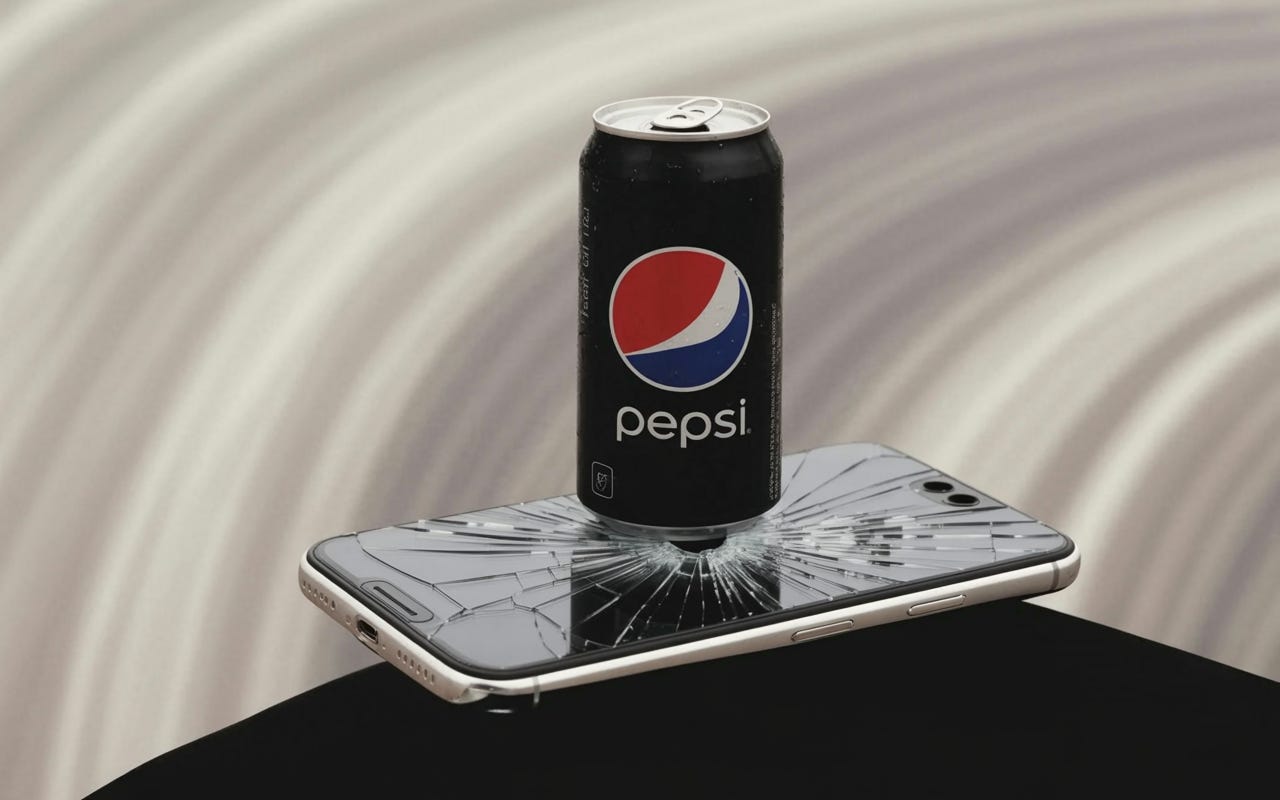

When Pepsi Is Crushing Microsoft, the Economy Should Be Worried

In 2026, the companies that sell you toothpaste and frozen chicken are dramatically outperforming the companies that were supposed to be building the future.

The winners (YTD):

Costco (COST): +19.19%

Walmart (WMT): +18.74%

PepsiCo (PEP): +16.67%

Coca-Cola (KO): +13.83%

Procter & Gamble (PG): +12.89%

McDonald’s (MCD): +8.02%

The Consumer Staples Select Sector SPDR Fund (XLP) is up approximately 13% year-to-date through early February, one of its strongest starts in over a decade. The tech sector is down roughly 3%. That’s a 16-point spread in six weeks. This is not normal.

Why Is This Happening?

Several forces are converging at once, and none of them are good.

1. AI Capex

For two years, investors poured money into anything with “AI” in the pitch deck. Valuations soared on the promise that artificial intelligence would generate trillions in new revenue.

Now the market is asking a simple question: where are the returns?

The big tech hyperscalers — Microsoft, Meta, Amazon, Alphabet — have announced combined capital expenditure plans approaching $700 billion for 2026. That’s more than the GDP of entire nations. And investors are getting nervous that this spend is running ahead of actual monetization.

2. The Market is Panic-Selling Anything that Looks Remotely Disruptable by AI

Software, legal services, wealth management, even transport. If a business model can theoretically be replaced by a chatbot or an algorithm, investors are running for the exits. That capital has to go somewhere. And right now it's flooding into the stocks that AI can't touch. Coca-Cola. Procter & Gamble. Walmart. ExxonMobil. The old economy. The companies that sell physical things to real people in the real world.

3. Economic Slowdown

We’re living in what analysts have called a “K-shaped” economy. Affluent consumers continue spending freely. Lower- and middle-income households are drowning. Rising debt, stagnant wages, and genuine anxiety about job security.

When money gets tight, people cut Netflix before they cut groceries. They cancel the app subscription before they stop buying toilet paper. They skip the new iPhone but they don’t skip dinner.

Defensive companies sell the things people can’t stop buying. Speculative tech sells the things people cut first. Capital is following that logic aggressively right now, and it’s telling you that the smart money is betting the bottom half of the K is about to drag everything else down with it.

4. Valuations Were Absurd and the Correction Is Rational

After three years of a tech-led bull market, valuations on many growth stocks had reached levels that only made sense if everything went right. Any disappointment was going to be punished severely.

Why This Should Scare You

When the market collectively decides to hide in Coca-Cola, Procter & Gamble, and Walmart, it’s not because those companies suddenly became exciting. It’s because the smart money is bracing for economic slowdowns.

The numbers support this. Consumers are becoming more cautious. Spending is shifting towards essentials and away from discretionary purchases. Businesses are showing restraint on hiring and capital allocation.

None of this is a prediction that the market will crash. It might. It might not. What it is, unequivocally, is a signal that the playbook of buying any tech stock and waiting for AI hype to carry it higher is broken. The companies outperforming now are the ones that generate cash, pay dividends, sell products people actually need, and don’t depend on a speculative future that may or may not materialize.