Volatility Clustering: The Core of Our Process

Recognizing when volatility shifts

Markets have moods.

One day, stocks are crashing and week after week prices swing up and down rapidly. But then, just as mysteriously, things quiet down, and we drift into weeks of sleepy, boring trading.

Volatility clustering is just a fancy way of saying when markets get volatile, they usually stay volatile for a while. When they’re calm, they stay calm for a while.

Picture it like weather: A sunny day rarely explodes into a hurricane overnight, but once the storm hits, it lingers, spawning more rain and wind.

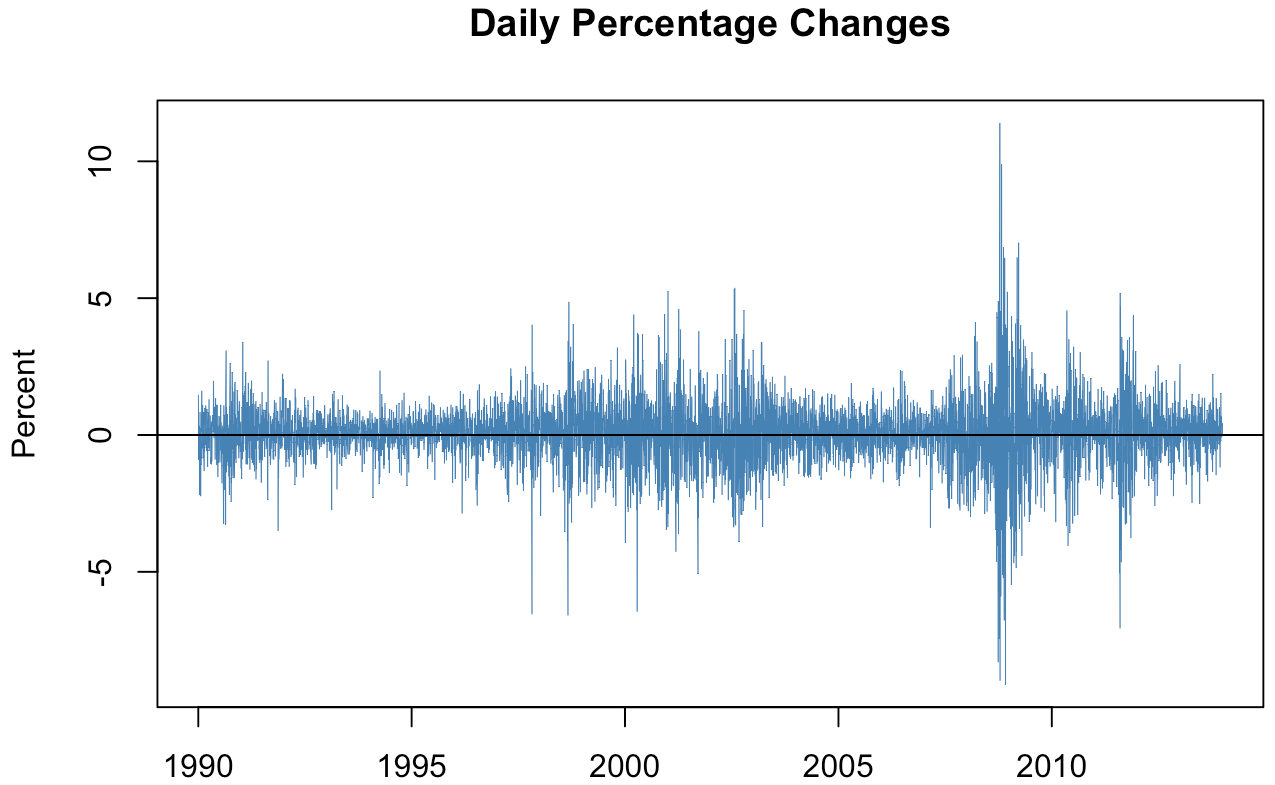

If you look at daily percentage changes in this graph you’ll see long, sleepy stretches followed by long bursts of volatility.

That’s volatility clustering.

Why It Happens

Psychology doesn’t reset overnight.

After a shock, traders stay tense. The first time they see a dip, they buy it. The second time, they hesitate. By the third, they’re nervous creating extended periods of heightened uncertainty.Leverage creates forced behavior.

When volatility spikes, so do margin requirements. Leveraged investors are forced to sell. This forced behavior propagates volatility beyond the initial catalyst.

Why Volatility Clustering Matters

Most Trading Strategies behave differently across different volatility clusters.

A system that performs well in low volatility environments often fail in high volatility environments and vice versa. That’s why in our backtests, we always bucket results by volatility regimes (low, medium, high).

Implications for Investors

For everyday investors, particularly those who lack the time, expertise, or sophisticated tools to monitor and react to changing volatility regimes, switching strategies whenever market volatility shifts can be impractical or impossible. Allocating to CI Volatility solves this challenge by handling the volatility dynamics for you.