Michael Burry Just Quit with a $9.2 Million Goodbye Trade

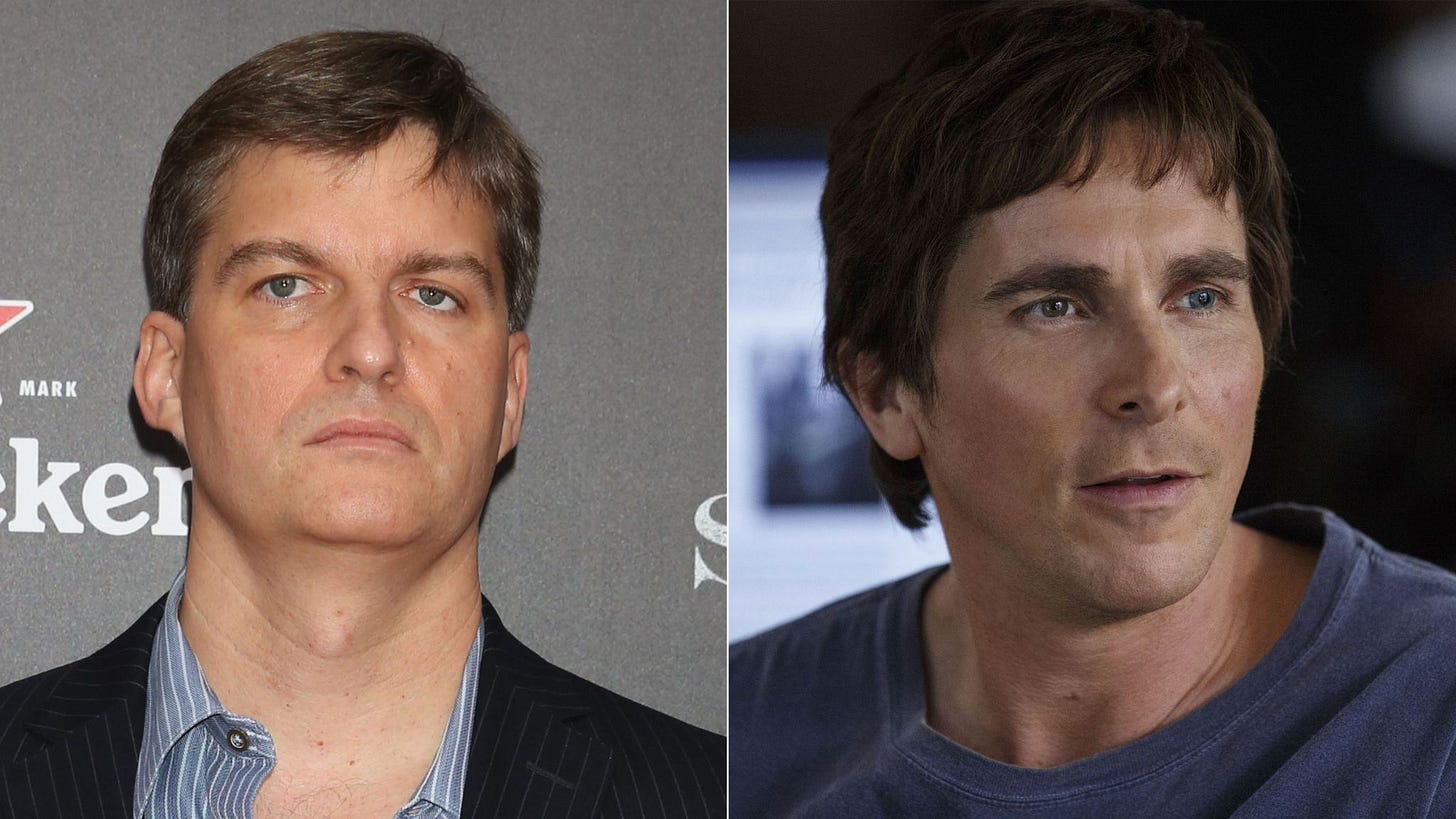

Michael Burry who famously called the great 2008 financial crisis just shut down his hedge fund.

He became a household name after he was portrayed by Christian Bale in the movie “The Big Short”.

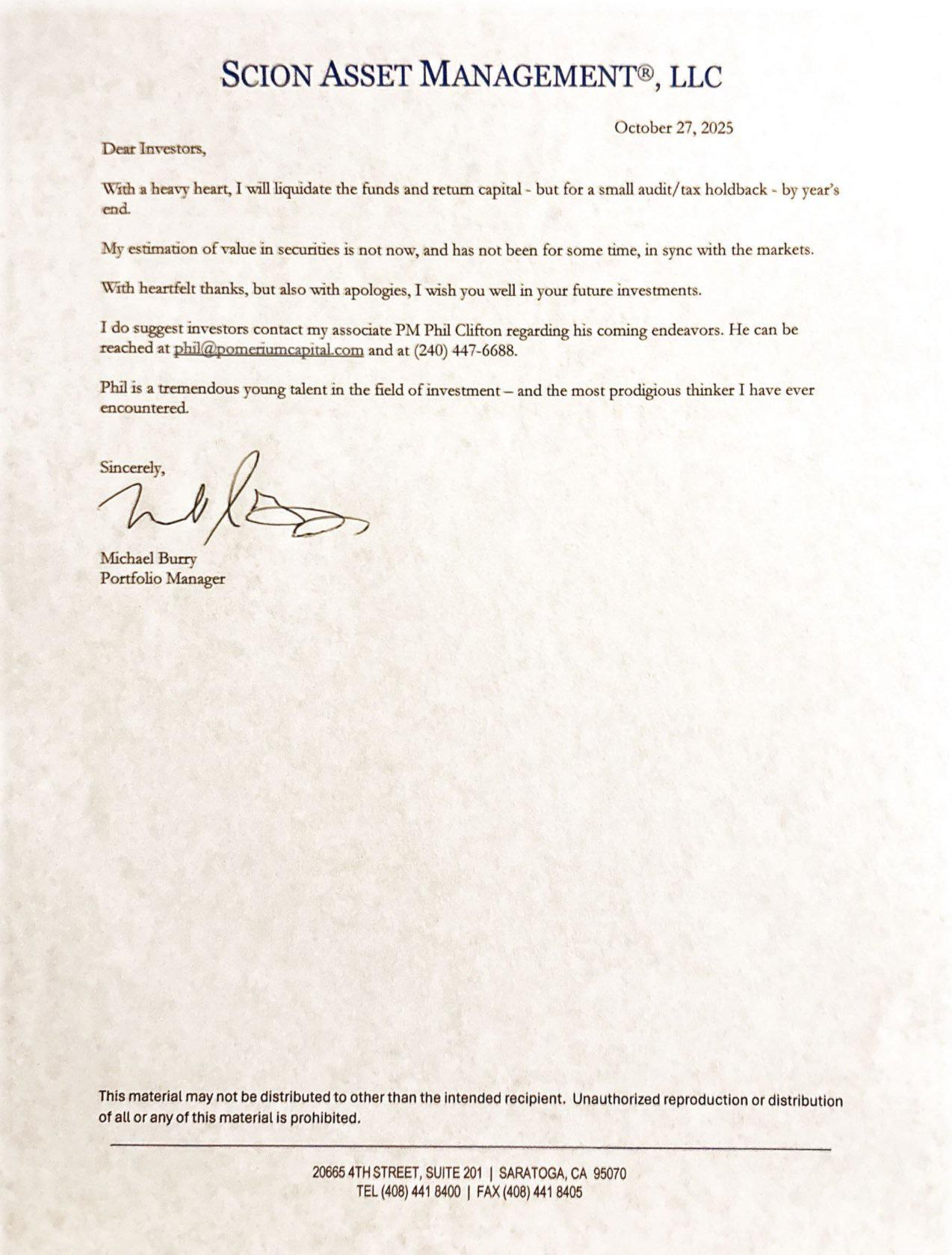

Below is his resignation letter:

Right after the news broke I shared my initial reaction on X:

Michael Burry - After his housing crash call made him a legend, he repeatedly positioned for more large macro collapses that never materialized.

He often focused on catastrophe trades that required perfect timing.

Ultimately, he spent years being “right too early,” which in markets is the same as being wrong.

Why Burry Walked Away

He didn’t want to relive the nightmare of being right too early again.

Burry lived this nightmare from 2005–2007:

Relentless pressure from furious investors

Severe personal psychological cost

The isolation that comes with holding an unpopular but accurate view

Now, facing a similar situation with overvalued AI stocks, and a euphoric market who thinks they are all geniuses because everything keeps going up, Burry has made a different strategic choice:

Even though he is convinced of an eventual AI-bubble collapse, he refuses to endure years of public ridicule and investor revolt while waiting to be proven right.

Michael Burry’s Goodbye Trade

After he quit, in his family fund, he made a $9.2 million bet using “long dated out of the money options”* that the stock Palantir (PLTR) would collapse by 70% or more by early 2027.

*Long dated out of the money options is the financial equivalent of buying cheap insurance on a building you believe is wired with explosivesWhy Palantir?

Palantir is the poster child of the AI bubble

Palantir is currently trading at an insane P/E* of 425.

*Price-to-Earnings ratio, is a key stock valuation metric showing how much investors pay for $1 of a company’s earningsTo give context, below are current P/E ratios of popular tech companies:

Palantir: 425

NVidia: 45

Apple: 37

Amazon: 32

Google: 31

Meta: 29

CI Volatility’s Takeaway on Burry’s Goodbye Trade

Burry is worth around $300 million, so the $9.2 million bet he made is about 3% of this net-worth.

If Palantir collapses, depending on the speed of the collapse, he can easily make over 20× or more return on his options adding tens or hundreds of millions to his net worth.

Overall we think it’s a brilliant trade FOR HIM, for 3 reasons:

Maintains conviction without the psychological damage

By sizing at just 3% of net worth, Burry can maintain his bearish AI thesis without enduring the torture that defined 2005-2007. He’s essentially paying $9.2 million for peace of mind while keeping skin in the game.The trade has asymmetric payoff

Capped 3% downside vs. potential 20x upside.It’s his personal money

Whether Palantir collapses or not, Burry won’t have to explain himself to anyone. And that might be worth more than the $9.2 million at risk.