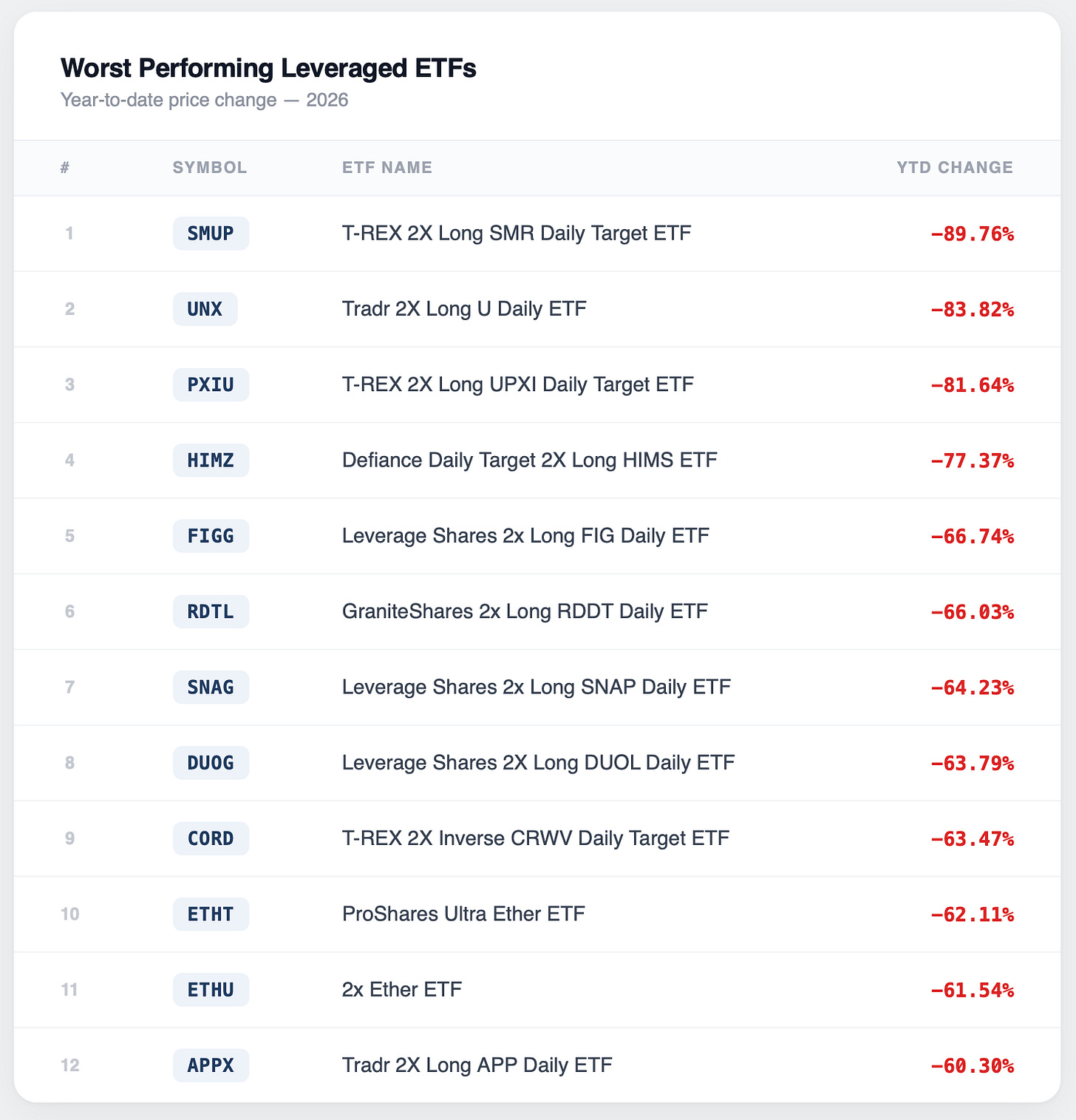

12 ETFs That Lost Over 60% Before Valentine's Day

The year is barely six weeks old, and a dozen of leveraged ETFs have already been decimated having lost more than 60% of their value year-to-date, with the worst offender (SMUP) shedding nearly 90% since January 1.

These are not hidden instruments that are difficult to find. They are SEC-registered, exchange-traded products available to any retail investor with a brokerage account. And the losses they have delivered in just six weeks are a stark reminder of how quickly beta slippage can destroy or make capital depending if you’re short or long.

Consider a simple example: if a stock drops 10% one day and recovers 11.1% the next, it is back to even. But a 2x leveraged product would fall 20% on day one and rise 22.2% on day two, ending at 97.8% of where it started which is a 2.2% loss from a round trip. Multiply that dynamic across dozens of volatile sessions, and losses compound rapidly.

Leveraged ETFs have a legitimate place in certain short-duration trading strategies. At CI Volatility, we use decaying instruments tactically, with strict risk parameters and defined holding periods. But the products on this list illustrate what happens when leverage is held rather than traded.