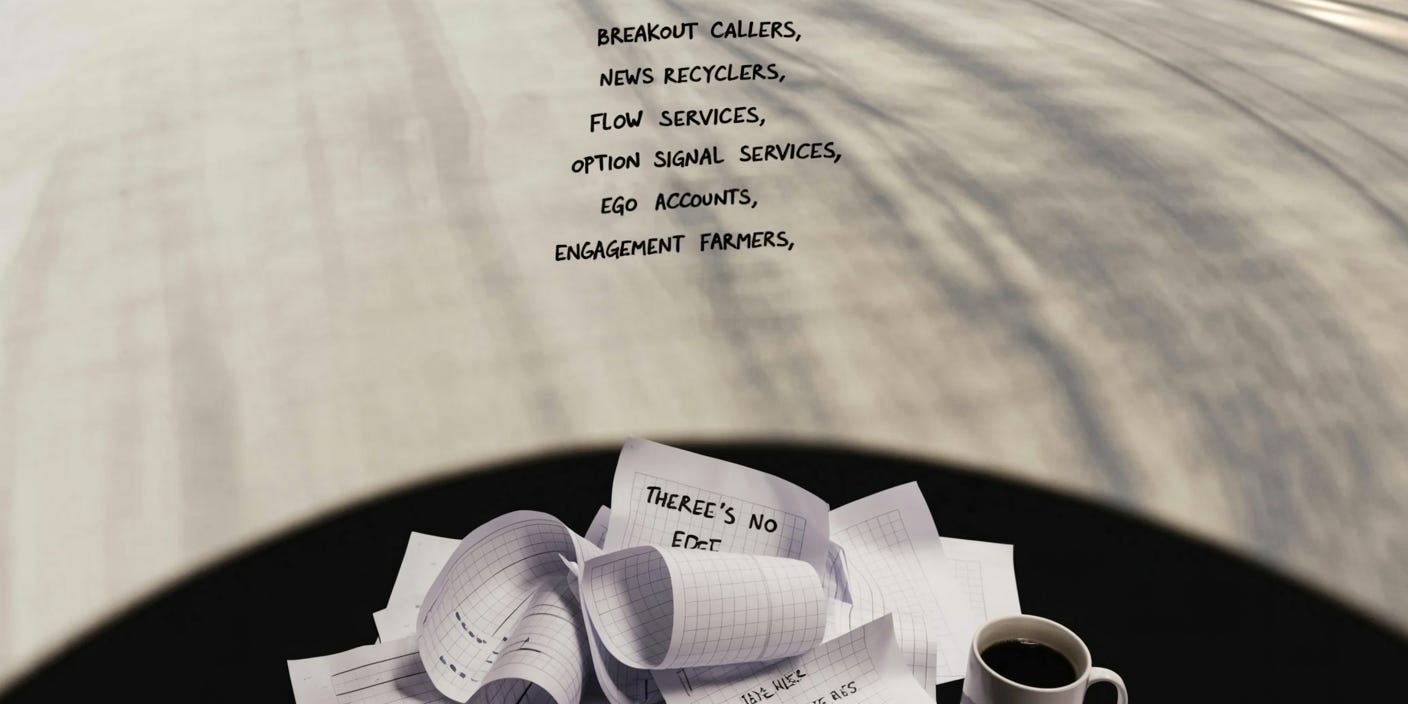

Top 10 Account Types With No Edge

For traders, the X platform delivers real-time information faster than any traditional source, but it’s also full of accounts that give you no edge.

Yes, there is alpha to be found on X, but that comes from curating a feed of genuinely smart, insightful voices that can inspire your own original trading strategies.

These Account Types Rarely Deliver Sustainable Edges

Breakout Callers:

The “TSLA breaking out!” crowd. These alerts are visible to anyone with a chart. By the time they post, algorithms have already front-run the move and the opportunity has evaporated.Their deception method: They repost successful calls weeks later while burying the failures, manufacturing an illusory win rate that never existed.

News Recyclers:

Accounts regurgitating earnings surprises and headline events. In liquid markets, this information gets absorbed into prices almost instantaneously. There’s no informational edge here.Flow Services:

Unusual options activity alerts and dealer gamma positioning. When institutional desks, quantitative funds, and retail scanners all monitor identical data streams, any edge dissolves within minutes.Option Signal Services:

These exploit options’ inherent volatility. Most options experience wild swings during their lifecycle (a 10x rally, a 50% drawdown, another 3x move) before expiring worthless or in the money.Their deception method: They advertise returns using the absolute peak price of a move. As if anyone can consistently catch the top. Followers who act on these alerts rarely capture the advertised returns, entering after the move or exiting before it.

The Engagement Farmers:

Accounts manufacturing witty commentary about market movements, optimized purely for virality. They’re monetizing attention through platform revenue-sharing programs, not trading acumen. There’s no edge here, these accounts are just for entertainment. Might as well grab some popcorn.The Ego Accounts:

Perpetually angry accounts that exist to ridicule others’ “bad takes.” They offer no insight, no process, and no actionable information.The Ideologues:

Traders imprisoned by their own frameworks. The irony is trading demands adaptability, yet these accounts remain rigidly committed to the same approaches while dismissing others.The Motivational Accounts:

Beginner-focused accounts trafficking in inspirational quotes and elementary advice. Typically funnel accounts for overpriced education packages targeting novices.The Macro Bears:

These accounts have gained followers with an endless stream of crash predictions that never materialize. Macro investing’s complexity makes it easy to cosplay expertise unlike technical trading, where blown calls are immediately visible in price action.Politically Motivated Accounts:

Traders who cannot separate their political identity from their market analysis. Sometimes the bias is subtle, sometimes overt, but it consistently appears. When someone routinely filters market reality through ideological preferences, their judgment becomes fundamentally compromised. You cannot trust analysis contaminated by the need to align financial outcomes with political narratives.