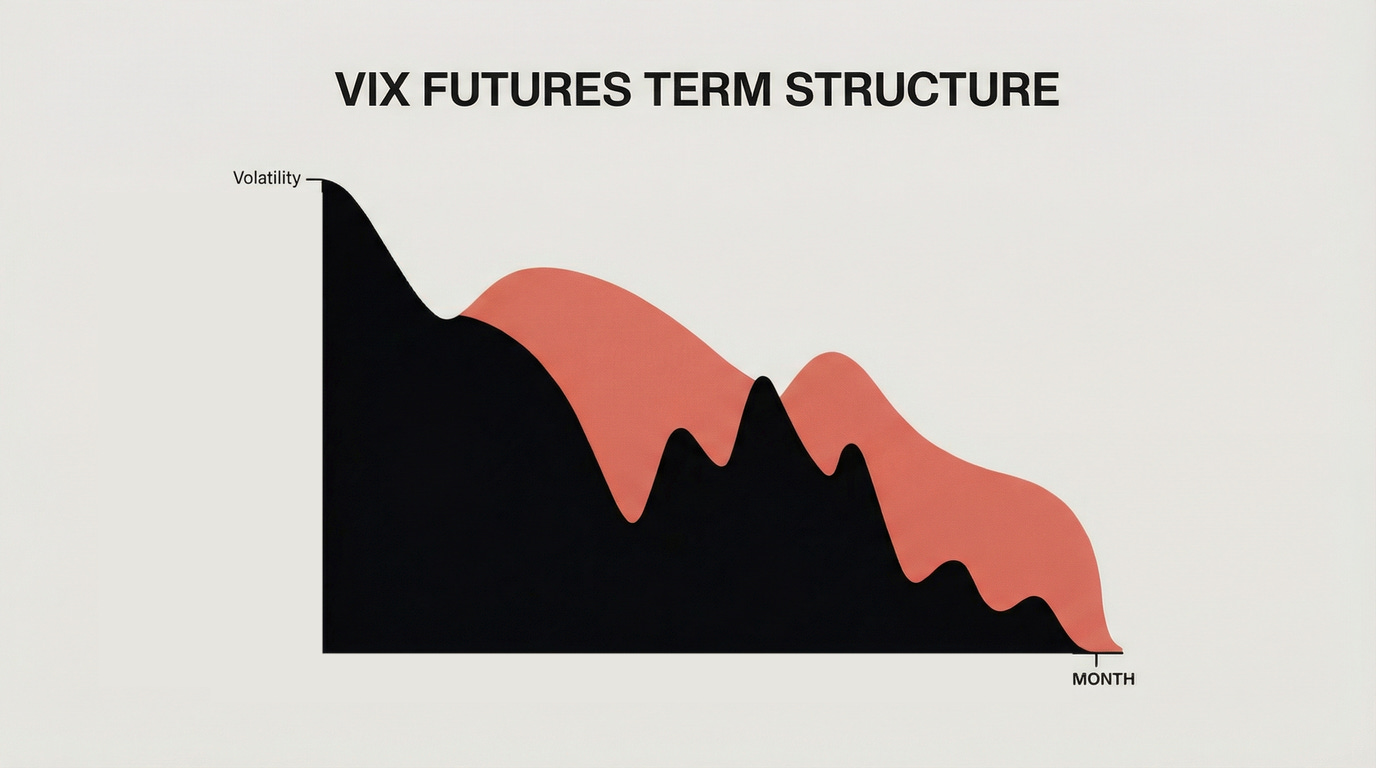

As you can see from the chart above, VIX futures contracts trading further out in time are priced higher than near-term contracts.

For example:

VIX today: 14

VIX futures expiring in 30 days: 17

VIX futures expiring in 60 days: 18

VIX futures expiring in 90 days: 19

VIX futures expiring in 120 days: 20

The curve slopes upward. Longer-dated futures cost more.

Why are the future ones more expensive?

Because Volatility is uncertainty.

And uncertainty grows with time.

You might have a decent sense of what tomorrow looks like.

You have far less clarity about next week.

And almost none about next month.

That uncertainty isn’t free.

When investors buy volatility they’re buying insurance against the unknown.

Short-dated insurance covers a narrow window of risk.

Long-dated insurance covers a much wider range of possible outcomes:

The further out you go, the more things can go wrong.

The market prices that reality.

So when you see higher prices for longer-dated contracts, the market is saying:

“There is more that can happen between now and then, and we demand compensation for bearing that risk.”