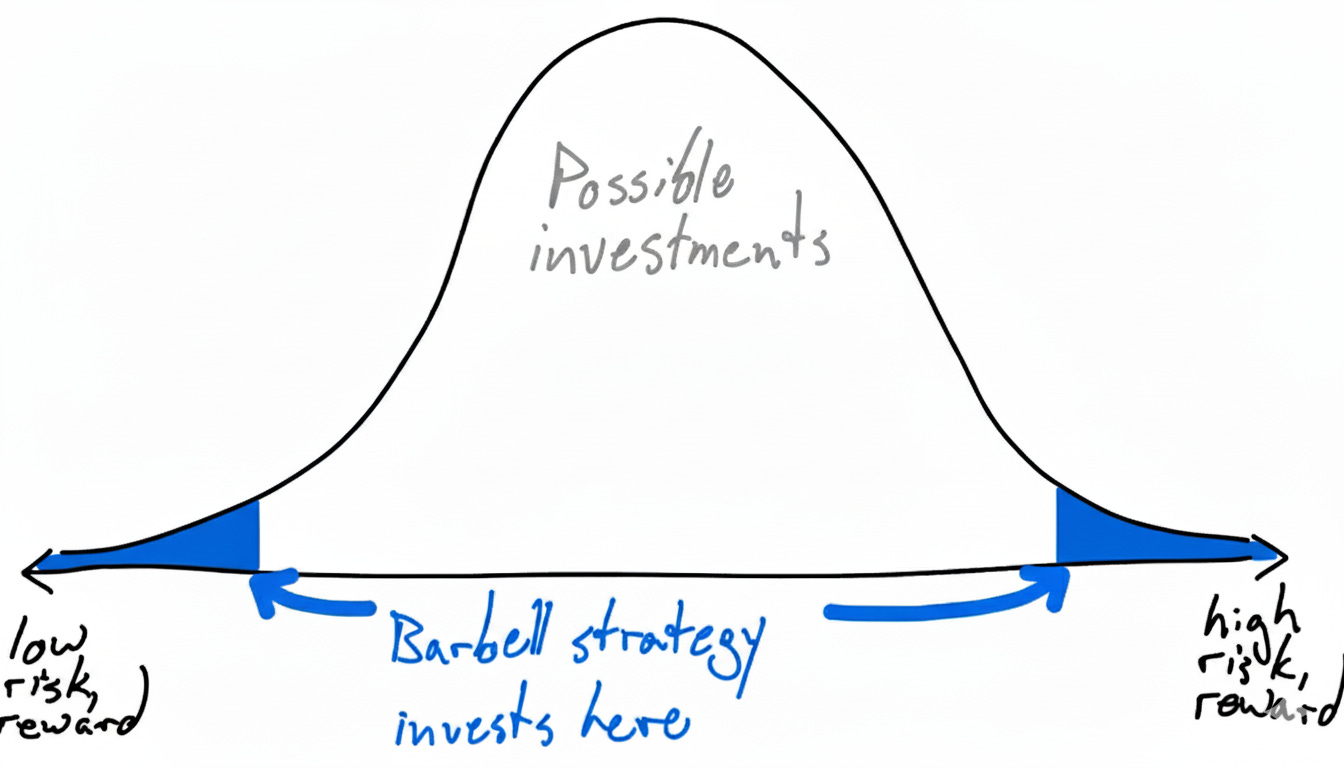

The barbell strategy is a portfolio construction framework that intentionally concentrates capital at opposite ends of the risk spectrum while avoiding the middle. The term comes from the shape of a barbell: heavy weights on both sides, connected by a thin bar with little in between.

This strategy challenges conventional wisdom, which often favors diversified, moderate-risk allocations. Instead, the barbell prioritizes asymmetry: robust protection against downside while maintaining exposure to high-upside convexity.

The strategy is straightforward:

Allocate 80–90% of the portfolio to ultra-safe, capital-preserving strategies.

Deploy the remaining 10–20% into highly speculative, high-convexity positions.

The middle (such as traditional equities or real estate) is largely avoided because these offer mediocre returns in good times but remain vulnerable to severe drawdowns during crises.

Why it works:

The safe end acts as “dry powder,” ensuring survival through volatility and black swans.

The risky ends provides convex exposure to both positive and negative black swans which are rare events that can deliver exponential payoffs.

Overall, the portfolio becomes antifragile. It doesn’t just withstand black swans; it potentially benefits from them.

In volatility trading, the speculative portion often includes long-volatility positions, such as VIX calls or far OTM equity puts. These are cheap in calm markets but explode in value during crashes, offering asymmetric protection or profit.

Advantages of the Barbell Approach

Downside protection

Reduces the risk of ruin, which is essential in fat-tailed markets.Upside capture

A small allocation to high-risk bets can generate life-changing returns.Convexity benefits

Performs well in high-volatility regimes.Psychological resilience

Knowing most capital is safe allows patience with risky positions.

Potential Drawbacks

Implementation difficulty

Selecting truly high-convexity bets requires skill.

Implementing the Barbell Today

Implementing the barbell strategy is especially important today because risk is increasingly concentrated in the “middle.” When volatility spikes, these assets tend to fall together, meaning the perceived safety of diversification in the middle often disappears precisely when it’s needed most.

The barbell is not an aggressive strategy. It is a defensive one that happens to preserve upside. It accepts uncertainty as a permanent feature of markets and builds a portfolio designed to survive it and occasionally profit enormously from it.