3 Reasons Why Every Option You Buy or Sell Starts in the Red

If you’ve ever bought or sold an option and watched it instantly flash red, you’re not alone. The market hasn’t even moved, yet your position’s already losing money.

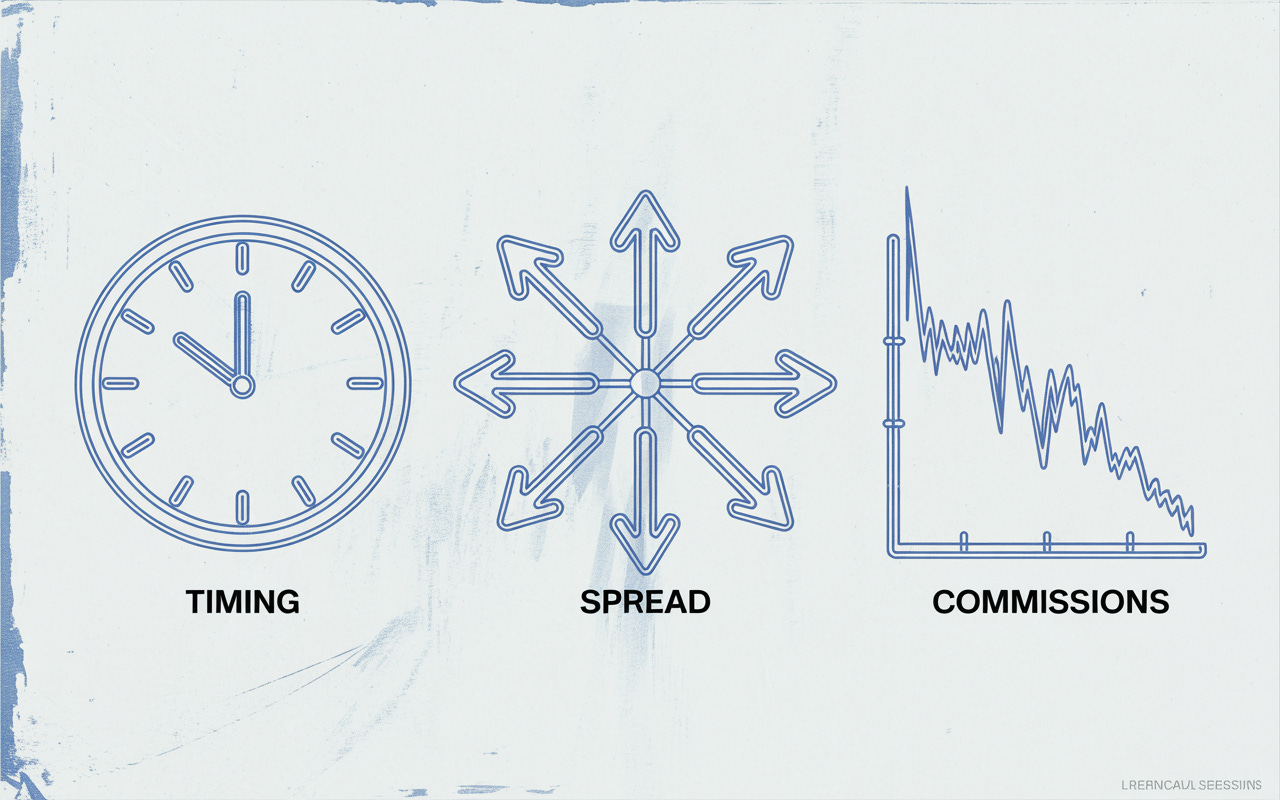

From the moment you enter an option, 3 things are quietly working against you:

1. You’ll Never Catch the Exact Top or Bottom

The exact low before a rally or the exact high before a drop is only visible after the fact. Anyone who “caught it” did so by luck, not repeatable skill. The same holds true for options.

If your trade flashes red moments after entry, it doesn’t mean you made the wrong decision. It’s just the reality that flawless timing isn’t humanly possible.

2. Bid-Ask Spreads Deliver an Instant Hit

Every option has two prices: the bid (what someone will pay you) and the ask (what you must pay to get in). That gap (or spread) is an automatic loss the moment you enter.

Example: if a call is quoted at $1.90 × $2.10 and you buy it for $2.10, you’re instantly down about 10% before anything happens.

This is why professional traders obsess over liquidity and tight spreads.

The spread and commission shows up as red P&L before the trade even has a chance.

3. Commissions and Fees Erode from the Start

Even small commissions add up, especially for active option traders.

Buy and close a vertical spread with four legs, and you will be paying eight separate charges.

The commission are reduced from your entry making you start in the red.