Testing the Japanese Overnight Reversal Theory

Two Japanese finance professors, Yasuhiro Iwanaga of Tamagawa University and Ryuta Sakemoto of Hokkaido University, published a paper titled ”Intraday Time Series Reversal.” They claim to have identified a reliable intraday pattern that has been working since 1996: That positive overnight moves tend to reverse downward at the open, and negative ones bounce upward, all within the 9:30–10:00 a.m. window.

In short, the opening gap often reverses early in the session.

Personally, I’m skeptical that this edge has survived into 2026 because the idea is remarkably simple which immediately raises red flags. Patterns this straightforward which require only basic price data are prime candidates for rapid arbitrage. Thousands of traders, systematic funds, and high-frequency firms have had years to spot and exploit it.

The professors themselves note the reversal was already fading after the 2010s.

That’s exactly why, now in early 2026 with a complete year of new data available, we’re putting Iwanaga and Sakemoto’s theory to the test. Does the overnight-to-first-half-hour reversal still exist in 2025 or has it finally been arbitraged away?

The Test is Simple

If SPY opens above yesterday’s close

Buy it

Close it at 10:00am regardless of price

If SPY opens lower than yesterday’s close

Short it

Close it at 10:00am regardless of price

2025 Results

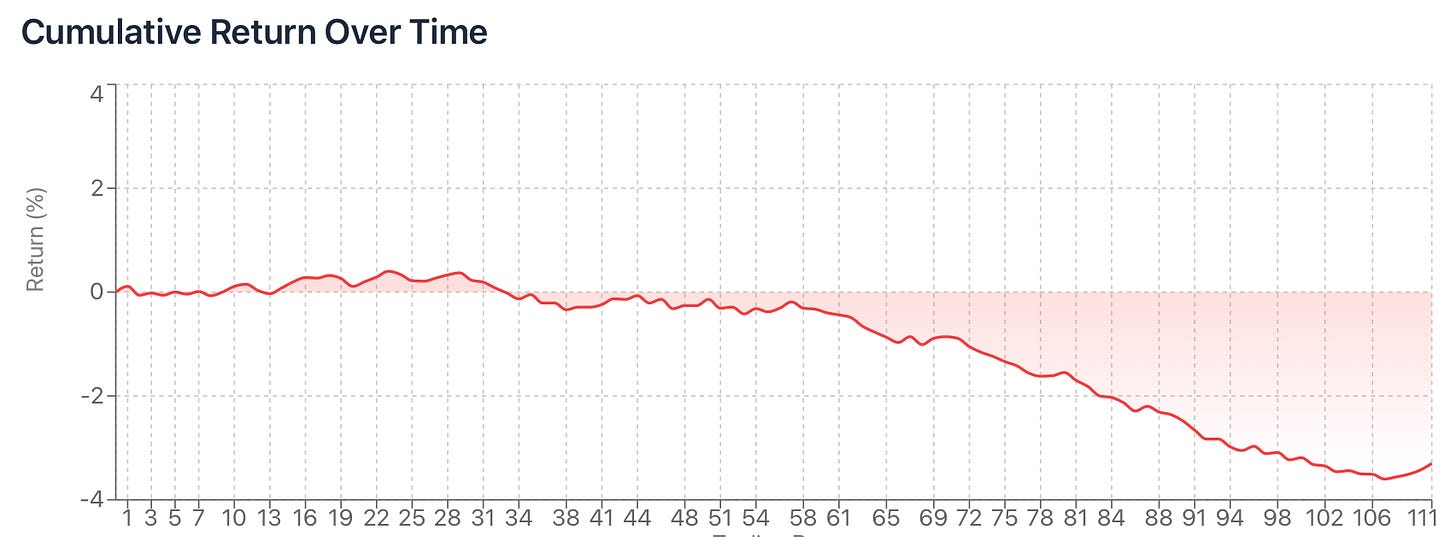

The strategy lost money in 2025, ending down -6.24%. The reversal effect appears to have largely disappeared amid growing market efficiency.

2025 Results (CI Volatility Version)

Given the paper’s finding that intraday reversal strengthens during periods of high volatility, at CI Volatility we decided to take it a step further. Not all gap ups and downs are true reversals. We tested only occasions where the gap up or down was 0.5% or higher. This filter reduced the trade count but focused on the setups most aligned with the authors’ volatility-based insights.

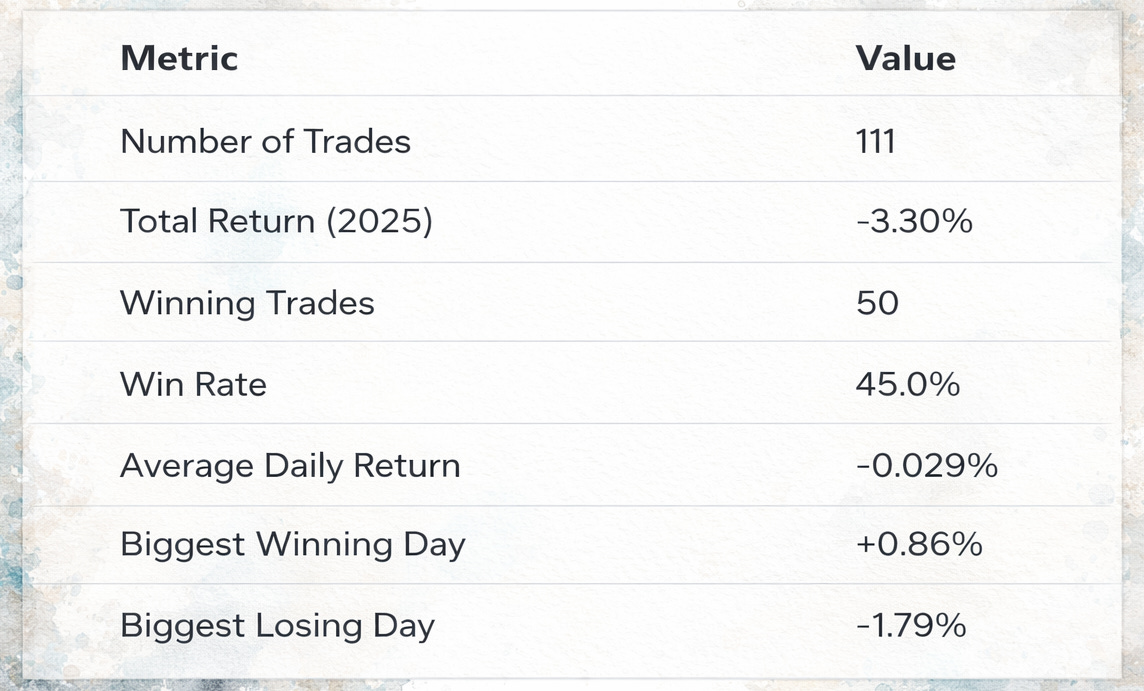

The backtest covers 111 trades in 2025 (triggering only on days with |overnight gap| ≥ 0.5% and a 30-minute hold).

Even with this higher-threshold filter, the results improved but the strategy still lost money in 2025, ending down -3.30%.

The Edge is Gone

For traders in 2026, there is no reliable advantage left to exploit here. The overnight-to-open reversal has joined the long list of strategies that worked before but has since been arbitraged away.