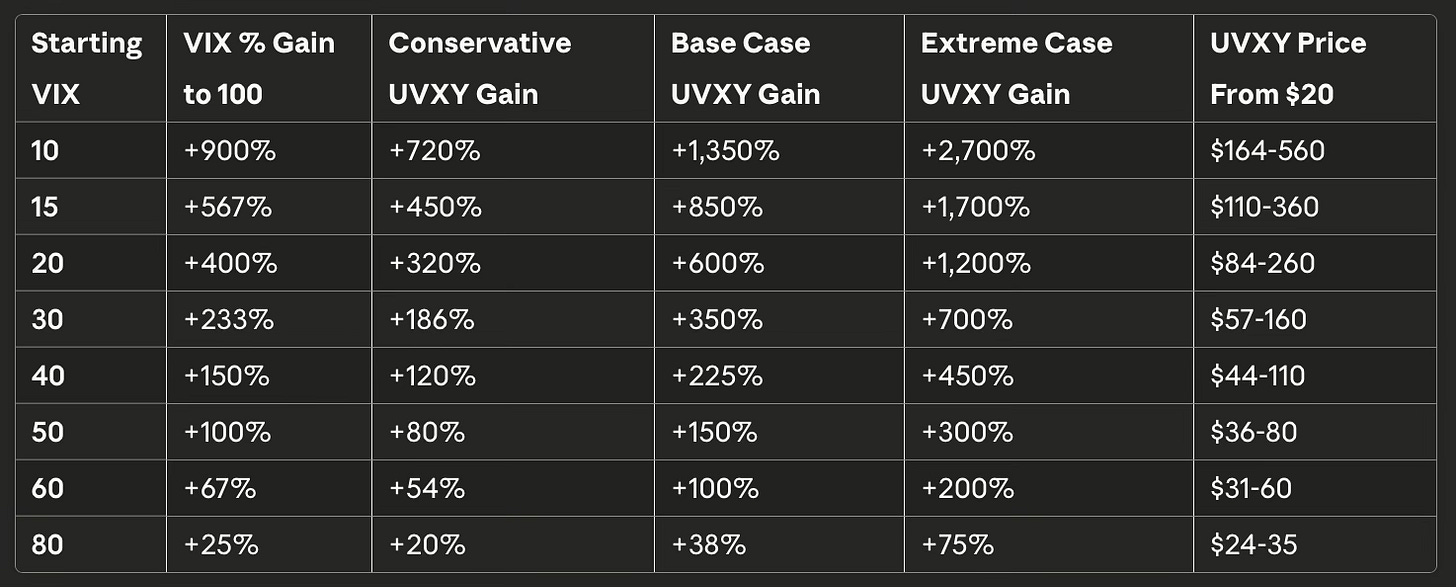

A VIX print of 100 would be financial armageddon - beyond COVID and 2008’s peak. It’s never happened before, but here’s exactly what UVXY could hit based on where VIX starts.

Conservative vs Base vs Extreme Case

Conservative Case (0.8x VIX move):

Assumes futures lag significantly

Slow grind higher over weeks

Contango fights some of the move

Lots of whipsaw action destroys some of the move through beta slippage

Base Case (1.5x VIX move):

Similar to March 2020 relationships

Multi-day spike with futures following

Some backwardation helps the move

Extreme Case (3x VIX move):

Instant gap with full backwardation

Maximum daily compounding

Theoretical but possible in true panic

Example Scenario: Starting from VIX 15 (Normal Market)

This is the most likely starting point

VIX Move: 15 → 100 (+567%)

Conservative: UVXY gains 450%, reaching $110 from $20

Base Case: UVXY gains 850%, reaching $190 from $20

Extreme: UVXY gains 1,700%, reaching $360 from $20

Starting VIX Level Is Important

Why Low Starting VIX = Bigger UVXY Gains:

More Room to Run: 10→100 is a bigger percentage than 50→100

Leverage Compounds: 1.5x daily leverage multiplies over more days

Futures Curve Flip: Bigger contango-to-backwardation shift

Psychology: Unexpected spikes from calm create more panic

Historical Context: Has 100 VIX Ever Happened?

Highest VIX Levels Ever:

October 24, 2008: VIX hit 89.53 intraday

March 16, 2020: VIX hit 82.69

VIX 100 would require:

Complete market structure breakdown

Multiple circuit breakers

Potential trading halts

Systemic financial crisis