Do you think stop-losses can save you? Nassim Taleb Disagrees

Many traders live by the rule: “Cut your losses short and let your winners run.” The standard tool for this is the stop-loss order, a predefined price level at which you automatically exit a losing position.

But Nassim Taleb, author of “The Black Swan”, put out a new paper in December that challenges this view.

(Someone asked him on X to explain it “in simple terms” and got roasted for it—but I’ll give it a shot anyway.)

3 Reasons Why Stop Losses Can Actually Hurt You

You Get Kicked Out of Good Trades That Just Had a Bad Day

Most beginners think a stop-loss just removes the worst possible losses. Like, if you buy a stock at $100 and set a stop at $90, you’re getting rid of the really bad outcomes such as if the stock dropped to $50.

But the more likely outcome is not that the stock would just drop straight to $50 in one day. It’s that it will bounce around randomly up and down day after day and one random bad day could dip to $89 (triggering your stop and selling you out at a loss), even if the stock bounces back to $120 a week later.

Without the stop-loss, you’d be up big. With it, you’re stuck with a loss.

You end up turning rare huge crashes into a bunch of annoying regular losses.Stop-Losses Create “Magnets” That Smart Algos Love to Hunt

Taleb points out that once a stop-loss is set, the possible path of an asset’s price becomes less random. The closer the market gets to your stop-loss point, the more likely the price gets “pulled” toward those spots because there’s tons of action waiting there.At the same time, these stop-loss points do not exist in isolation, but together with other investors’ stop-loss points, which usually everyone puts at the same levels (round numbers, moving averages, etc…)which forms a huge and fragile liquidity area in the market. Market prices are naturally drawn there, as a large number of pending orders are waiting to be triggered at that spot.

Therefore, the seemingly “risk-reducing” act of setting a stop-loss actually creates new risk.

Stop losses trigger way more than you think

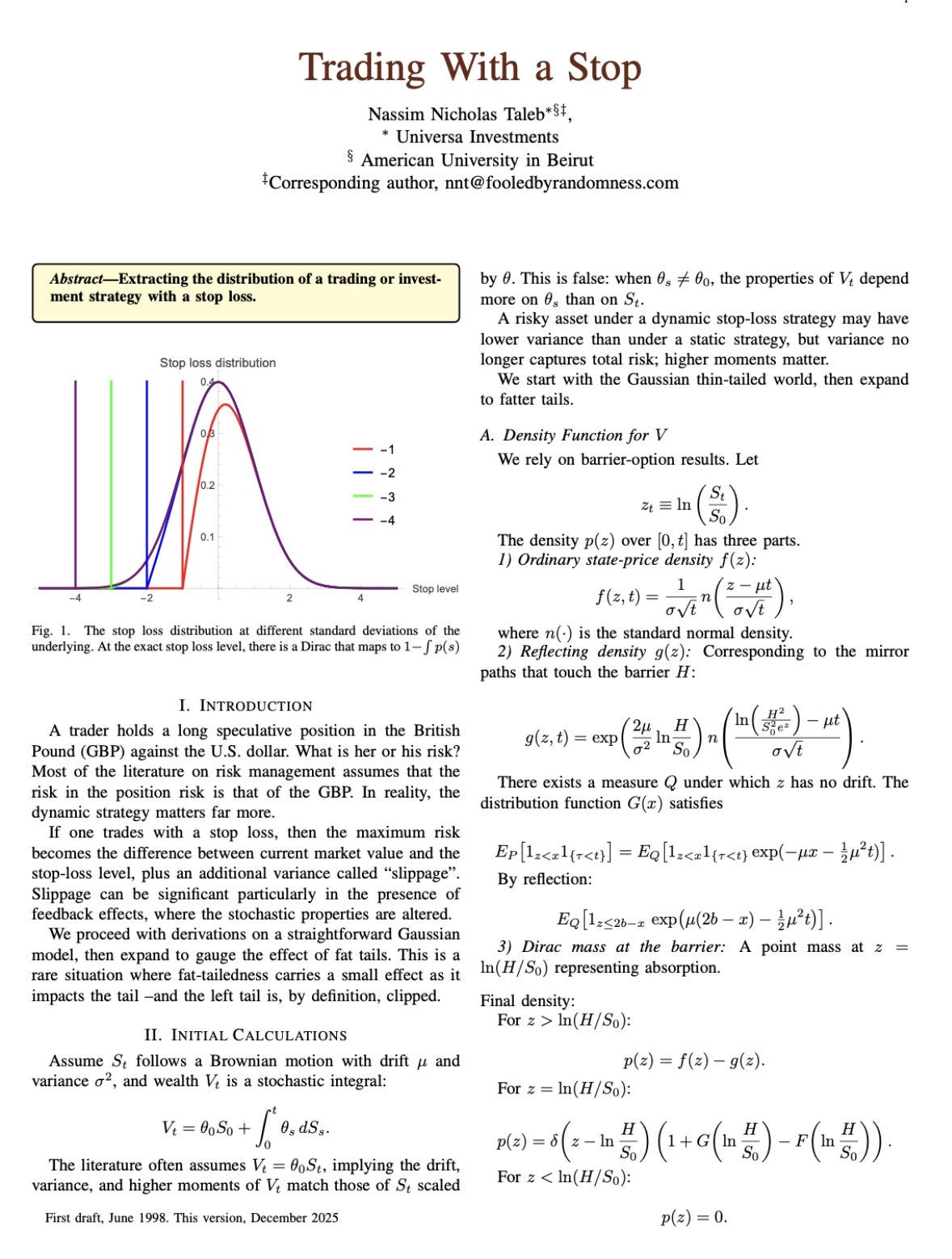

Math shows the odds are worse than intuition suggests.

For a normal stock over a year:

A 10% stop-loss has a 30-40% chance of triggering

A 15% stop-loss has a 20-30% chance of triggering

A 20-25% stop-loss has a 12-20% chance of triggering

Only really wide stop losses (35-50%) are rare triggers

Basically, tight stops (like 10%) are fighting random market wiggles more than protecting you from real disasters.What’s interesting is the chance of your stock hitting your stop loss is 2x greater than your stock ending up below your stop loss.

Tight stops: Almost guaranteed to hit eventually.

High volatility: At 60% annualized volatility (common in crypto or earnings seasons), even moderate stops become almost certain triggers.

Long holding times: Over years, even wide stops might get hit from accumulated randomness.

Taleb isn’t saying “never use stop-losses”

He’s simply saying stop-losses are not free protection.

You’re swapping one type of risk for another. It’s a tradeoff.

Basically: “It’s not reducing risk, it’s picking exactly where you’re willing to get hurt, and deciding if the trade-off is worth it.”

CI Volatility Recommendations

For day traders: Never put your stop loss at obvious levels like round numbers or previous highs/lows.

For swing traders: The best way is to use volatility-adjusted “trailing stops”. For example, like 2-3 times the average daily move (called ATR). They loosen up when markets are wild and tighten when calm.

For long term investors: For true tail protection, buy out-of-the-money put options. You retain full upside if the asset recovers, while the option pays off during black swan events.