Options vs. Stocks: Why Options Are a Better Way to Express Yourself

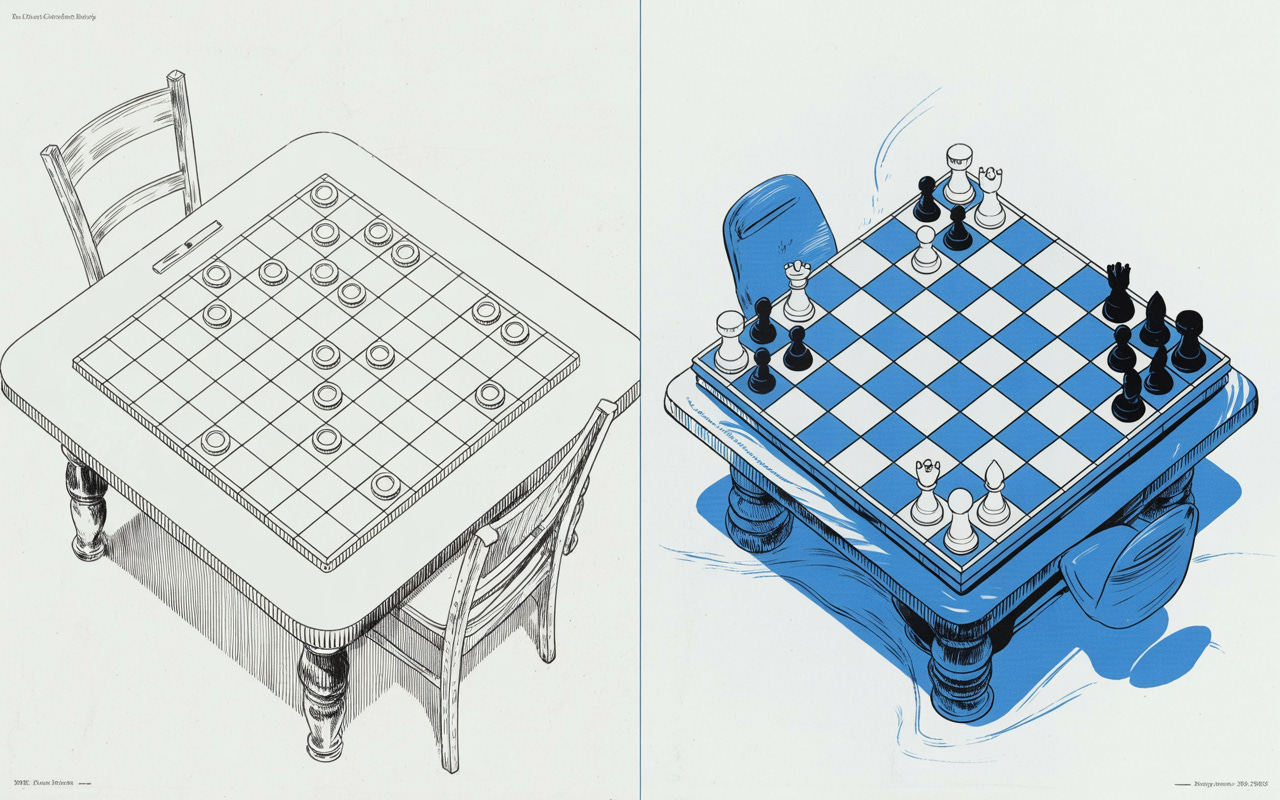

Stocks are 2D. Options are multidimensional.

When you buy a stock, you’re making a two-dimensional bet: price goes up. If it does, you profit. If it doesn’t, you lose.

Simple.

Options aren’t simple. They let you say: what you think will happen, by when, how much, how bumpy the ride will be, and even how much you want to risk along the way.

These extra dimensions is why options can be a superior way to express a view compared to buying stocks outright.

Why Stocks Are 2D

Buying shares gives you linear exposure to price. If price rises $1, your profit rises $1 per share. If it falls $1, you lose $1 per share.

Time passes, but time itself doesn’t change your P&L unless the price moves.

There’s no way to say:

“I think it hits $120 by June.”

“I think it chops sideways for a month, then rallies.”

“I think earnings causes a big move, but I don’t know which direction.”

The 5 Dimensions Options Let You Express

1. Direction – Where is it going?

Up, down, or nowhere? With stocks you can only bet “up” by buying or “down” by shorting. Options let you profit from sideways, too.

Not every thesis is directional. Sometimes your edge is knowing something won’t move.

2. Magnitude – How much will it move?

Will it move 5% or 20%? Options let you bet on the size of the move..

3. Timing – By when?

Time is money. The longer you give a trade to work, the more you pay. If you think something happens soon, you can pay less by buying less time.

4. Volatility – How calm or chaotic will the ride be?

If you think the stock will swing wildly and the market prices in calm, you can profit from being right about volatility alone even if the stock ends where it started.

5. Path

With multi-leg strategies, you can express when you expect movement to show up. A stock that reaches your price target in week one versus week eight produces very different outcomes.

Options are a Better Fit for How You Actually Think

Most investors don’t think in pure binaries. They’re probably thinking in scenarios. Here are some examples:

Big move either way (Straddles): “I don’t know if earnings will send it up or down, but I think it moves a lot.” You buy a call and a put so you’re long realized volatility.

Small move either way (Strangles): “I don’t know if earnings will send it up or down, but I think it doesn’t move a lot.” You sell a call and a put so you’re short realized volatility.

No move now, but big move later (Calendars/Diagonals): “I predict the stock doesn’t do anything for two weeks, then it goes up alot.” Buy a longer‑dated option and sell a shorter‑dated option at the same (or nearby) strike.

“I think it goes Up, but I want defined risk” → Long call or debit call spread

“I think it goes Down, but defined risk” → Long put or debit put spread

“I think it goes to $115 exactly on this date” → Butterfly centered at the target, with chosen expiration

Each choice is you expressing not just “up/down,” but how you expect reality to unfold.

Options are tools that speak the same language your market brain already uses

That’s why options are, in many cases, a superior way to express yourself : they match the multi‑dimensional nature of your beliefs.