Why We Are Comfortable Being Short Zoom (ZM)

We are betting against the company’s declining relevance.

1. No Moat Anymore

In 2020, Zoom was a necessity because it worked when nothing else did.

Today, for the vast majority of companies, Microsoft Teams is “free” because it’s included in the Microsoft 365 licenses they are already paying for. Justifying a standalone Zoom license when Teams is “good enough” doesn’t make sense.

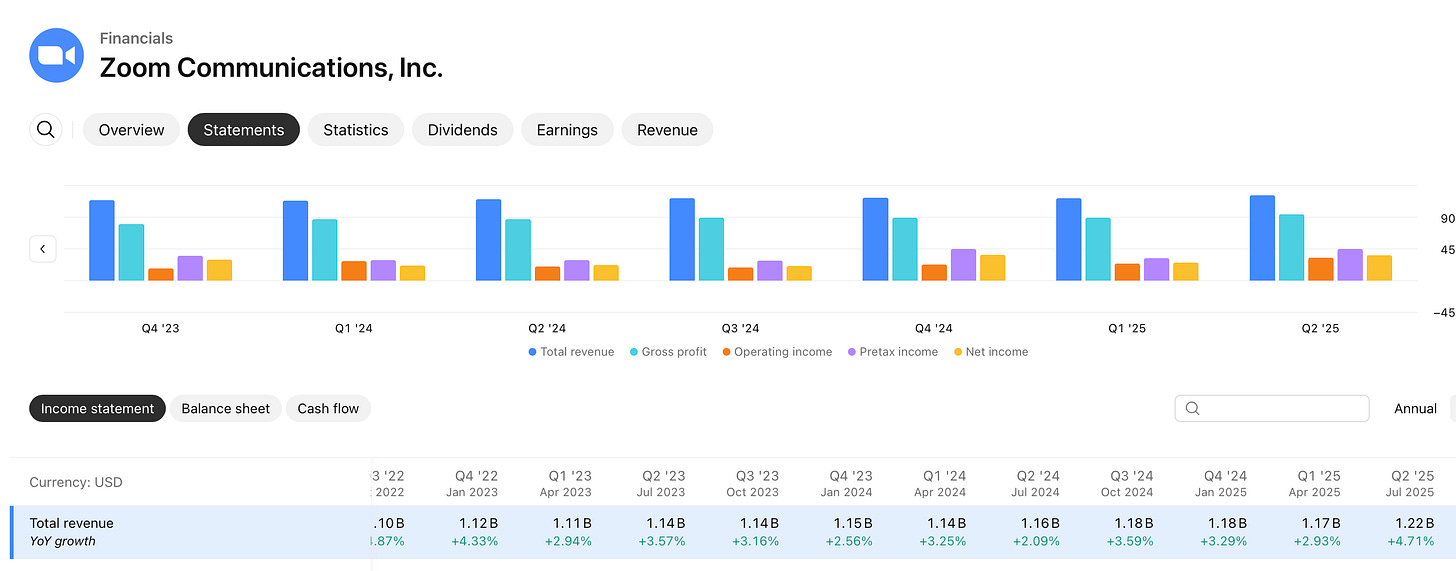

2. Growth Has Hit a Ceiling

Zoom is no longer a growth stock. Leading up to this earnings print, revenue growth had decelerated to the low single digits (~3–4%). That is barely keeping pace with inflation.

3. The Asymmetry Favors a Short

If Zoom’s future earnings reports surprises to the upside, the stock might pop a few percentage points, but if they deliver anything less than a perfect report going forward, the downside will be far greater.