Updated Dec 28, 2025

Our research uses calendarized returns because portfolios live on calendar time. In real life you carry positions across weekends and holidays.

Research Results

Below you’ll see graphs that measure:

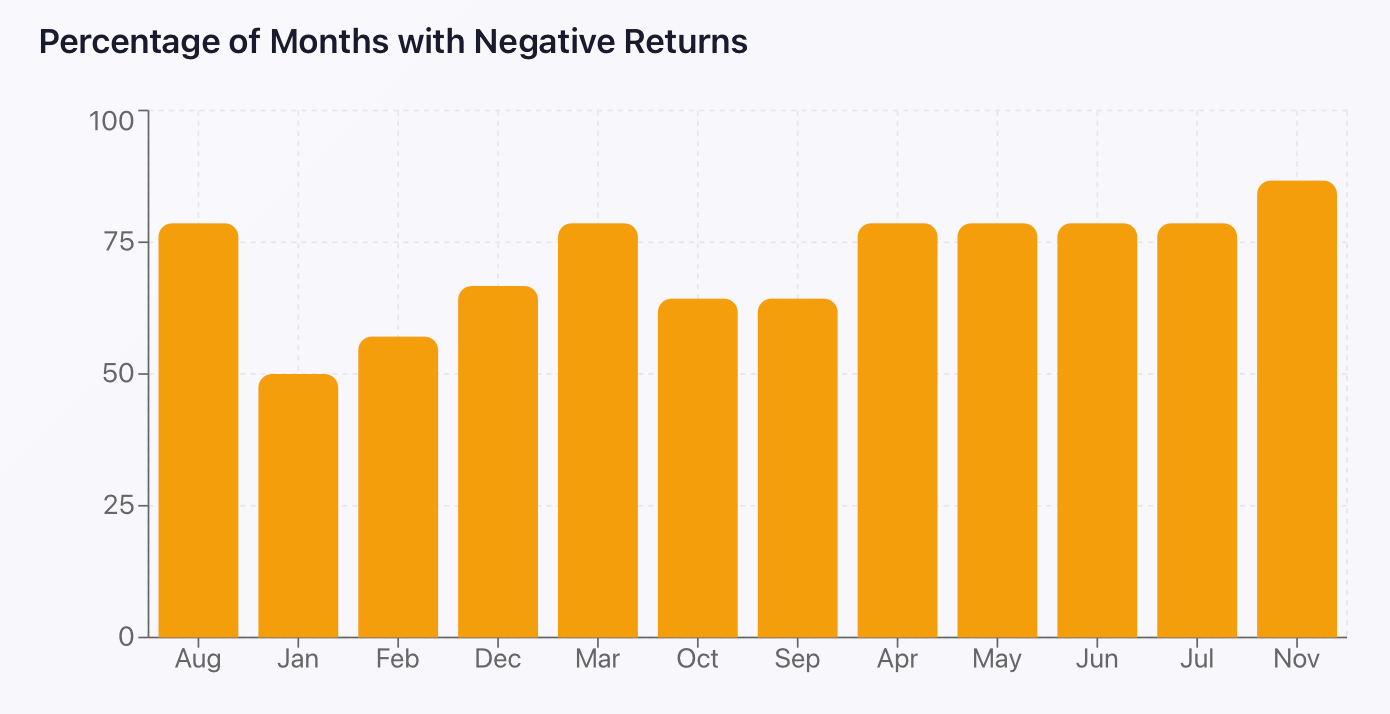

Percentage of month’s with negative returns

Average monthly returns

Biggest intra-month spikes and crashes