This strategy implements a volatility-weighted long-term momentum signal.

Concept

Rather than treating all past days as equally important, a small subset of large price moves carries much more information in predicting future momentum than small, noisy day to day fluctuations.

We believe only a few specific days a year contain real predictive information:

Earnings announcement days

Fed days

Basically any day with unusually large volatile moves

…carry far more information than the other ~230 days in the year.

Our Signal

That’s why we’ve launched our own volatility inspired momentum indicator. a smarter approach that focuses on the handful of trading days that truly matter.

The signal calculates daily log returns over a lookback window, skipping the most recent period to avoid short-term reversal effects. Each day’s return is then weighted by it’s volatility. Bigger moves have more influence on the momentum signal.

When this signal crosses above zero, the strategy enters long. When it crosses below zero, it exits.

This Signal Works Best on True Momentum Names

It performs best on stocks with momentum characteristics like TSLA, PLTR, NVDA, META, AMD, RDDT, etc…

These stocks exhibit exactly the behavior this signal looks for: Large information days (earnings gaps, huge macro-reaction days, explosive single-day moves)

This Signal Requires a Long-Term Mindset

If it triggers a Buy… it might not trigger a Sell for 3–15 months.

The strategy is explicitly designed to capture that multi-month grind upward, not daily fluctuations.

If you’re using this signal, you must have a “holder’s mindset,” not a daytrader’s mindset.

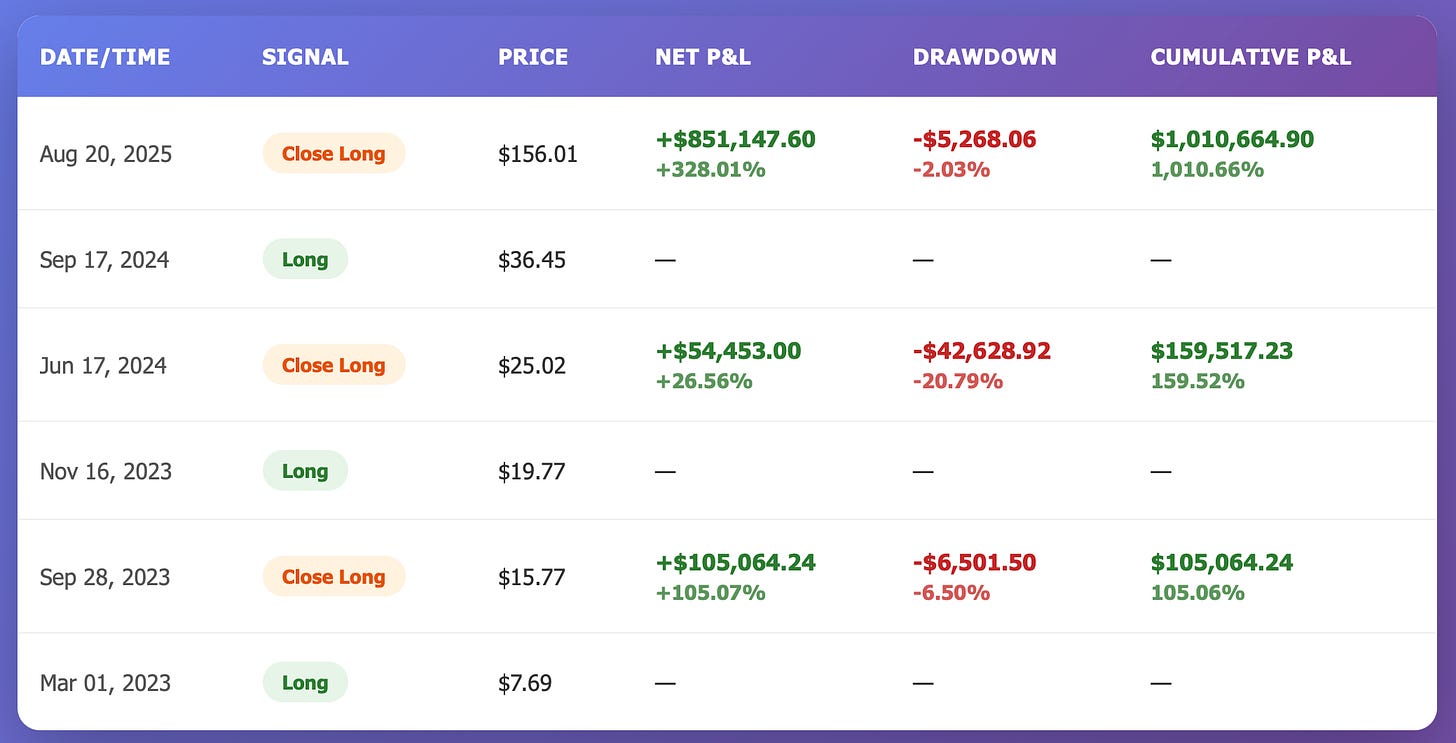

Example Backtest (PLTR)

Return: 1,010.66%

Number of Trades: 3

Timeframe: Mar 1, 2023 - Aug 20, 2025

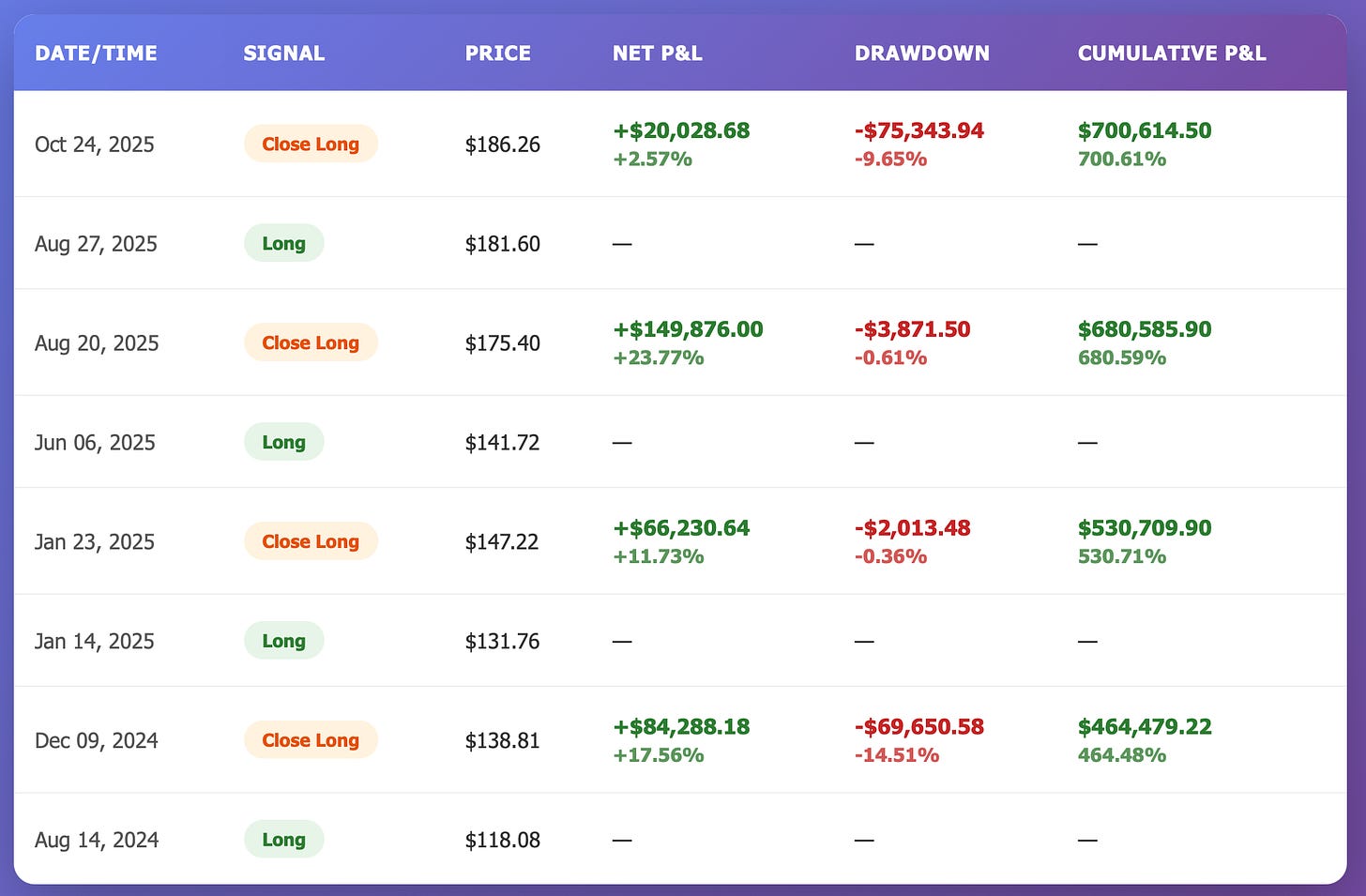

Example Backtest (NVDA)

Return: 700.61%

Number of Trades: 11

Timeframe: Jul 24, 2020 - Oct 24, 2025

If you’re interested in incorporating this signal into your workflow click below: