When people talk about the VIX, they usually mean the “fear gauge” the index that measures expected volatility in the S&P 500. They’re usually not referring toVIX futures.

For beginners, VIX futures may sound complex, but they’re simply a way for traders and investors to bet on where volatility is headed.

What Are VIX Futures?

The VIX index itself is not directly tradable. It’s a calculated number based on S&P 500 options.

VIX futures are contracts that allow traders to speculate on what the VIX will be at a certain date in the future.

For example:

A July VIX future represents what traders think the VIX will be in July.

If you buy it, you’re betting volatility will rise by then.

If you sell it, you’re betting volatility will fall by then.

Think of them as a “futures market for fear.”

Why Do VIX Futures Exist?

Futures give traders and institutions a way to:

Hedge: Protect their portfolios against volatility spikes.

Speculate: Bet on rising or falling volatility.

Price risk: Futures prices reflect the market’s expectations of future volatility, which helps traders gauge sentiment beyond today.

Why VIX Futures Are Often Less Volatile Than the VIX

One of the most surprising things for beginners is that VIX futures don’t move as wildly as the spot VIX.

VIX Index: Can jump 10% in a single day.

VIX Futures: Move much more gradually.

Why? Because VIX futures are based on expected volatility in the future, not today. A one-day panic may spike the spot VIX, but VIX futures know it will likely calm down.

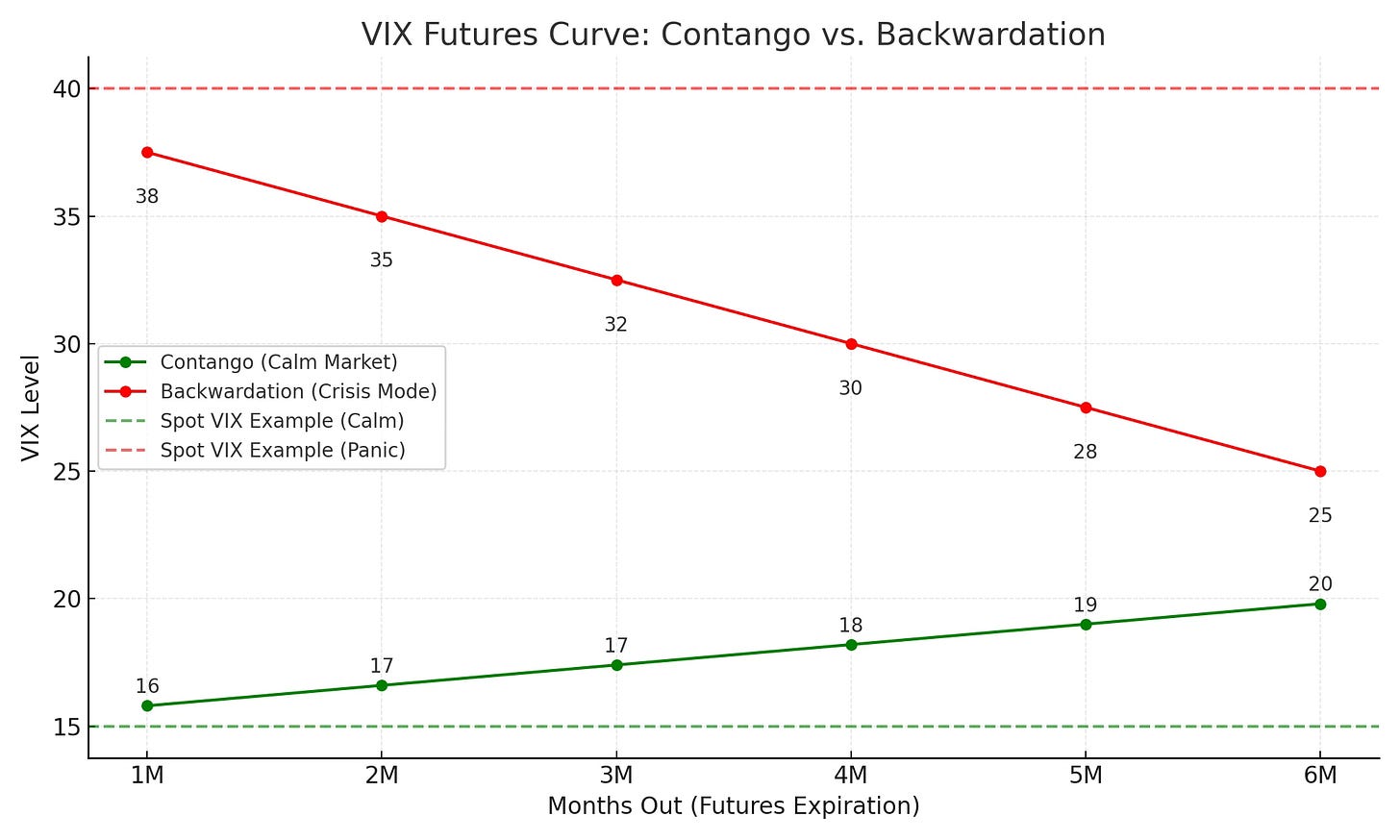

Contango and Backwardation in VIX Futures

The shape of the VIX futures curve — whether it’s in contango or backwardation — is one of the most important features to understand:

Contango (normal state):

Futures prices are higher than today’s VIX.

This happens most of the time, because volatility usually reverts higher in the future.

Example: Spot VIX = 15, but 3-month futures = 18.

Impact: Traders holding long futures may lose money over time as contracts roll down toward the lower spot level.

Backwardation (crisis mode):

Futures prices are lower than today’s VIX.

This happens when fear is extremely elevated today, but expected to ease later.

Example: Spot VIX = 50, but 3-month futures = 30.

Impact: Traders long futures may benefit, since the futures can rise toward the elevated spot level.

Whether the curve is in contango or backwardation can make or break trading strategies in volatility products (like VXX, UVXY, UVIX, SVXY, or other ETFs linked to VIX futures).

For Beginners

VIX futures may look intimidating, but they boil down to a simple idea: a way to trade what volatility will look like next week, next month, 3 months from now, 6 months from now, etc…

In calm markets, futures sit above spot (contango).

In crises, futures sit below spot (backwardation).

For beginner traders, don’t jump straight into trading them. Simply watching the curve and noticing whether it’s pricing in calm or panic can sharpen your understanding of the market.