Social Media Erupts Over Credit Card Interest Rate Cap

President Trump just dropped a bomb on the credit card industry: he wants to cap interest rates at 10%.

With U.S. credit card debt surpassing $1.2 trillion and average interest rates hovering around 20-23%, it’s a real pain point for millions of Americans who are bleeding money to banks every month.

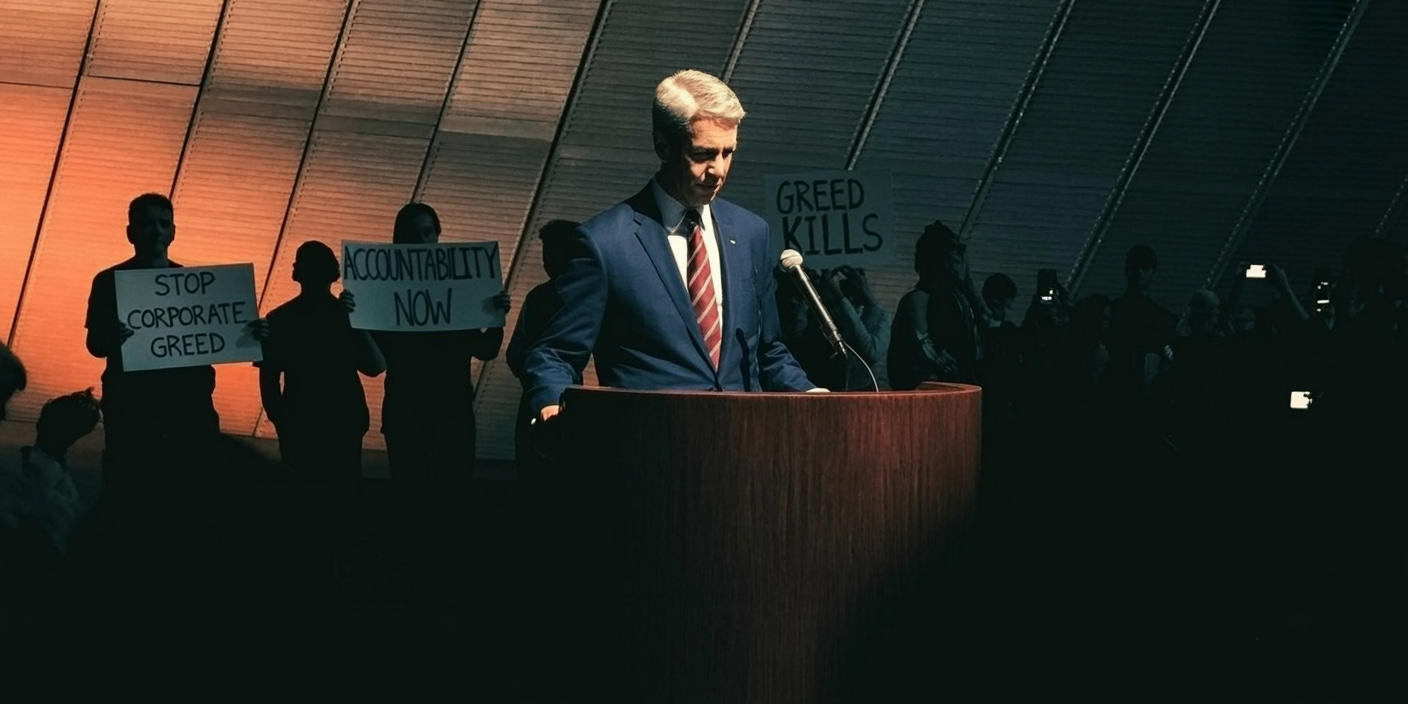

Social media exploded immediately from every possible angle. Some cheered it as taking on corporate greed. Others rang alarm bells calling a disruption to free markets. Even billionaires waded into the fray, which turned out to be a terrible idea.

The Bill Ackman Backlash

Enter Billionaire investor Bill Ackman.

Ackman’s initial take? The cap is “a mistake.” He posted his objection on X, presumably expecting a thoughtful policy debate.

Instead, he faced public backlash.

The backlash was swift and brutal enough that Ackman deleted his post.

While Ackman later posted a more measured response acknowledging Trump’s goal as “worthy and important” while maintaining his concerns about implementation, the episode demonstrated how toxic it can be for billionaires to publicly oppose populism policies, even when raising legitimate economic concerns.

The Responsibility Wars

But Ackman wasn’t alone in his criticism. The proposal has ignited a fierce debate about personal accountability.

Many fiscally conservative Americans view the rate cap as rewarding irresponsible behavior at the expense of responsible consumers.

This perspective argues that high interest rates exist precisely because some borrowers are high-risk, and that those who manage credit responsibly shouldn’t subsidize those who don’t. Critics from this camp see the proposal as another form of wealth redistribution or “bailout culture” where people who made poor financial decisions are rescued by government intervention, while disciplined savers and responsible borrowers get nothing or actually lose benefits like rewards programs.

This viewpoint often connects to broader frustrations about government dependency. If credit becomes cheaper regardless of behavior, critics argue, what incentive exists for financial discipline? They point out that personal finance education, budgeting, and living within one’s means are available to everyone, regardless of income.

However, this framing oversimplifies the reality of who carries credit card debt. Research shows that medical emergencies, job loss, divorce, and other life disruptions drive much of America’s credit card debt. Many struggling borrowers are working multiple jobs and still falling behind due to rising costs.

A Balanced Analysis

The Potential Benefits:

Consumer Savings: Capping rates at 10% could halve interest costs for millions carrying balances. For borrowers paying 20-23% currently, this would free up disposable income, potentially reducing financial stress and defaults.

Reduced Financial Stress: Lower interest rates would reduce the psychological burden of overwhelming debt. This could have positive spillover effects on mental health, family stability, and workplace productivity.

Increased Economic Stimulus: Lower interest rates could encourage spending on goods and services, providing an economic lift.

The Potential Risks:

Card Cancellations: Banks warn that a 10% cap would make lending unprofitable for higher-risk borrowers, leading to lower credit limits or card cancellations. This would particularly harm lower-income consumers who rely on credit cards.

Higher Fees: Issuers might offset lost interest revenue with increased annual fees or more severe penalty charges.

Cancellation of rewards programs: Cashback, points and travel benefits are largely subsidized by interest payments. A rate cap could force issuers to reduce or eliminate these programs, disappointing the 40-50% of cardholders who pay their balances in full and currently benefit from these perks.

Push Toward Predatory Lending: Consumers denied traditional credit cards might turn to higher-cost alternatives like payday loans or pawn shops. More concerning, those desperate for credit could fall into the arms of loan sharks and predatory lenders operating in legal gray areas or entirely outside the law. These underground lenders typically charge exorbitant rates, often 60% APR or more, and use coercive or even violent collection practices.

Inflation: Cheaper credit might fuel spending and increase inflation, complicating Federal Reserve rate decisions.

Small Business Effects: Many small business owners use personal credit cards for business expenses. Reduced availability or limits could constrain small business investment and growth.