Real Trading is Messy

No matter how good a year someone has and no matter how consistent they seem, in real-time it’s always messy.

Trading always looks clean right before you enter a trade. Your chart is presenting a logical entry point, you have a good risk-to-reward setup, and perfectly sized position, but none of that captures the real time messiness. Markets are living unpredictable organisms that don’t care about following your strategy.

A major reason trading feels so messy is that markets constantly do things that should have had a very low probability of happening.

The three-standard-deviation move that models said occurs once every five years? Well it happened twice this month.

The support level that held for two years breaks on no news.

The correlation that’s been reliable for a decade suddenly inverts.

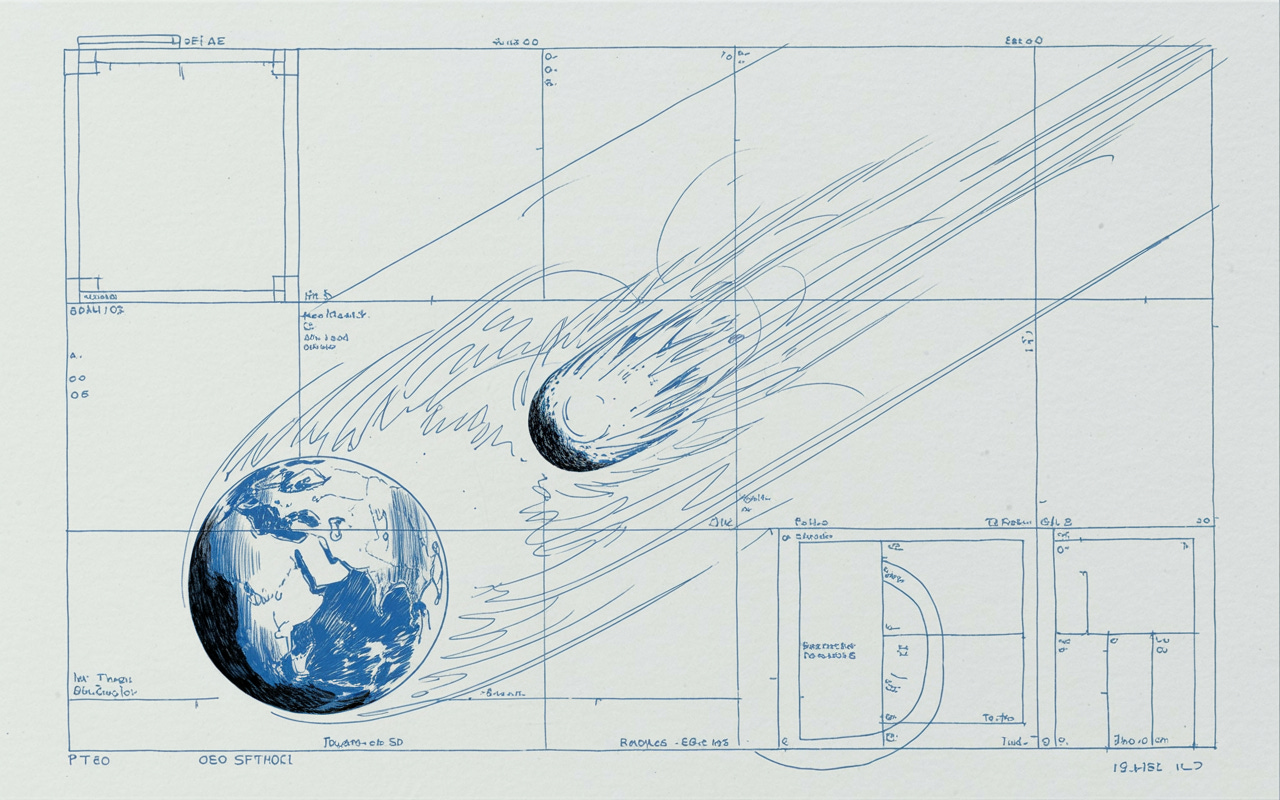

“One can predict the course of a comet more easily than one can predict the course of a stock.” - Jim Simons

Improbable isn’t the same as impossible.

Markets constantly produce outcomes that “weren’t supposed to happen,” which means traders must routinely respond to behavior they never anticipated.

The messiness fades only when you zoom out far enough. Across hundreds or thousands of trades, the edge your models predicted starts to emerge. Real alpha exists, but short-term variance is so violent that it can conceal competence until you zoom out.

The messy feel to it is not proof that your process is broken. Your only realistic job is to build a game you can win at the sample size the market requires.

Stop waiting for trading to feel clean. It never will. The best year of your life will still have messy weeks. Build a process you can repeat. Trust the sample size. And keep trading.