Silver: Is it Better to Trade SLV or SIL?

The silver market offers investors two distinct ways to play the precious metal:

SLV: which tracks physical silver bullion (SLV 0.00%↑)

SIL: which follows silver mining companies (SIL 0.00%↑)

While both provide exposure to silver prices, their performance characteristics are a bit different.

The Correlation Isn’t Perfect

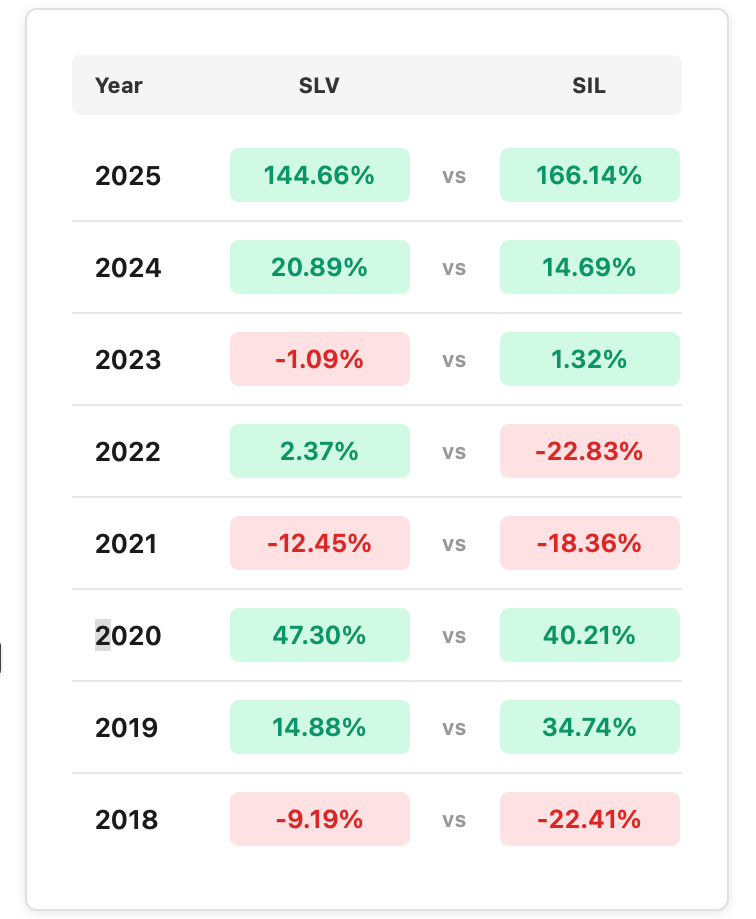

Consider 2025’s remarkable rally. SLV posted an impressive 144.66% gain, but SIL surged 166.14%, adding an extra 21 percentage points to an already extraordinary move. This gives the impression that SIL is a leveraged play on SLV.

The year 2022 perfectly illustrates why SIL demands caution. While SLV managed a modest 2.37% gain, SIL plummeted 22.83%. That’s a 25-percentage-point divergence in the wrong direction. Investors who assumed the two would move in lockstep learned an expensive lesson about operational leverage, mining costs, and sector-specific risks.

Similarly, in 2018, SLV dropped 9.19%, painful, but manageable. SIL crashed 22.41%, more than doubling the losses. The pattern repeats in 2021: SLV down 12.45%, SIL down 18.36%.

This volatility stems from mining companies’ unique cost structures. When silver prices fall, mining operations don’t just see lower revenues but their profit margins also get crushed. Fixed costs, energy expenses, labor, and capital requirements don’t decrease proportionally with metal prices. Some miners operate at break-even or losses during downturns, leading to severe stock price declines that far exceed the underlying commodity’s move.

The Better Trade

SLV’s relative stability and deep options market make it more ideal for tactical trading strategies:

Covered Calls: During sideways or mildly bullish periods, selling monthly calls against SLV holdings can generate consistent income. The tighter bid-ask spreads mean you’re not giving away edge to market makers.

Directional Options Plays: Want to bet on a silver breakout? SLV’s weekly options provide precise timing tools with minimal friction costs. The liquidity allows for easy entry and exit.

Core Holdings: For long-term precious metals allocation, SLV offers silver exposure without the business risk inherent in individual mining companies.

On top of that, SIL only offers monthly options, and the spreads are significantly wider than SLV. If you’re trading SLV options, you might see spreads of $0.05 to $0.15 depending on strike and expiration. With SIL, you’re often looking at $0.20 to $0.50+ spreads. On a percentage basis, this can represent 5-10% slippage on entry and exit. Scale that across multiple trades, and you’re fighting a serious headwind.

The monthly-only structure also means you can’t make quick weekly adjustments.