How Backtesting Builds Your Confidence

Every trader knows the feeling.

You’re in a good position. The setup was perfect. The entry was clean. And then… the market wiggles a little against you. Suddenly, that conviction turns into doubt. You exit early. Minutes later, the stock does exactly what you expected.

What changed?

Not the data. Not the setup. Only your confidence in it.

That’s where backtesting becomes more than a technical exercise. It helps you build confidence to stay in positions.

The Confidence to Sit Through Volatility

Most people see backtesting as a way to the measure the potential profitability a trade.

At CI Volatility, we see it as something deeper: a way to understand how markets behave so that you’re emotionally ready for what comes next.

When you’ve tested a strategy over hundreds or thousands of data points (bull markets, bear markets, flash crashes, calm periods) you know that a 2% unrealized drawdown isn’t a disaster; it’s just short term volatility.

Without backtesting, every red candle feels painful.

With backtesting, every red candle is just part of a familiar pattern.

You start to realize:

Pullbacks are normal.

Temporary drawdowns don’t invalidate your thesis.

When you know that your system has survived worse in backtesting, you stop reacting to every price tick. You stop micromanaging. You stop sabotaging your own edge.

You’ve already seen the story play out thousands of times in your tests.

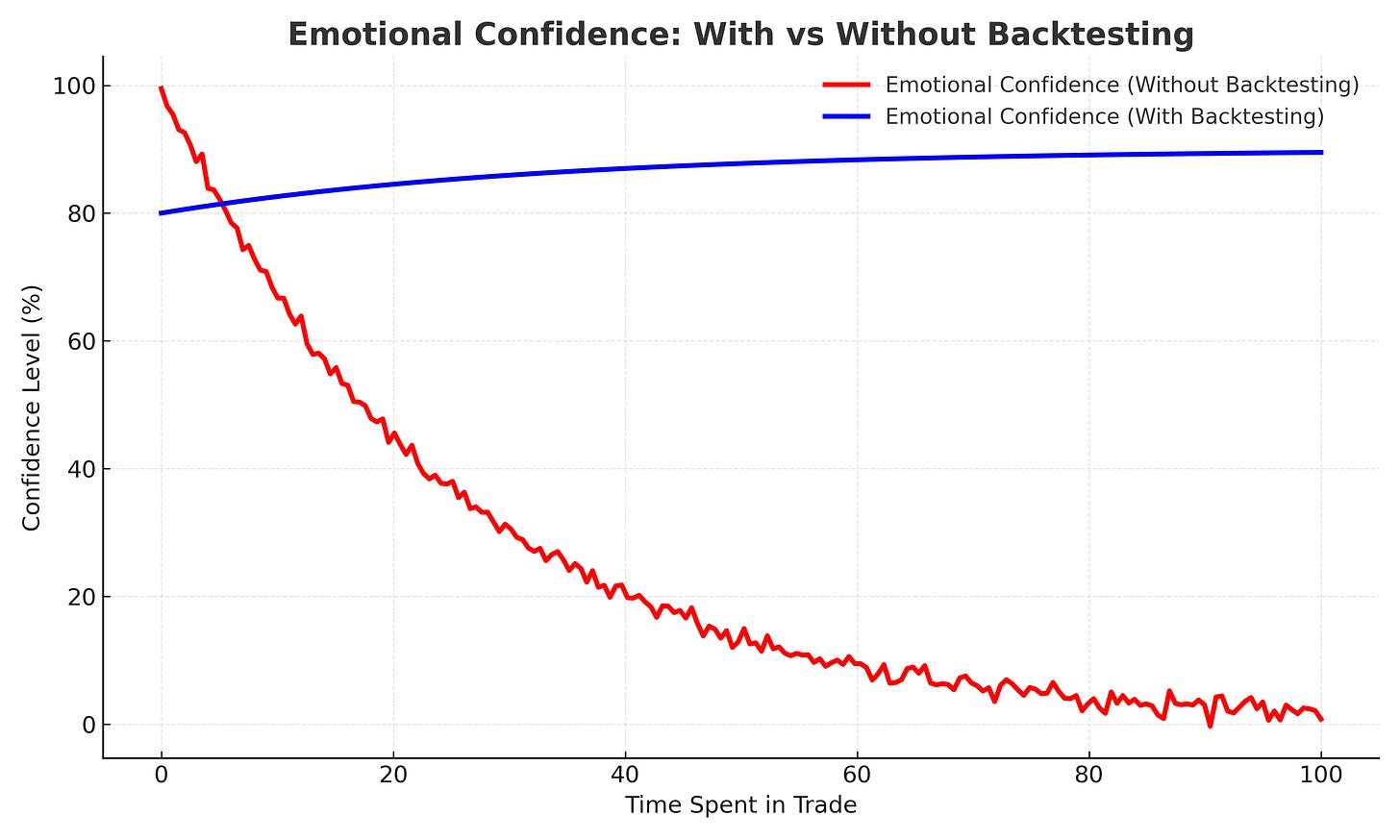

This theoritical chart illustrates how emotional confidence evolves over time with and without backtesting. The red line shows how confidence typically erodes the longer you hold onto a trade when traders rely solely on emotion.

The blue line represents emotional confidence after backtesting.

At CI Volatility

We take and hold because we’ve tested the conditions under which they pay off.

Each strategy is stress-tested across thousands of days, volatility regimes, and market events.