Sep 1-5, 2025

September 1-5, 2025: The S&P 500 had a mixed week, ending at 6,482 points on September 5th with a 0.32% decline from the previous session, though it hit a record high of 6,502.08 on September 4th. The Nasdaq gained 1.14% for the week, while the Dow finished roughly flat.

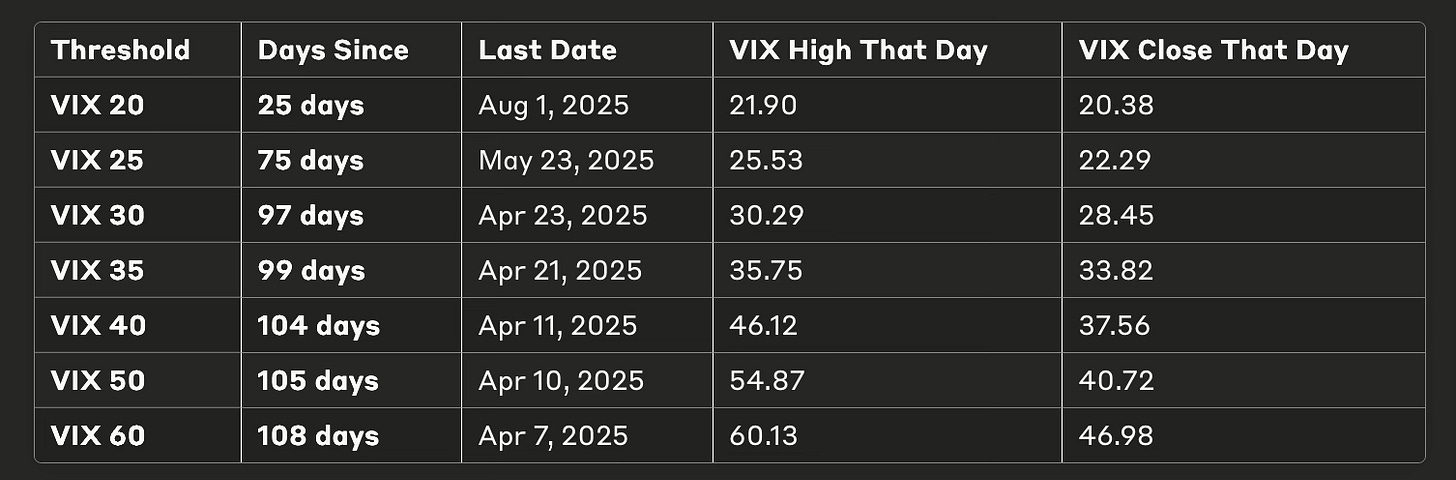

Volatility remained relatively subdued despite some intraday swings. The VIX climbed toward 16 on Friday after touching its lowest levels of 2025, but still remained 19% below its one-year average. Markets were described as volatile to end the week, particularly around the jobs report release, but overall volatility stayed contained compared to historical norms.

Day-by-Day Breakdown

Monday, September 1: Markets Closed

Tuesday, September 2: The S&P 500 rose 0.5% to 6,448.26, while the Nasdaq climbed 1% to 21,497.31. The Dow dipped 25 points to 45,271.23. Tech stocks led the gains, particularly after a favorable antitrust ruling for Alphabet/Google.

Wednesday, September 3: Strong performance across the board with the S&P 500 finishing up 0.83% at 6,502.08 - its 21st record close of the year. The Nasdaq settled up 0.98% at 21,707.69, and the Dow gained 350 points or 0.77%.

Thursday, September 4: S&P 500 Gained 0.5% to 6,448.26, marking its 20th record close of the year and extending its year-to-date advance to over 18%. Nasdaq: Climbed 1% to 21,497.73, driven by strength in technology and AI-related stocks, with intraday highs nearing 21,772.

Friday, September 5: Stock futures initially fell but rallied after the August jobs report showed only 22,000 jobs added, well below the forecasted 75,000. The unemployment rate rose to 4.3% from 4.2%.

Key Market Drivers

Jobs Data Impact: The weak employment data reinforced expectations for Federal Reserve rate cuts, with markets now pricing in 100% probability of a September rate cut and about a 12% chance of a larger 0.5% cut rather than the traditional 0.25%.

Sector Performance: Communications services was the best-performing sector, up 3.64% for the week, while energy was the worst performer, down 3.13%. Large-cap stocks rose 0.50%, while small-cap stocks outperformed with a 1.25% gain.

Individual Stock Highlights:

Alphabet jumped 9.1% after a federal judge ruled Google can keep its Chrome browser but must share search data

Broadcom soared nearly 11% after earnings beat estimates and revealed it's helping OpenAI design AI chips

Market Outlook

Despite the generally positive performance, analysts noted that September is historically the worst month for stocks, with the S&P 500 averaging a 0.7% loss over the past three decades. However, the market's strong momentum from April lows (up nearly 30%) and expectations of Fed rate cuts continue to support equity valuations.

The week reflected the ongoing tension between seasonal weakness concerns and optimism around potential monetary policy easing, with the jobs data ultimately reinforcing the case for Fed action in September.