The Silver Crash That Shouldn't Happen for 7,000 Years

On January 30, 2026, silver experienced one of the most violent price movements in modern commodity history. It dropped 38% intraday from its record high near $121 per ounce. To understand just how extraordinary this event was, we need to examine it through the lens of statistical probability.

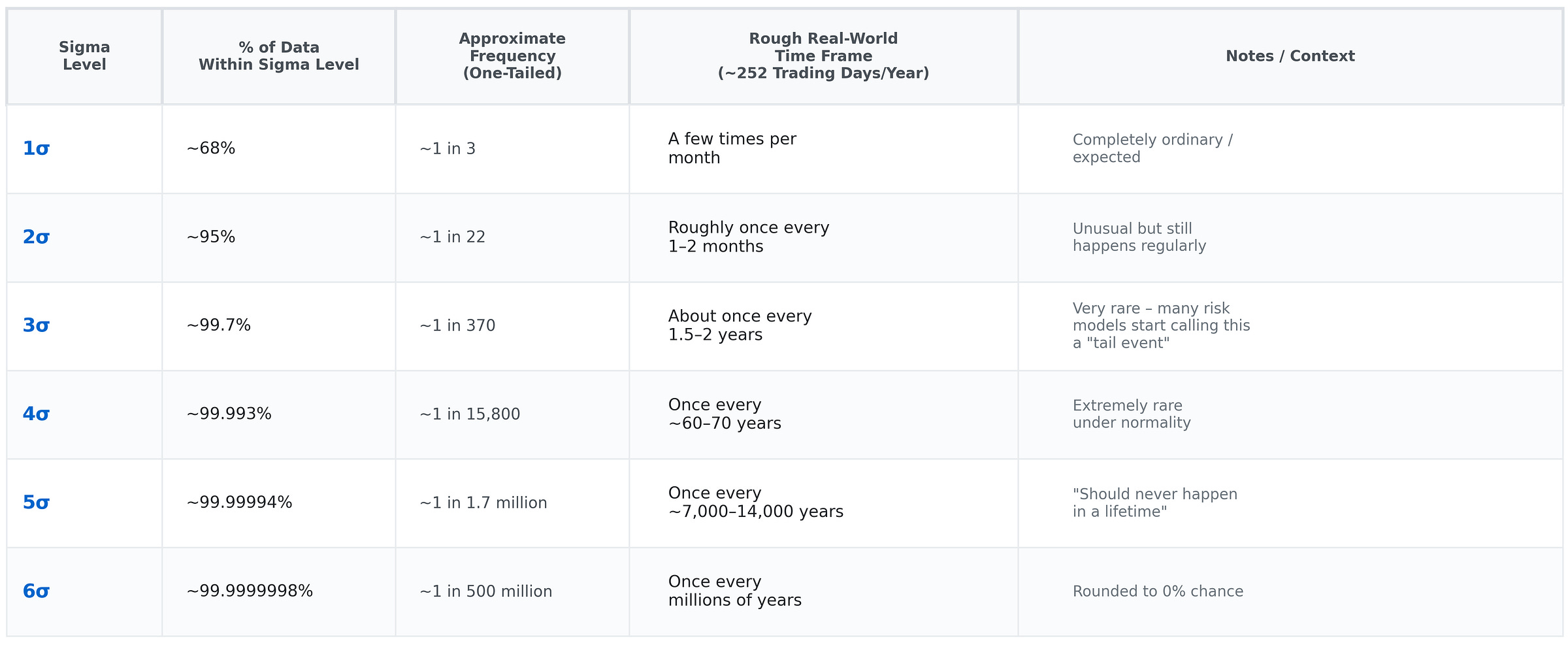

Understanding Sigma Events

In financial markets, we measure price movements using standard deviations, or “sigma” levels. A sigma event tells us how many standard deviations a price moves from its expected average. The higher the sigma number, the more statistically improbable the event.

How Improbable Was Silver's 38% Crash?

To classify silver’s crash as a sigma event, we need to know silver’s typical daily volatility. Even during heightened volatility periods, its daily standard deviation typically ranges from 2-4%.

Using conservative historical norms where silver’s daily volatility averages 3-4%, the 38% settlement drop measures approximately 9.5-12+ sigma.

Even accounting for the elevated volatility during January 2026’s bubble conditions (where daily volatility had surged to 8-12%), this crash still registers as a 3-5+ sigma event.

Under a normal distribution, a 5-sigma event should occur once every 7,000+ years. Anything beyond that enters the realm of statistical near-impossibility. A 10-sigma event is so rare that conventional probability models essentially round its likelihood to zero.

Yet here we are, witnessing exactly such an “impossible” event.

What makes this 5 sigma event more remarkable is that silver generally exhibits more stability than equities precisely because they represent real physical objects. A company can become worthless overnight when its business model fails. Silver cannot cease to be silver.

The Market That Keeps Breaking Its Own Record

The reality is that financial markets no longer follow normal distributions. Extreme events happen far more frequently than models predict.

Whether you measure it as 5-sigma, 10-sigma, or somewhere in between depends on your volatility assumptions, but any way you calculate it, this event should fall firmly into “impossible” territory, but in today’s market there’s no such thing as impossible anymore.