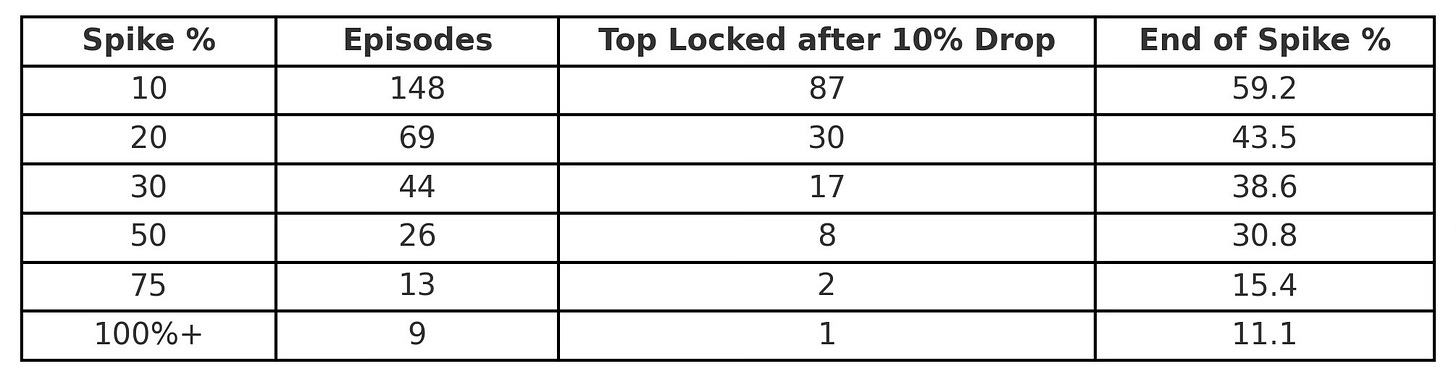

When UVXY spikes, a quick 10% pullback can feel like “the top is in.” The data says otherwise.

The bigger the surge, the less you should trust a mere 10% pullback. By the time a move is +30%, +50%, or more, a 10% dip is usually just day to day chop as most episodes go on to print a higher high.

How To Trade This

Don’t treat a 10% dip is as a reliable end-of-spike signal, especially after +30% and +50% runs. Treat it as a pause, not proof the top is in. If your goal is to ride the move to the next all time low, wait for deeper confirmation (scaled to spike size).