Leveraged ETFs like 2x or 3x funds that promise to move two or three times as much as the VIX, S&P 500, Nasdaq, or oil prices are popular among traders. On the surface, they sound amazing: if the market goes up 1%, the stock should go up 2% or 3%.

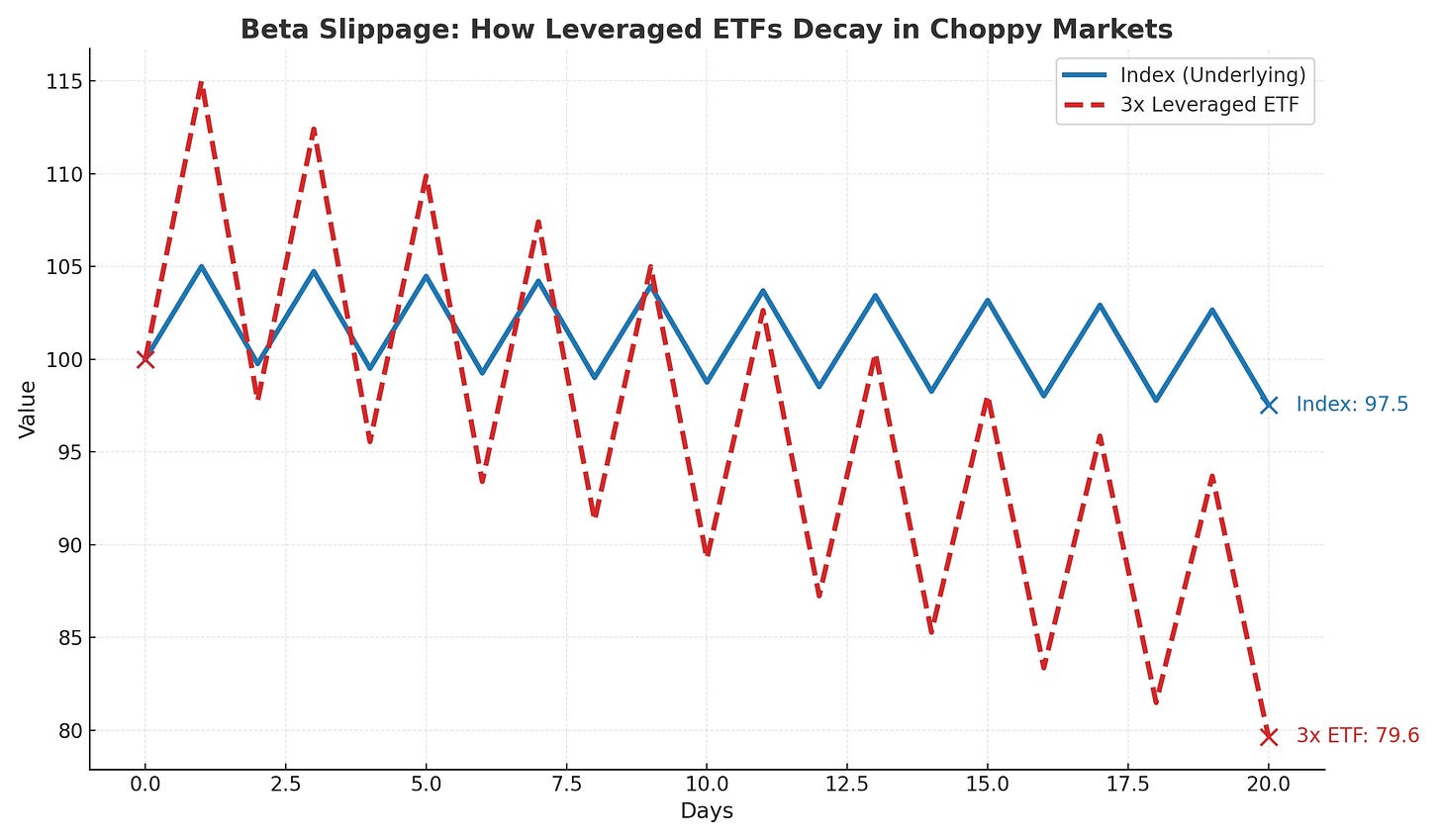

But there’s a catch. Over time, these products often lose value even when the underlying market goes higher. The hidden reason is something called beta slippage.

What Is Beta Slippage?

Beta slippage (sometimes called volatility decay) happens because leveraged products are designed to deliver daily performance multiples, not long-term multiples.

A 2x ETF tries to give you twice today’s return of the index.

A 3x ETF tries to give you three times today’s return.

The key word is today. Over days, weeks, and months, the math of compounding makes the performance drift away from what traders expect.

S&P Leveraged ETF Example

Imagine the S&P 500 moves like this over two days and is being tracked by a 3x ETF:

Day 1: S&P 500 goes up 10%.

The Index goes from $100 to $110

Day 2: S&P 500 goes down 10%.

The Index goes from $110 to $99

It ends up being down only 1%

Now look at a 3x ETF:

Day 1: +30% → 100 becomes 130.

Day 2: –30% → 130 becomes 91.

Even though the S&P500 is only down 1%, the 3x ETF is down nearly 9%.

That’s beta slippage in action.

In trending markets leveraged ETFs can perform as expected sometimes even better.

In choppy markets (lots of up and down moves), the compounding works against you. Each swing eats away at your profits.

This is why many leveraged ETFs slowly grind lower over time, even if the underlying index is flat.

What Beginners Need to Know

Marketing focus: Leveraged funds advertise “2x” or “3x” exposure, but many investors don’t read the fine print that says it’s a daily multiplier.

Looks safe in the short run: In a one-day or one-week trade, these products often behave as expected. Problems show up in longer holding periods.

Know the product: Leveraged ETFs are short-term trading tools, not long-term investments.

Check volatility: The higher the volatility, the worse beta slippage tends to be.

Don’t “buy and hold”: These funds can decay even if you’re “right” on market direction in the long run.

Use stop-losses and targets: Treat them as tactical tools for quick trades, not core positions.