The Most Powerful Confession in Investing History

The Man Knew Better

The dot-com bubble burst, and one of history’s greatest investors, Stanley Druckenmiller, watched as his fund lost $3 billion.

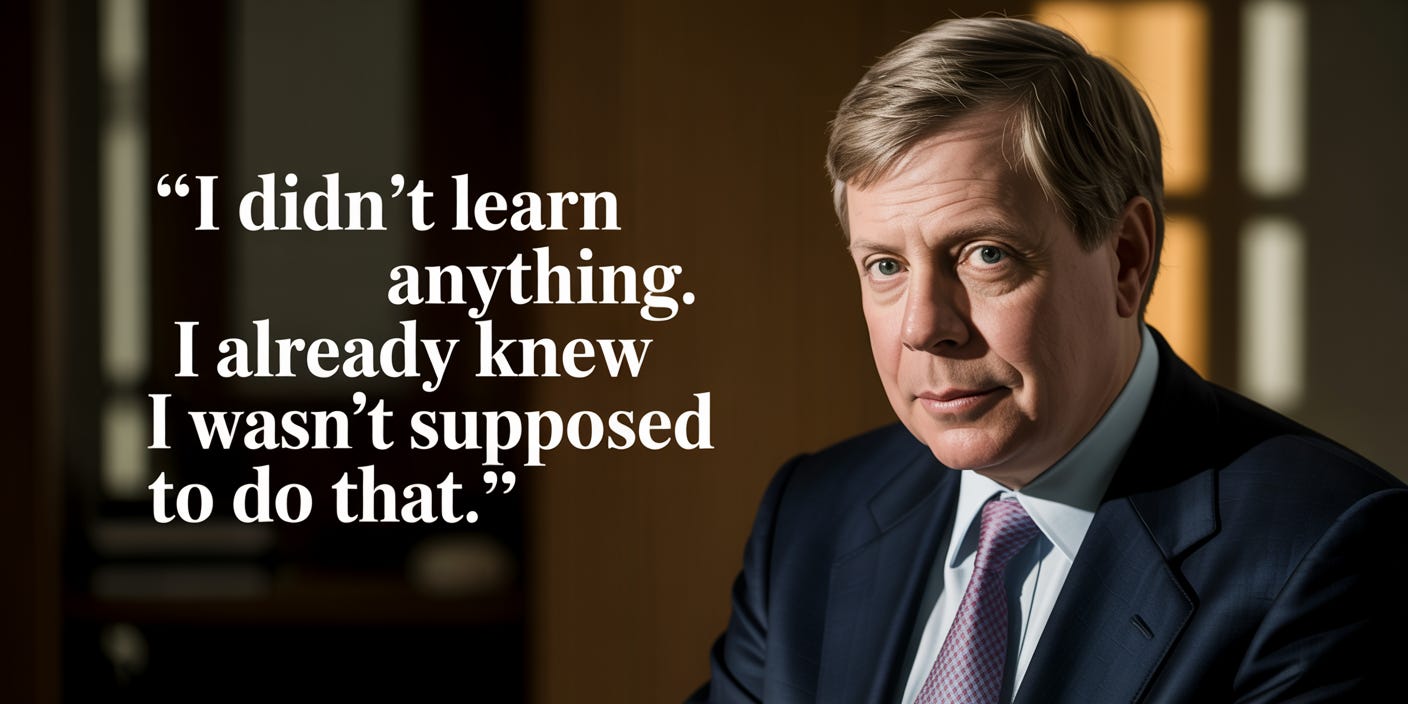

His quote after the loss remains one of the most powerful quotes in investing history:

“I didn’t learn anything. I already knew I wasn’t supposed to do that.”

The Man Knew Better

Druckenmiller, often compared to Buffett or Dalio, built his legend on his ability to read economic cycles and exit before the crowd realized the party was over.

By 1999–2000 he obviously knew tech stocks were in a bubble:

Valuations were detached from fundamentals (P/E ratios of 100–200+ were common).

Companies with no profits were valued in the tens of billions.

But this moment showed that no one is immune to FOMO when the market is in euphoria.

He later said he got “seduced” by the momentum and by younger analysts who mocked his old-school valuation metrics. He got tired of watching competitors post extraordinary returns, feeling the psychological weight of being left behind while inferior investors got rich.

Why He’s Still Respected

Druckenmiller’s willingness to own this failure completely, without any excuses, is precisely why he remains one of the most respected voices in investing. He doesn’t hide from his worst moment. He teaches from it.

Today, at 72 years old, Druckenmiller is worth over $8 billion. He often gives interviews and money managers still tune in and take notes.