How We Obtain Alpha Without Exposing Ourselves to Tail Risk

Offense vs. Defense

The perceived trade‑off: Offense vs. Defense

Conventional wisdom says you can either pursue alpha or buy protection against market crashes BUT not both. It’s a problem because unhedged portfolios will suffer large drawdowns but make alot of money when markets are going up, while hedged portfolios will suffer small drawdowns but will make less money when markets go up.

Many believe portfolios that make alot of money are simply over exposed to tail risk and it will soon catch up with them.

We reject that trade‑off. You shouldn’t have to choose between protecting your portfolio and growing it. We design algorithmic volatility trades that do both.

What is “tail risk”?

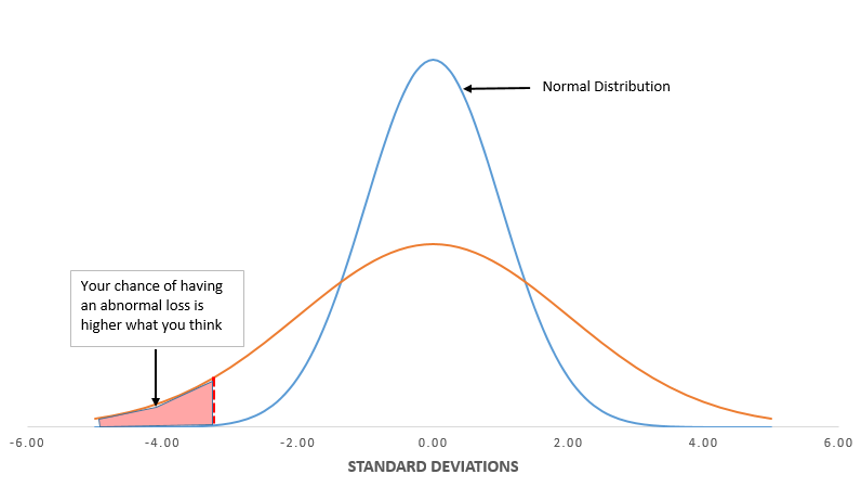

In markets, “tail risk” typically refers to left-tail risk—the rare but severe crashes that can erase months or years of gains. The chart above shows roughly 68% of returns clustering within normal distribution parameters (the blue lines), but it’s the small percentage of extreme outcomes in the left tail that inflict disproportionate damage.

Why Most Traders are Exposed to Tail Risk

Picture two camps of traders:

The Eternal Optimists (only buys stocks): These are the trend-chasers. They’re hooked on buying hot stocks that are climbing. Their whole playbook? “If it’s going up, pile in!” They’re betting the market will keep rising forever, riding the wave of good vibes and FOMO.

The Doom-and-Gloom Bears (only shorts stocks): On the flip side, you’ve got the permanent pessimists who think every rally is a bubble about to pop. They’re always short stocks. They think the world’s ending so let’s bet against everything!

Both groups are “one-sided” because they’re ignoring half the game.

Both groups are extremely exposed to tail risk and eventually have big drawdowns.

Why Volatility is the right tool

While most strategies are one‑sided, our approach is deliberately two‑sided. Volatility is uniquely positioned to generate profits in both directions of the market because it reflects the speed and magnitude of price change, not just the direction.

When markets crash, volatility spikes sharply as investors rush to buy protection. A long-vol position before the crash happens turns market crashes into profits.

The flip side is equally powerful. After the panic passes and volatility contracts, volatility products mean-revert lower as risk premium collapses. Traders who short volatility structures (like selling overpriced calls or shorting UVXY at elevated levels) can harvest that decay as the market normalizes. This “volatility bleed” is a predictable return stream when timed correctly.

At CI Volatility, our research focuses on this duality

When volatility expands, our long-vol algorithms seek to profit from convex payoffs that benefit from acceleration in fear.

When volatility contracts, our short-vol algorithms aim to capture the premium decay left behind.

By integrating protection with performance our approach makes it easier to outperform broad market indices, especially in the inevitable years when those indices are negative.

So yes, you can have alpha without exposing yourself to tail risk. We do it by using our proprietary algorithms so that defense and offense work together.