Why Tim Cook Just Dropped $3 Million on Nike Stock (Instead of Apple)

Nike, one of the world’s most recognizable brands, has endured a painful multiyear drawdown that remains hard to fathom for such an iconic brand.

At its lowest point, April 1, 2025, the stock traded at just $52.28, representing a steep 70.8% plunge from its all-time high of $179.10.

Nike’s stock has been under alot of pressure:

Persistent weakness in Greater China, once a growth engine.

Tariff and cost pressures squeezing margins.

A challenging macro environment for discretionary consumer spending.

As of January 6, 2026, shares have recovered somewhat but they are still down a remarkable ~64% from those 2021 peaks.

In late December 2025, social media found it unusual that Apple CEO Tim Cook, stepped in and purchased 50,000 shares for approximately $3 million.

Why Didn’t Cook Buy More Apple Stock Instead?

Most people don’t know that Tim Cook has served on Nike’s board of directors since 2005, a full decade before he became Apple’s CEO in 2011. That’s two decades of overlap between leading one of the world’s most valuable tech empires and advising one of the planet’s iconic consumer brands.

Executive Compensation Provides Plenty of Stock

Apple ties Cook’s pay heavily to performance via restricted stock units (RSUs) and awards that vest over time. He receives hundreds of thousands of shares annually as incentives, aligning his interests with shareholders without needing personal purchases. Buying more would be redundant, he’s already one of Apple’s largest individual shareholders through these grants.

Prudent Diversification

Cook’s net worth is overwhelmingly tied to Apple (historically 90%+ from stock). Prudent financial planning encourages diversification to reduce risk from one company’s performance. Executives often sell shares periodically for this reason, rather than concentrating further by buying more.

Different Role at Nike vs. Apple

Cook serves as a Nike director, so he doesn’t receive primary compensation in Nike stock.

No Need for Additional Signaling

Cook’s ongoing Apple leadership and massive existing holdings already show commitment. For Nike, the buy served as a contrarian vote during a tough period.

Wall Street’s Recommendations

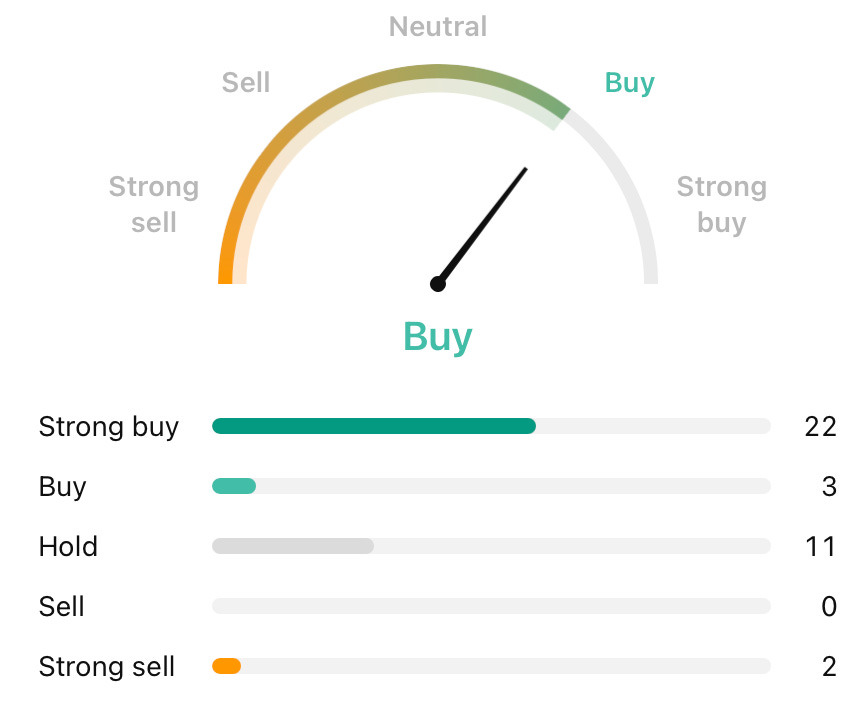

While we always warn everyone not to listen to Wall Street recommendations, recent data from 38 analysts in the past 3 months shows optimism:

66% of analysts recommend buying (combining Strong Buy and Buy ratings).

CI Volatility’s Take

Insider buying alone isn’t a guaranteed green light, we’ve seen plenty of insider buying where the stock continued to go lower. Executives can be wrong, and turnarounds take time and Nike’s issues are real.

But when a figure like Tim Cook, known for disciplined, long-term thinking, deploys millions post-selloff, it shifts the narrative. It suggests the risk/reward skew has improved: the “easy downside” from panic selling may be exhausted, replaced by a period where patience could pay off.

For options traders (especially those focused on option selling strategies), this setup might be a good opportunity if the stock is stabilizes. Cash-secured puts or covered calls could capture income while positioning for upside.