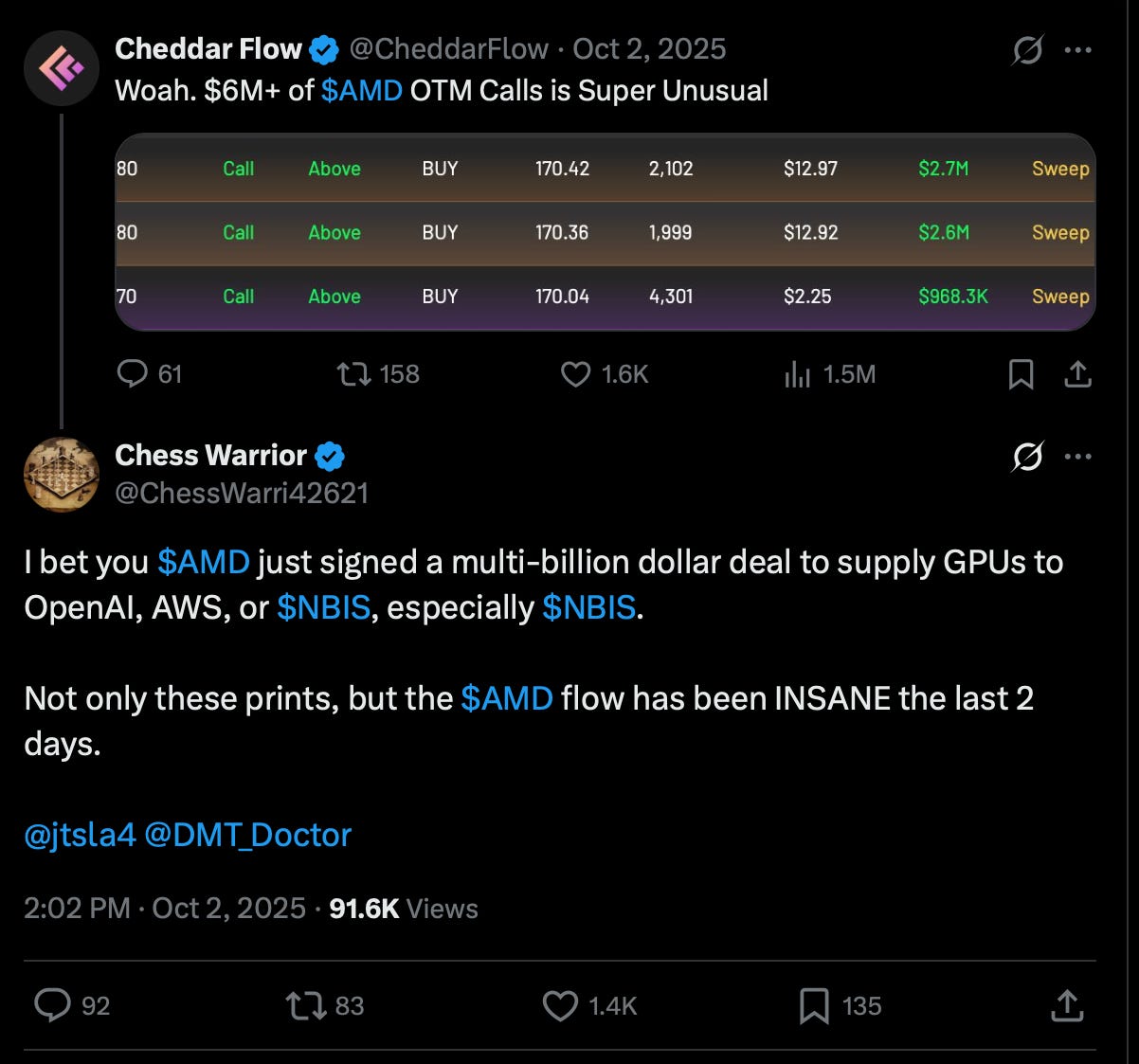

AMD-OpenAI Deal

AMD announced a multi-year partnership with OpenAI for up to 6 gigawatts of AI GPUs, with warrants potentially giving OpenAI a stake; AMD stock rose 35% on the news.

Suspicious activity: 2 days before the official announcement, unusual options flows flagged over $6M in aggressive out-of-the-money call sweeps.

What’s remarkable is one trader by the name of “Chess Warrior” correctly speculated about a imminent multi-billion-dollar GPU supply deal, explicitly naming OpenAI as a likely partner!

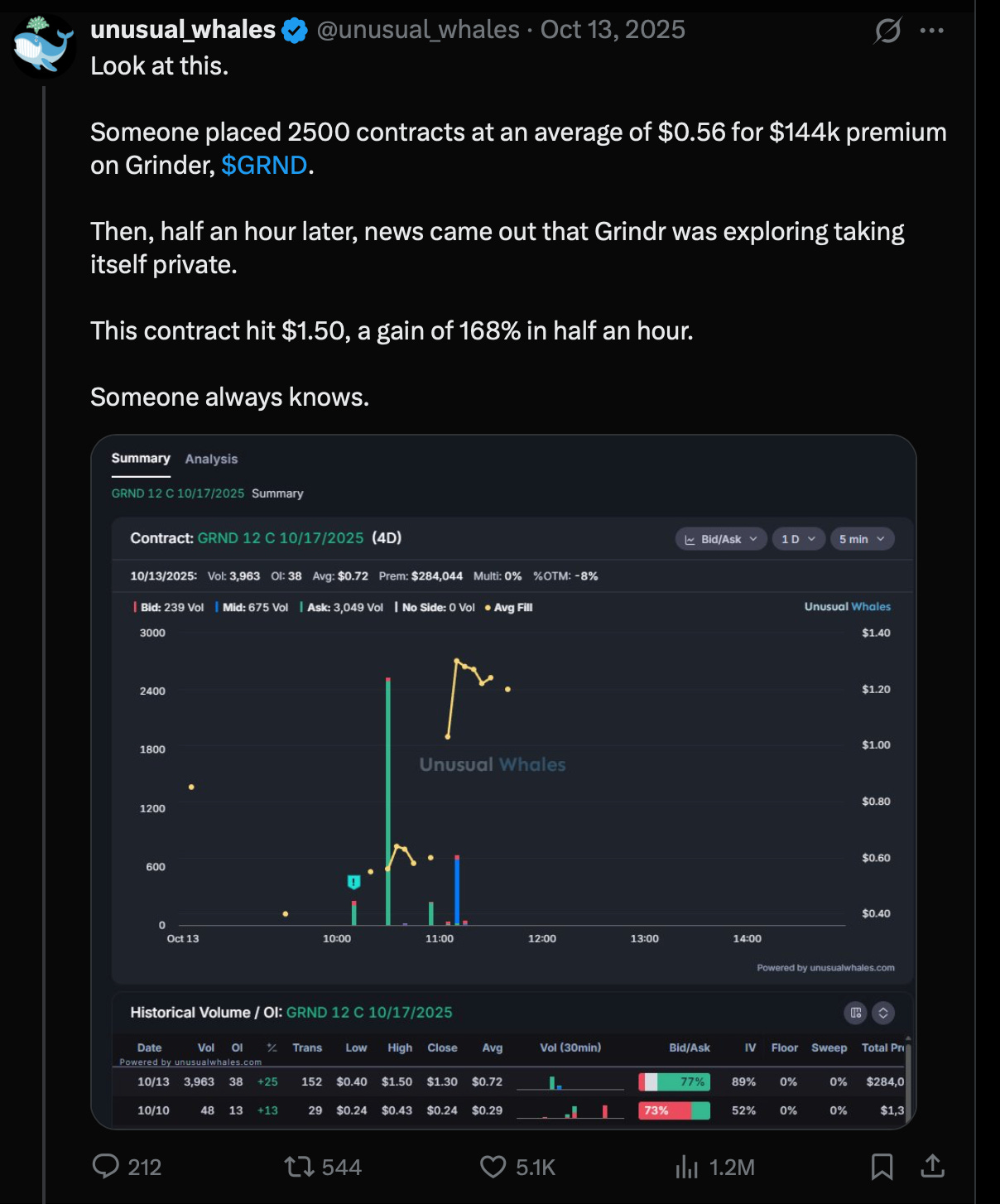

Grindr Exploring Going Private

Grindr announced the possibility of taking the company private.

Suspicious activity: A trader purchased 2500 options contracts at an average price of $0.56 (total premium ~$144,000). Roughly half an hour later, the going-private news broke, sending the contracts to $1.50—a 168% gain in under 30 minutes.

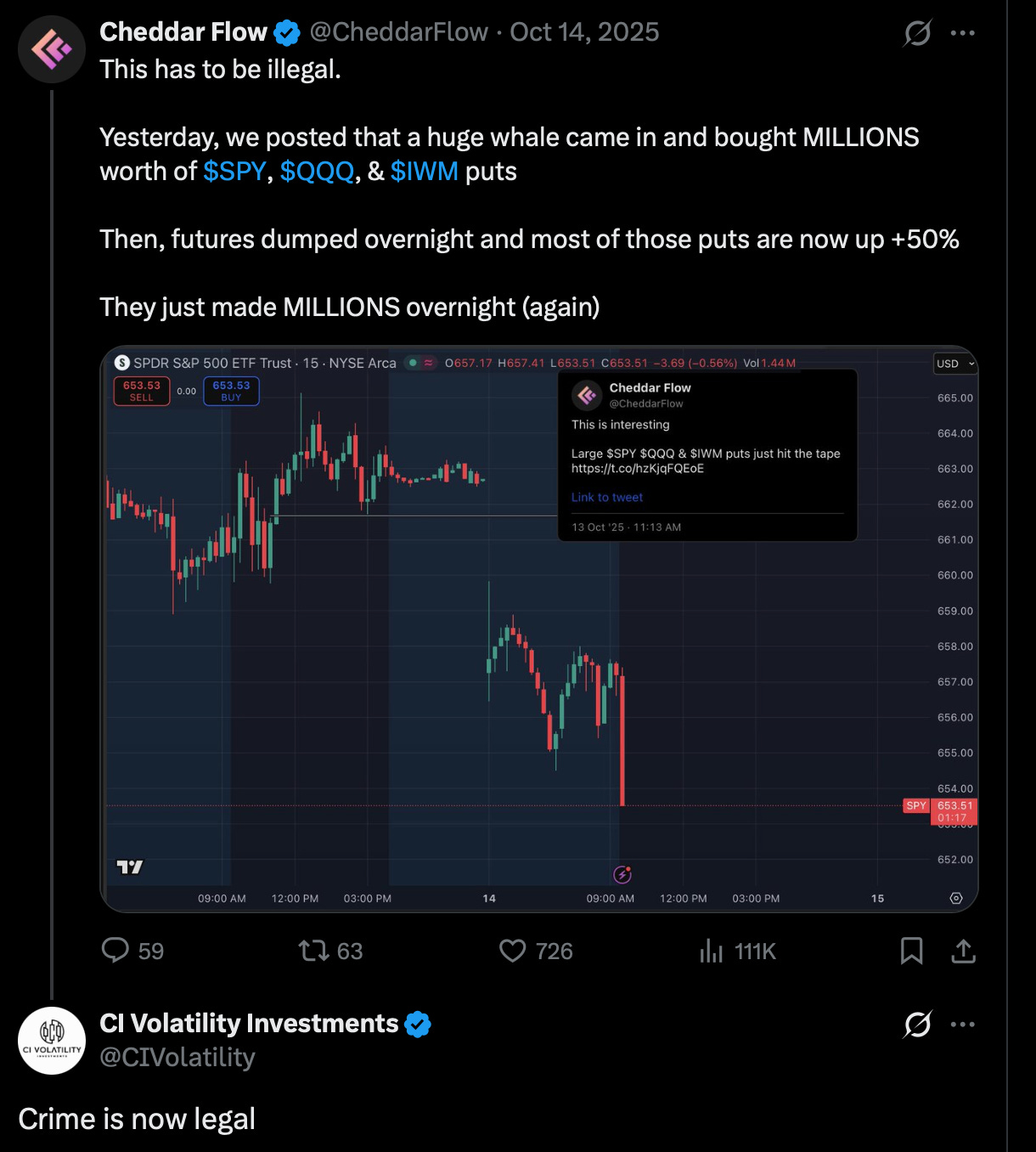

The Insider Trading Epidemic of 2025

These weren’t isolated incidents. Throughout 2025, market observers documented hundreds of similar cases across sectors

2025 was a banner year for “someone always knows” moments with perfectly timed options sweeps, massive pre-news flows, and trades that turned modest premiums into life-changing gains, all tied to announcements that conveniently leaked just in time. The pattern was unmistakable.

By year’s end, the SEC claims it opened investigations into dozens of the most egregious cases.

But critics argued the enforcement infrastructure was hopelessly outmatched. With millions of daily options trades, encrypted communications, and international coordination required to track offshore flows, catching sophisticated operators proved nearly impossible.

Perhaps most troubling was how normalized it all became. By late 2025, seeing unusual options activity before major announcements no longer shocked anyone. It was simply how the game was played.

Yet despite the headlines, viral screenshots, and outrage, no major convictions from these specific events were ever reported

Heading into 2026, the trading community can only hope the SEC finally changes course. Will actually be done about it this year?

Well this sounds not okay.. But there is a legit way to ride the wave

https://open.substack.com/pub/jarviscapitalresearch/p/the-only-signal-that-matters-insider?r=6qs9m8&utm_campaign=post&utm_medium=web