Why There Are So Many Volatility Products (UVXY, UVIX, VXX, SVIX, etc.)

They all track volatility — but each one takes a different path

Because Volatility Can’t Be Traded Directly

You can’t buy or sell the VIX itself because it’s just a calculation based on S&P option prices.

To make volatility tradable, the CBOE created VIX futures, which allow traders to bet on where volatility will be in the future.

From there, several firms built products that package those VIX futures into stock-like vehicles regular investors can trade.

Different Issuers

Although they all revolve around the same underlying (VIX futures), these products come from different issuers with different design choices:

Barclays introduced VXX in 2009 to give investors long exposure to short-term VIX futures.

ProShares launched UVXY and SVXY offering leveraged long and inverse versions of that same index.

Volatility Shares entered the space in 2022 with UVIX (2× long) and SVIX (1× inverse).

Each one gives traders a slightly different way to express a view on volatility: long, short, slow, fast, or leveraged.

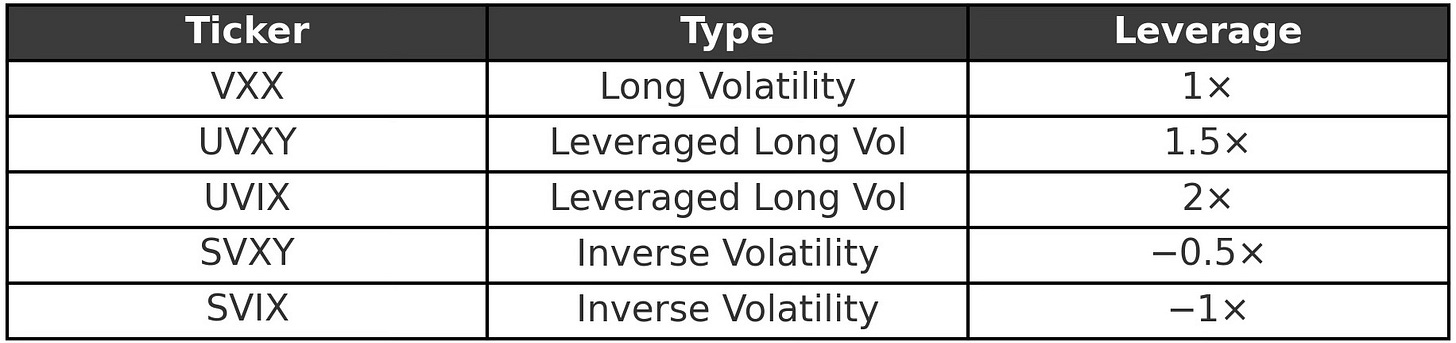

The Main Volatility Products and How They Differ

How Issuers Make Money from Volatility Products

Each volatility product makes money primarily through Management Fees.

Each product charges an annual expense ratio, typically between 0.85% and 1.35%, deducted daily from the fund’s net asset value. This fee accrues whether the fund rises or falls which creates a steady revenue stream for the issuer.