What Time of Day Do Most Market Reversals Happen?

Ranked from 1 to 3

Certain times of the day have a statistically higher probability of producing market reversals.

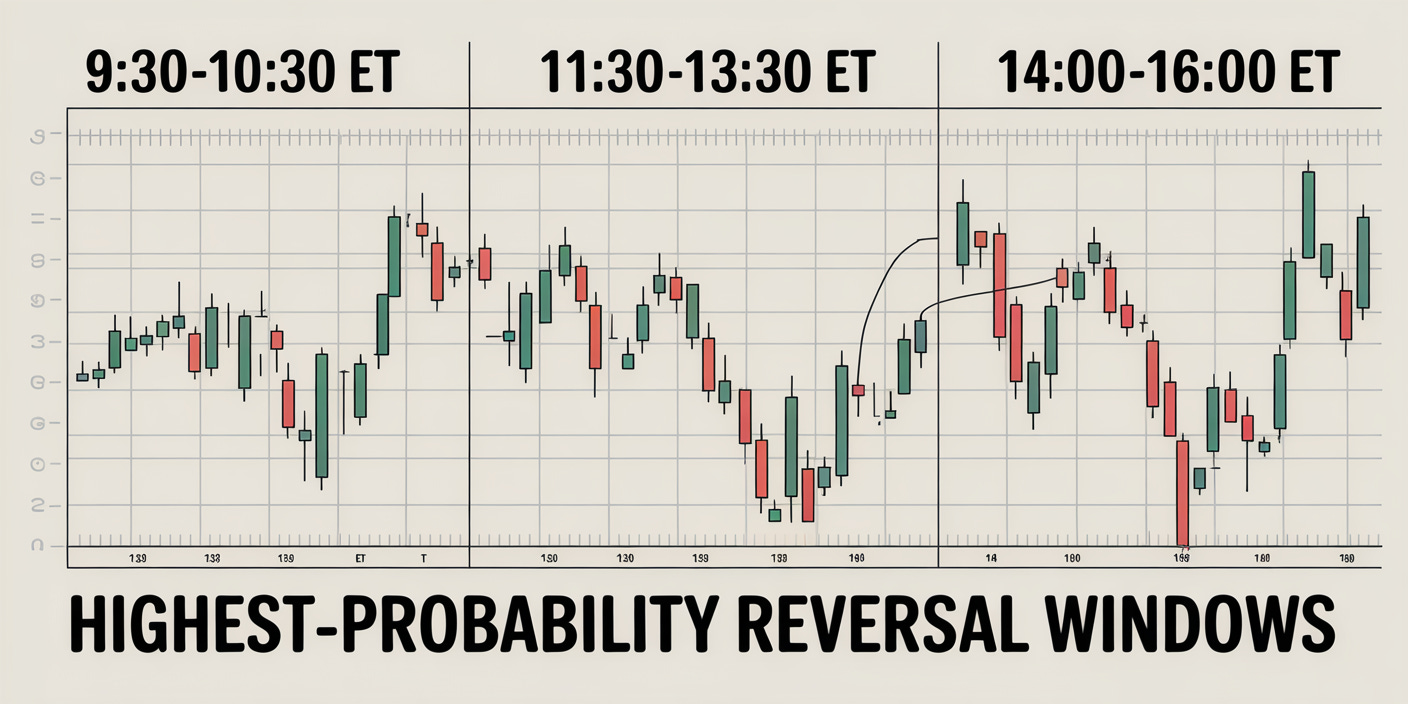

Highest-Probability Reversal Windows Ranked from most likely to least likely

1) 9:30–10:30 ET (New York open – first hour)

By far the most common time for intraday reversals.

Often the opening 15–45 minutes run in one direction (continuation of overnight momentum or gap fill), then reverse sharply as the early emotional buying/selling gets absorbed.

Classic patterns: “opening range reversal,” “first-hour reversal,” or failed breakout of the overnight high/low.

2) 11:30–13:30 ET (U.S. lunch hour / European close overlap)

Second most common reversal window, especially on lower-volume days.

The 11:30–11:45 ET period frequently marks the turn when morning trends exhaust (sometimes called the “11:35 reversal” among day traders).

European close (around 11:30–12:00 ET for London) can trigger reversals in forex and indices.

3) 14:00–16:00 ET (Power hour / last two hours before close)

Very common for reversals that set the closing direction, especially 14:30–15:00 and the final 30 minutes.

Institutional rebalancing, MOC (market-on-close) orders, and stop runs often create sharp reversals right into the close.

These patterns are so consistent that many professional day-trading and algorithmic systems are explicitly built around fading moves in these windows.