If you’re brand new to volatility trading, you’ve probably noticed something strange:

sometimes the S&P 500 (SPX) closes lower and yet UVXY, which is supposed to rise when volatility increases, also ends the day down.

At first glance, that seems weird. But as the data shows, it’s actually quite common.

The Misconception

Most traders assume:

“When stocks fall, volatility rises so UVXY must go up.”

In reality, UVXY doesn’t track the stock market directly. It follows short-term VIX futures, which represent traders’ expectations of volatility 30 days ahead, not the volatility happening today.

So while the S&P can be red, if the market’s decline is small volatility may actually calm down, not rise.

How Often It Happens

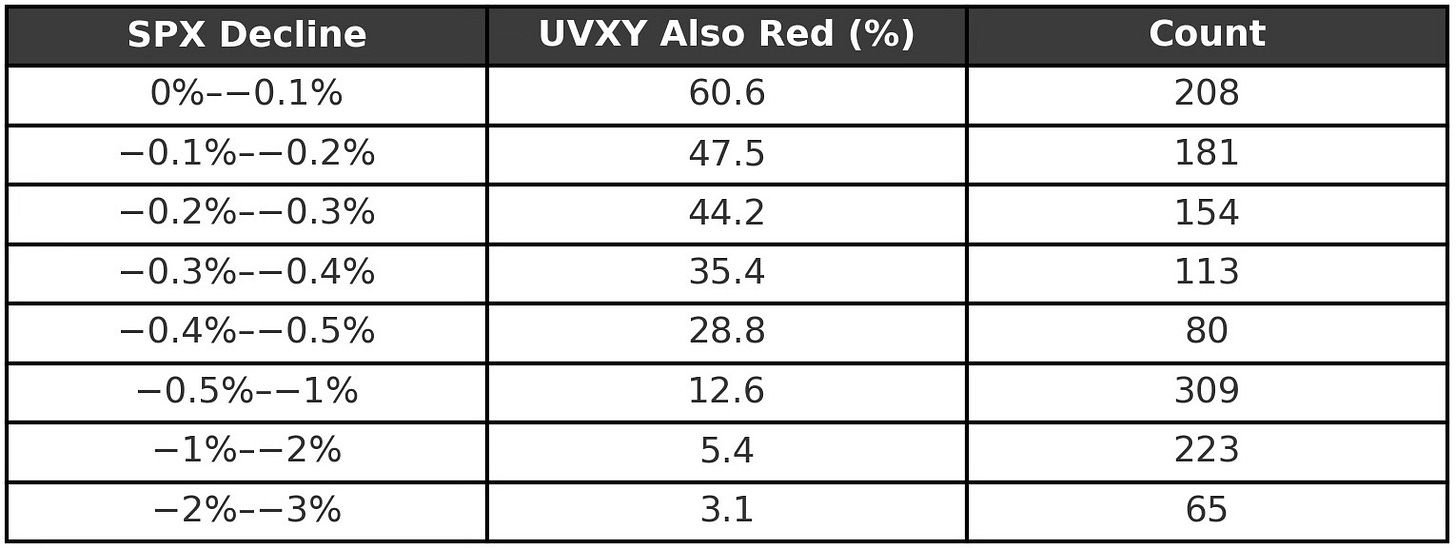

A full historical study of SPX and UVXY daily closes shows that UVXY finishes red about 29% of the time when SPX is also red.

But the relationship depends heavily on how big the market drop is.

Based on close-to-close daily changes:

On tiny market dips (<0.2%), UVXY actually falls most of the time: 6 out of 10 days.

When SPX drops between 0.3% and 0.5%, UVXY still fails about one-third of the time.

Once SPX falls more than 1%, UVXY almost always rises because the move is finally large enough to shake volatility expectations.

The Lesson for New Traders

Don’t assume UVXY is a perfect hedge for every market dip.

It’s designed to explode only during real fear events, not every time the S&P slips a few points.

If you buy UVXY every time SPX turns red, you’ll likely lose money.