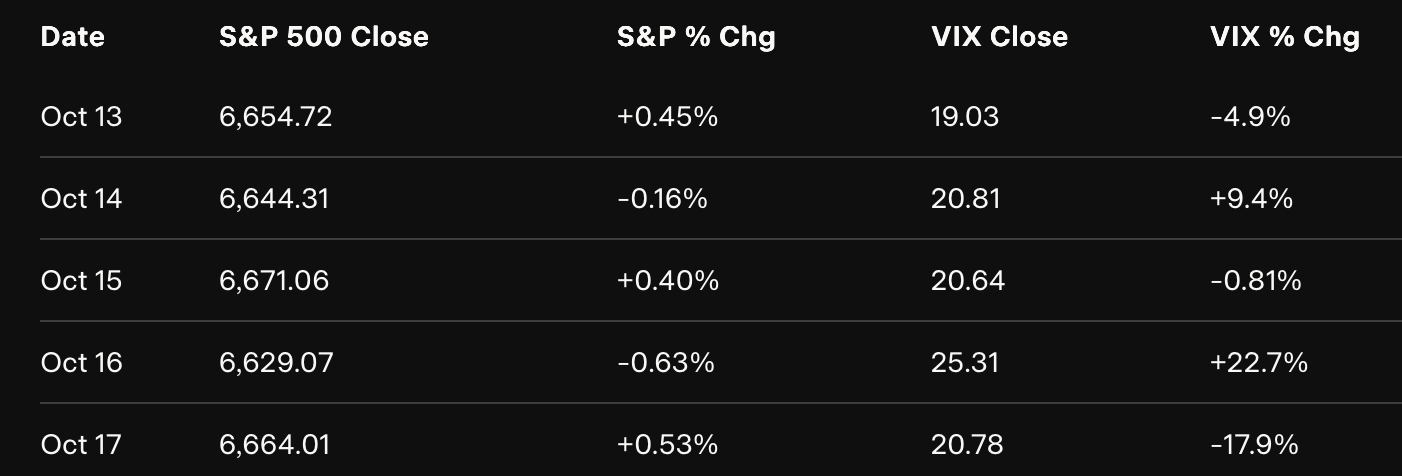

Oct 13-17, 2025

Monday, October 13, 2025

Key Drivers:

Markets rebounded sharply after the prior week’s weakness, lifted by a softer tone in U.S.–China trade headlines and improving global sentiment. Traders rotated back into risk assets as optimism about upcoming earnings built.

Sector Breakdown:

Technology led the advance, powered by semiconductor and AI-related strength. Industrials and materials followed, while defensive sectors such as utilities and staples trailed behind.

Notable Movers:

A major chipmaker surged roughly 10 percent after unveiling a strategic partnership, helping lift the broader technology complex. Other cyclical names rallied on renewed growth hopes.

Volatility Insight:

Implied volatility declined markedly as fear subsided. The VIX fell from elevated levels, reflecting reduced demand for protection. However, such steep drops after stress periods can often precede renewed volatility bursts.

Tuesday, October 14, 2025

Key Drivers:

Markets traded more cautiously after Monday’s surge. Traders balanced optimism about earnings with resurfacing trade and tariff concerns, creating an indecisive tone.

Sector Breakdown:

Technology and consumer discretionary sectors continued to outperform, while defensive sectors remained soft. Financials were mixed as yields fluctuated.

Notable Movers:

There were no dominant single-stock catalysts—gains were broad-based, reflecting modest follow-through rather than concentrated enthusiasm.

Volatility Insight:

Volatility remained in a holding pattern—off the highs but not yet calm. Both realized and implied measures suggested investors were still paying for optionality in case of another macro headline surprise.

Wednesday, October 15, 2025

Key Drivers:

Equities paused ahead of key macro data releases. Some renewed trade tension headlines limited upside momentum, while earnings results came in mixed.

Sector Breakdown:

Industrials and materials showed relative strength on modest trade optimism, while technology traded flat. Defensive groups such as healthcare and staples lagged.

Notable Movers:

No single company drove the day’s moves; the index closed largely unchanged, reflecting a classic “wait-and-see” stance.

Volatility Insight:

Both implied and realized volatility compressed further. Front-month option pricing softened slightly, though the back end of the curve stayed firm—suggesting traders expected quiet near-term action but still hedged against medium-term risks.

Thursday, October 16, 2025

Key Drivers:

A mix of credit and regulatory headlines, particularly around regional banks, injected mild stress into markets. Despite solid earnings elsewhere, sentiment turned defensive.

Sector Breakdown:

Financials underperformed due to credit-quality concerns. Energy and technology sectors traded mixed, while defensive groups caught a small bid as investors trimmed exposure.

Notable Movers:

Regional banks saw notable downside after updates on loan-loss provisions. Broader indices held up but momentum faded.

Volatility Insight:

Implied volatility ticked higher as traders added short-dated downside hedges. The rise was modest but notable given recent complacency, signaling sensitivity to renewed credit stress.

Friday, October 17, 2025

Key Drivers:

The week ended on a mixed note. After early strength, the S&P 500 faded into the close as traders squared positions ahead of weekend risk and incoming macro data. The index slipped about 0.6 percent to finish near 6,629.

Sector Breakdown:

Technology cooled off slightly after a strong run, while defensives and healthcare held firm. Financials again lagged.

Notable Movers:

Volatility-linked instruments and hedging ETFs saw large intraday swings as traders unwound protection. Equity-index vol measures recorded one of their steepest intraday declines in years before stabilizing.

Volatility Insight:

The VIX’s drop from its intraday high—nearly 30 percent—was among the largest single-day collapses in recent decades. Historically, such sharp volatility contractions have preceded short-term equity strength, though they can also mark complacent turning points.