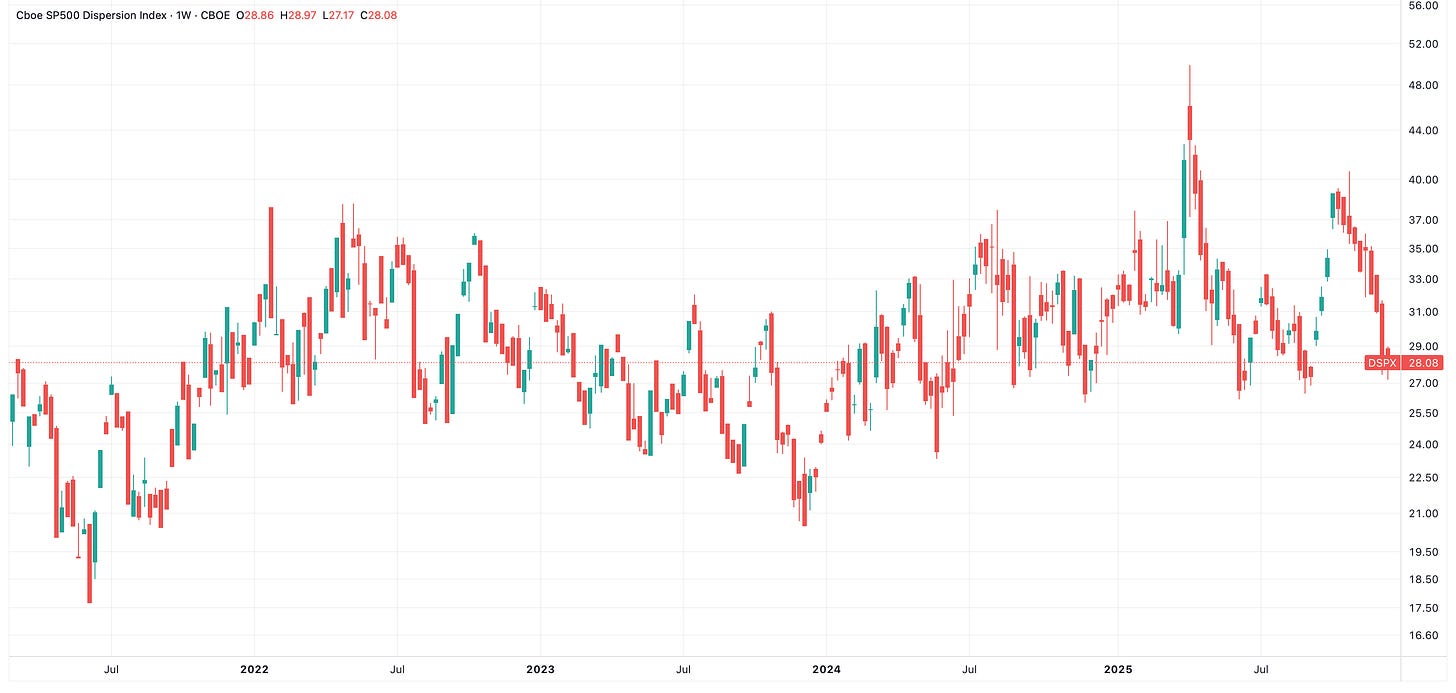

The DSPX Index (pictured above) is a measure of expected dispersion in the S&P 500. It essentially tells you how much individual stocks are expected to move relative to the overall index.

High dispersion means individual stocks are moving independently of each other. This suggests a good opportunity for stock picking. When dispersion is elevated, individual stock selection matters more because companies are trading on their own merits rather than moving together with the broader market

Low dispersion means stocks are all moving together as a herd.

Most Common Way to Use DSPX

For Dispersion Trading: When dispersion is high it means stocks are going to be more volatile than the index so the classic dispersion trade involves buying options on individual stocks while selling options on the index.

For example: