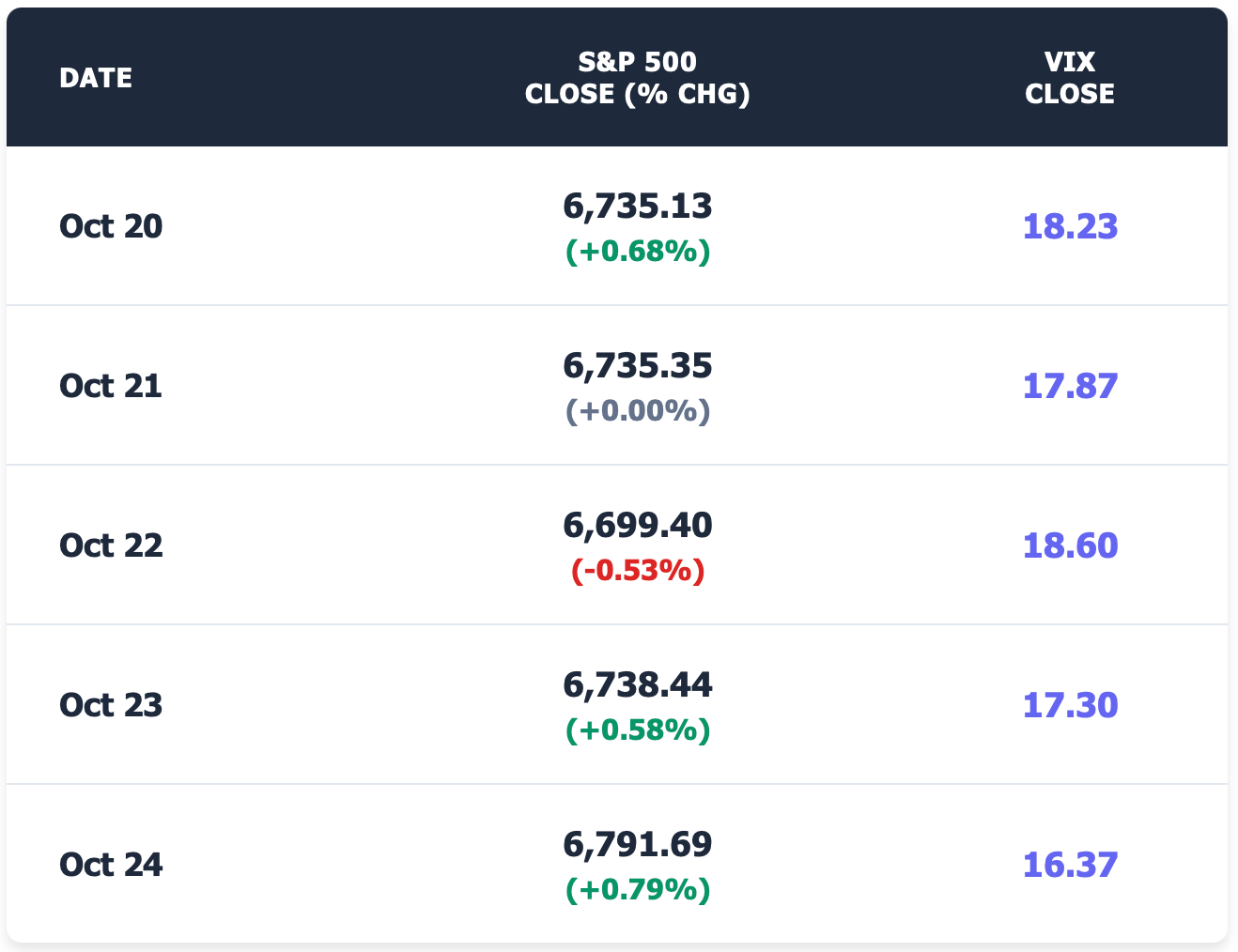

Oct 20-24, 2025

Monday, October 20, 2025

Key Drivers:

Markets opened the week with strength as optimism grew around corporate earnings and reports of easing U.S.–China trade tensions. Strong Chinese industrial data added to global risk appetite, and traders positioned for a busy earnings calendar.

Sector Breakdown:

Technology and large-cap growth led the advance, particularly megacaps tied to consumer tech. Industrials and materials benefitted from improving trade sentiment, while defensive sectors lagged slightly.

Notable Movers:

Apple rallied nearly 4 percent on upbeat iPhone demand expectations. Select industrial names tied to global manufacturing also outperformed.

Volatility Insight:

Implied volatility drifted lower as buying resumed and tail-risk pricing eased. The VIX stayed near the high-teens, consistent with a “recovery momentum” environment rather than panic.

Tuesday, October 21, 2025

Key Drivers:

The index extended gains but with more measured tone as investors weighed strong earnings against mixed macro data. Credit and valuation concerns surfaced, yet risk appetite remained firm.

Sector Breakdown:

Consumer discretionary and technology outperformed again. Energy stayed firm, while utilities and staples weakened as investors rotated back into growth and cyclicals.

Notable Movers:

Broad-based advances across tech and retail lifted the market roughly 1 percent. No single headline name dominated performance.

Volatility Insight:

The VIX fell about 12 percent to the low-18s, underscoring a reduction in fear. Traders noted that the drop in implied vol may signal complacency if earnings surprises fade.

Wednesday, October 22, 2025

Key Drivers:

Markets paused after two strong sessions. Participants awaited upcoming macro releases, particularly inflation data. A quiet tape reflected positioning adjustments more than new information.

Sector Breakdown:

Consumer discretionary and industrials advanced modestly, while utilities and healthcare lagged. Sector leadership rotated toward cyclicals, reflecting optimism for continued growth.

Notable Movers:

No major outsized movers; performance was evenly distributed. The S&P closed little changed.

Volatility Insight:

With flat index action, implied volatility compressed further. The term structure steepened slightly, suggesting markets expected calm in the near term but maintained some protection further out.

Thursday, October 23, 2025

Key Drivers:

Energy strength and solid corporate earnings fueled another push higher. Oil prices spiked on supply constraints, boosting risk appetite. Broader sentiment stayed constructive.

Sector Breakdown:

Energy led the day, followed by technology and industrials. Financials lagged as traders digested mixed guidance from large banks.

Notable Movers:

Oil-linked equities and semiconductor names outperformed. Broader advances suggested renewed risk-on sentiment.

Volatility Insight:

Implied vol continued to edge lower as spot equities rose. However, rising oil volatility created a mild divergence between equity and commodity vol curves—an early sign that cross-asset risk premium remained alive beneath the surface.

Friday, October 24, 2025

Key Drivers:

Softer-than-expected inflation data boosted hopes for a Fed rate cut, igniting a strong rally into the weekend. Investors embraced the “Goldilocks” narrative of cooling prices and resilient growth.

Sector Breakdown:

Technology and financials led the advance. Defensive groups underperformed as investors favored cyclical exposure and higher beta.

Notable Movers:

Large-cap tech names gained sharply, and major banks rose on expectations of easier policy. Broad participation pushed the S&P toward fresh highs.

Volatility Insight:

The VIX slipped further toward the mid-teens as short-term hedges were unwound. Realized volatility also declined, signaling a reversion to calm conditions. Traders noted, however, that such rapid vol compression can precede sharp snapbacks if next week’s data disappoints.