Is the Santa Rally Real?

We checked using 42 years of data

The final stretch of the calendar year is often referred to as the “Santa rally.”

Using S&P 500 data spanning 42 years, we analyzed how the market behaves in:

The second-to-last week of the year

The final week of the year

The combined two-week window

And compared all of it to a normal (baseline) week

Start With the Baseline

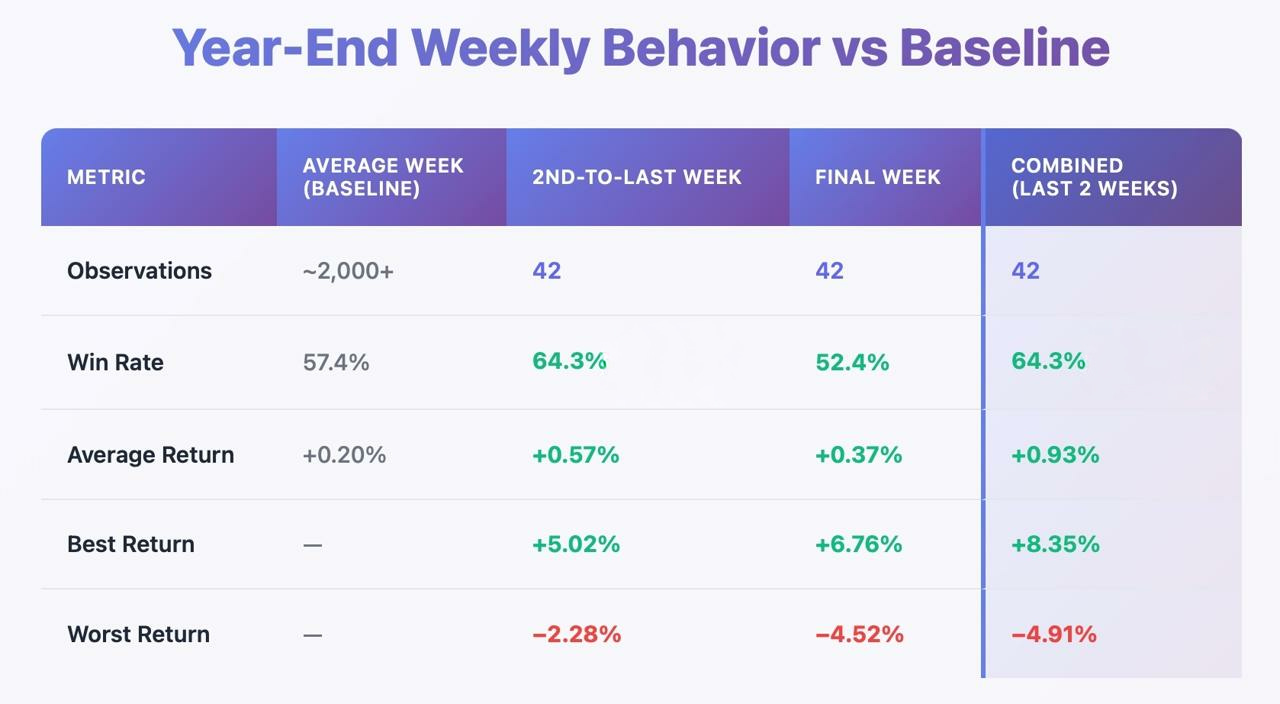

Over the full dataset, the average S&P 500 week looks like this:

Win rate: ~57%

Average return: ~+0.20%

That’s your benchmark. Any seasonal edge needs to beat this to matter.

The Second-to-Last Week Is Where the Edge Begins

The second-to-last trading week of the year stands out immediately:

Win rate: ~64%

Average return: ~+0.57%

That’s a material improvement over a normal week, both in reliability and magnitude.

This is the week that does the heavy lifting for year-end performance.

The Final Week Is Overrated

By contrast, the final trading week on its own is far less impressive:

Win rate: ~52%

Average return: ~+0.37%

The Real Opportunity Is the Two-Week Window

When you combine the second-to-last week and the final week into a single two-week return, the picture sharpens dramatically:

Win rate: ~64%

Average return: ~+0.93%

Best outcome: +8.3%

Worst outcome: −4.9%

This window:

Matches the strong win rate of the better week

Nearly quintuples the average return of a normal week

Captures the full effect of year-end positioning and flow continuity

So is the Santa Rally Real?

Based on four decades of data:

The “Santa rally” is not a one-week event. It’s a two-week window and the rally starts earlier than most people think.

The second-to-last week provides the reliability.

The final week completes the move.

Together, they meaningfully outperform a normal week.