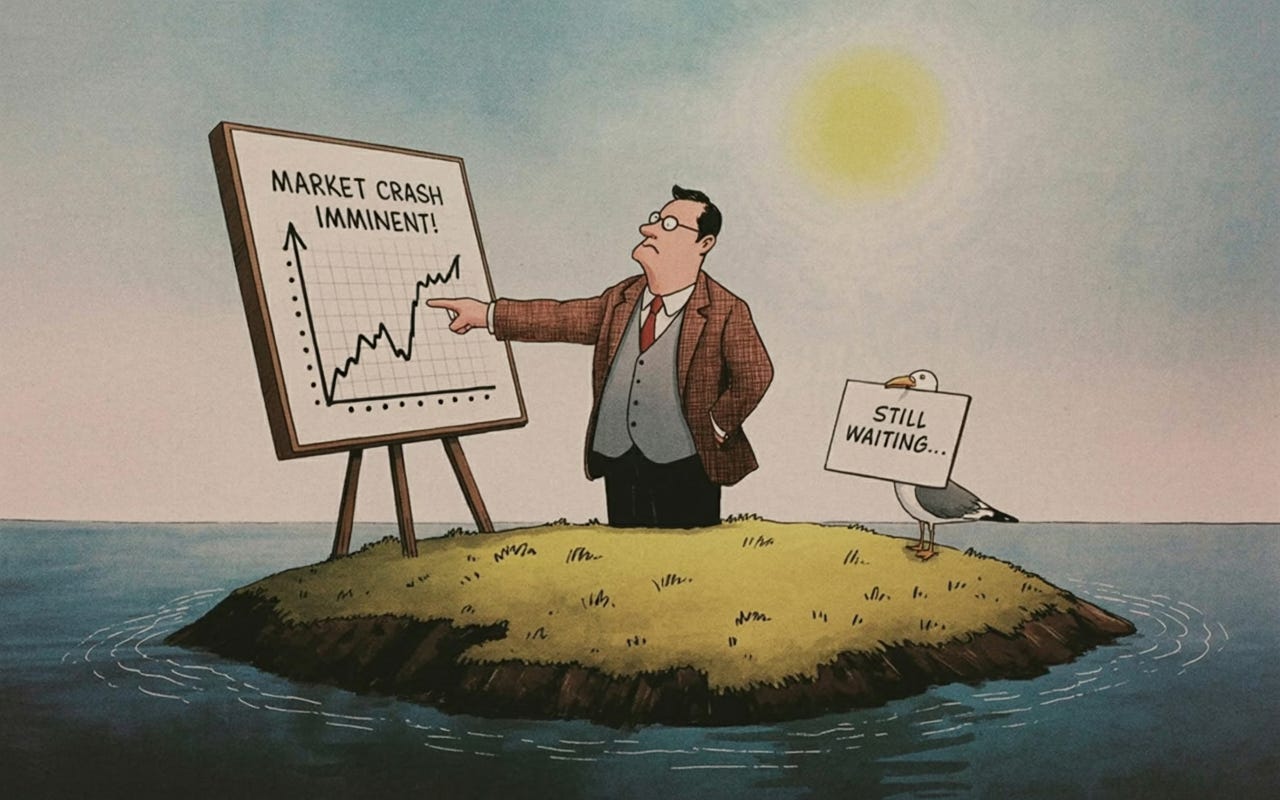

Investors Keep Losing Money Because Economists Keep Predicting Market Crashes That Never Happen

Economists have successfully predicted 53 of the last 2 market crashes

Investors keep losing money betting that the market will crash all because they’re listening to economists who cry wolf over and over again.

Here’s what happens: An economist warns that a recession is coming. Traders panic and buy protection against a market crash (like VIX calls). But the crash never comes. Instead, the protection they bought slowly bleeds money while they wait for the disaster that never arrives.

Economists Can’t Predict Crashes

The numbers are embarrassing:

In 2023, 85% of economists predicted a recession. The economy actually grew 2.5% and stocks went up.

A study looked at 153 recessions across 63 countries from 1992-2014. Most weren’t predicted beforehand. Even the 2008 financial crisis wasn’t flagged until it was already happening.

Economics isn’t like physics or chemistry where you can run the same experiment thousands of times. We’ve only had 12 recessions in the U.S. since World War II. Each one was caused by different things—a pandemic, a housing crisis, an oil shock, etc.

Even famous recession indicators are shaky. The researcher who discovered the “inverted yield curve” signal admits: “We only have 8 examples since 1968—that’s nowhere near enough data to be confident.”

Predicting Doom is More Profitable

Fame and attention: Scary predictions get clicks, interviews, and book deals. Boring predictions like “things will probably be okay” don’t get attention.

Better safe than sorry: If an economist misses a recession, they look terrible. But if they predict a recession that doesn’t happen? No one really remembers. So they default to pessimism.

Media loves drama: “MARKET CRASH INCOMING” gets way more views than “Market will likely continue with normal ups and downs.”

Do Not buy protection based on scary headlines

Stop betting on market crashes just because economists sound the alarm. They have a terrible track record, bad incentives to be dramatic, and not enough data to make solid predictions anyway.

Why CI Volatility Is the Better Path

If you’re tired of bleeding money on crash bets that never pay off, stop outsourcing your decisions to economists who get paid to scare you. At CI Volatility, we don’t rely on headlines or theories with only eight historical samples. We rely on real-time volatility data, quantitative signals built on thousands of trading days of market behavior.