Every trader has heard the line:

“The VIX always fills its gaps.”

Yes, most VIX gaps eventually fill. But that doesn’t mean you can easily profit from them.

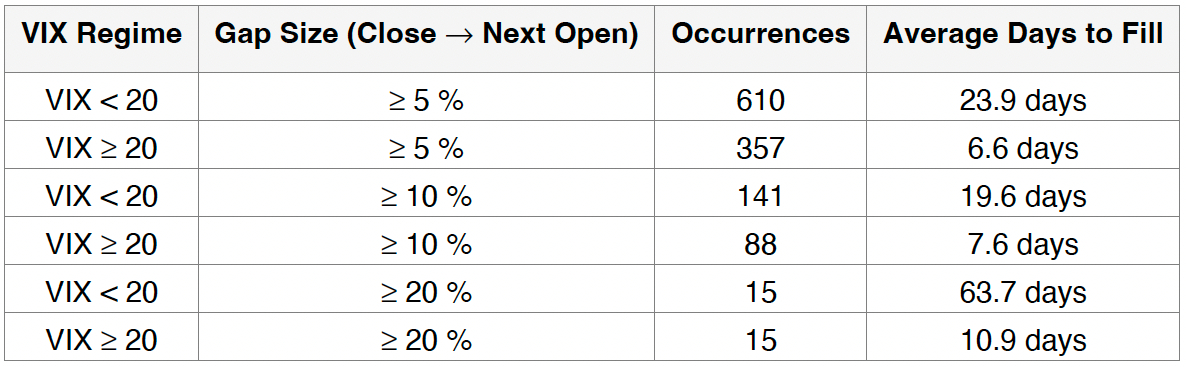

We looked at 35 years of daily VIX data, measuring every time the index opened higher than the prior close by at least 5%, 10%, or 20%, and tracked how long it took to “fill”, meaning the VIX eventually traded back down to or below that previous close.

Then we split the data by volatility regime: below 20 (calm markets) versus above 20 (elevated volatility).

VIX Below 20

When the VIX is below 20, the market isn’t prepared for fear so spikes stick.

A 5% overnight gap in a low-vol regime can take a full month to fill.

Those who short immediately after the open usually get steamrolled as volatility expands before mean-reverting.

VIX Above 20

10%+ gaps in this environment usually fade within a week, not a month.

That’s when “gap fill” setups actually make sense because they’re exhaustion peaks, not new waves of panic.

20% Gaps

A 20%+ overnight jump in a calm market (VIX < 20) took an average of 63 days to fill.

The same-size gap during a high-vol regime filled in just 10 days.

Same move, opposite implication.

How to Trade The Gaps

Fade spikes only in high-VIX regimes.

When volatility is already elevated, the odds of quick mean reversion is greater.Avoid shorting gaps in calm VIX regimes.

When people say “the VIX always fills its gaps,” what they miss is time.

Yes, the fill rate is basically 100%, but the path varies.

That “fill” may happen a month or two later.Be patient.

The edge in volatility is not in being early, it’s in waiting for exhaustion.

Volatility usually spikes faster than it decays.