The VIX doesn’t behave like a stock when it touches its moving averages. It’s a mean-reverting index that oscillates around a long-term average near 19–20.

To prove this point, we tested the 5, 10, 20, 50, and 200-day simple moving averages (SMAs) from 1990 to 2025 and tracked the performance afterward.

Key Statistics for Each SMA Touch

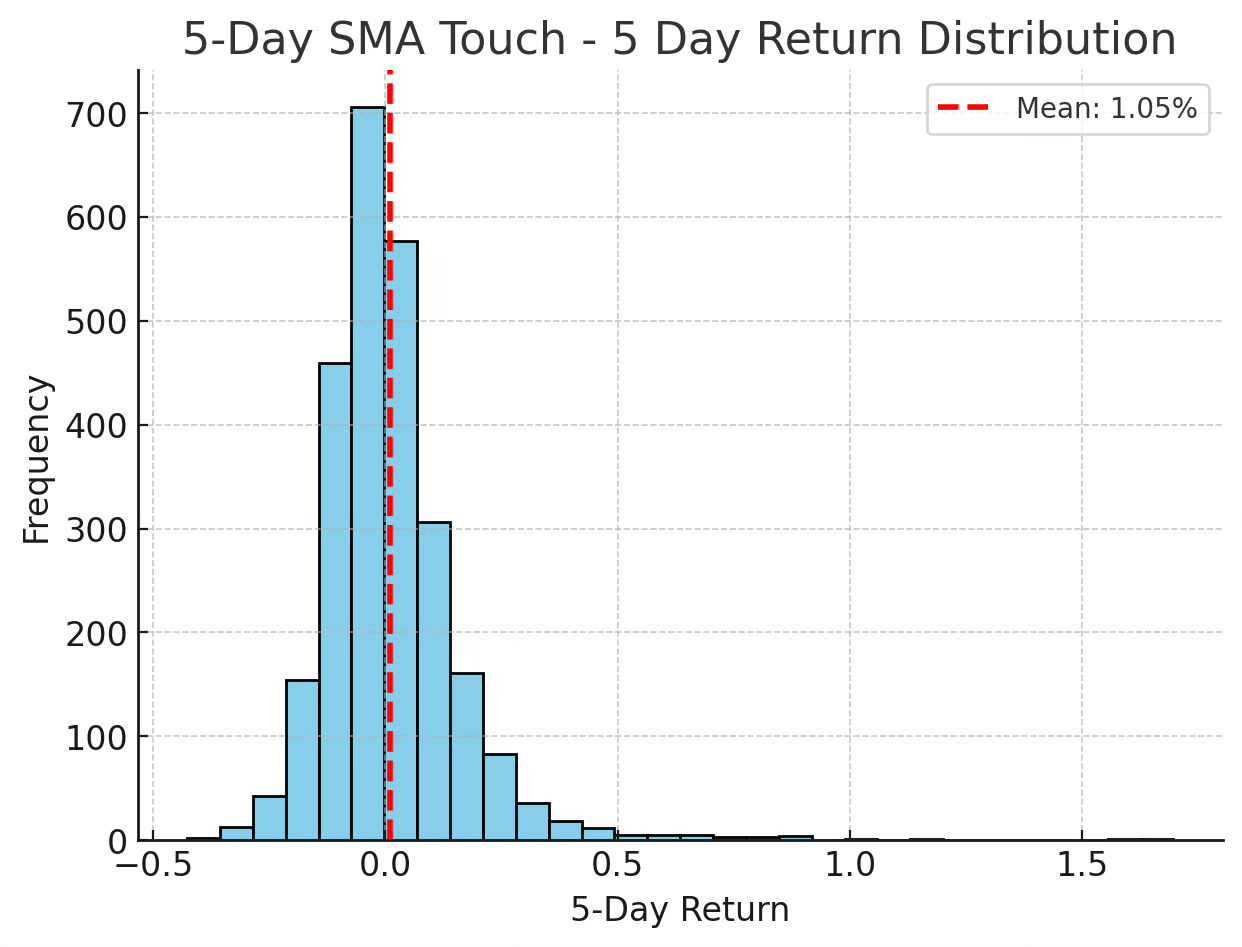

5-Day SMA

Occurrences: 2,601

Average next-day return: +0.10%

Average 1-week return: +1.05%

1-day outcomes: 46% positive / 53% negative

1-week outcomes: 46% positive / 54% negative

Median days to revert: 3

Average days to revert: ~3.5

Avg VIX level at touch: ~19.3

Very frequent — roughly once every 3–4 trading days. Quick reversion in about 3 days.

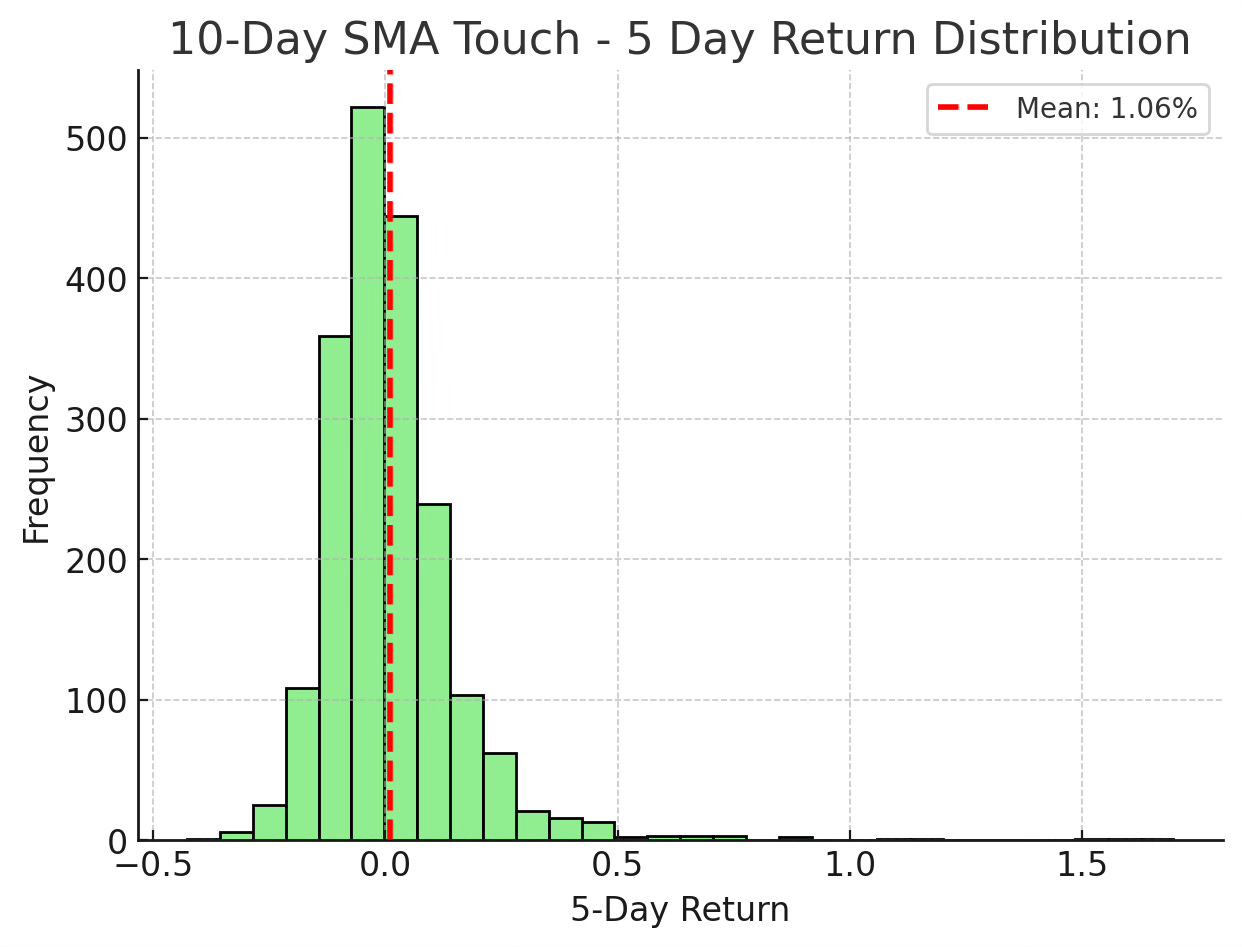

10-Day SMA

Occurrences: 1,938

Average next-day return: +0.33%

Average 1-week return: +1.06%

1-day outcomes: 46% positive / 54% negative

1-week outcomes: 46% positive / 54% negative

Median days to revert: 3

Average days to revert: ~4.6

Avg VIX level at touch: ~19.0

Slightly stronger short-term drift than the 5-day, but still mean-reverts in under a week.

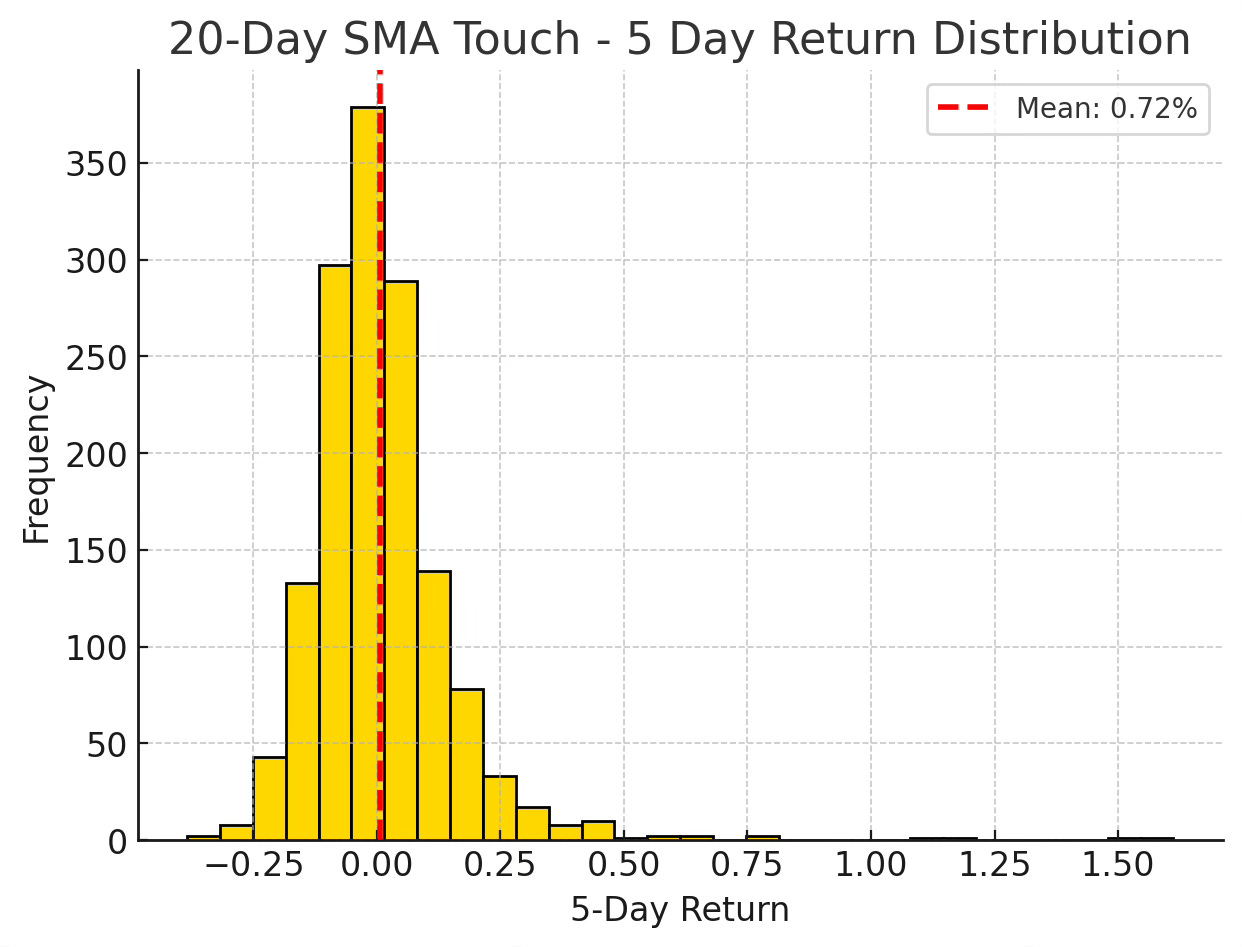

20-Day SMA

Occurrences: 1,448

Average next-day return: +0.19%

Average 1-week return: +0.72%

1-day outcomes: 46% positive / 53% negative

1-week outcomes: 47% positive / 53% negative

Median days to revert: 3

Average days to revert: ~6.2

Avg VIX level at touch: ~18.9

Touches are less frequent, and the VIX tends to hover longer before reverting.

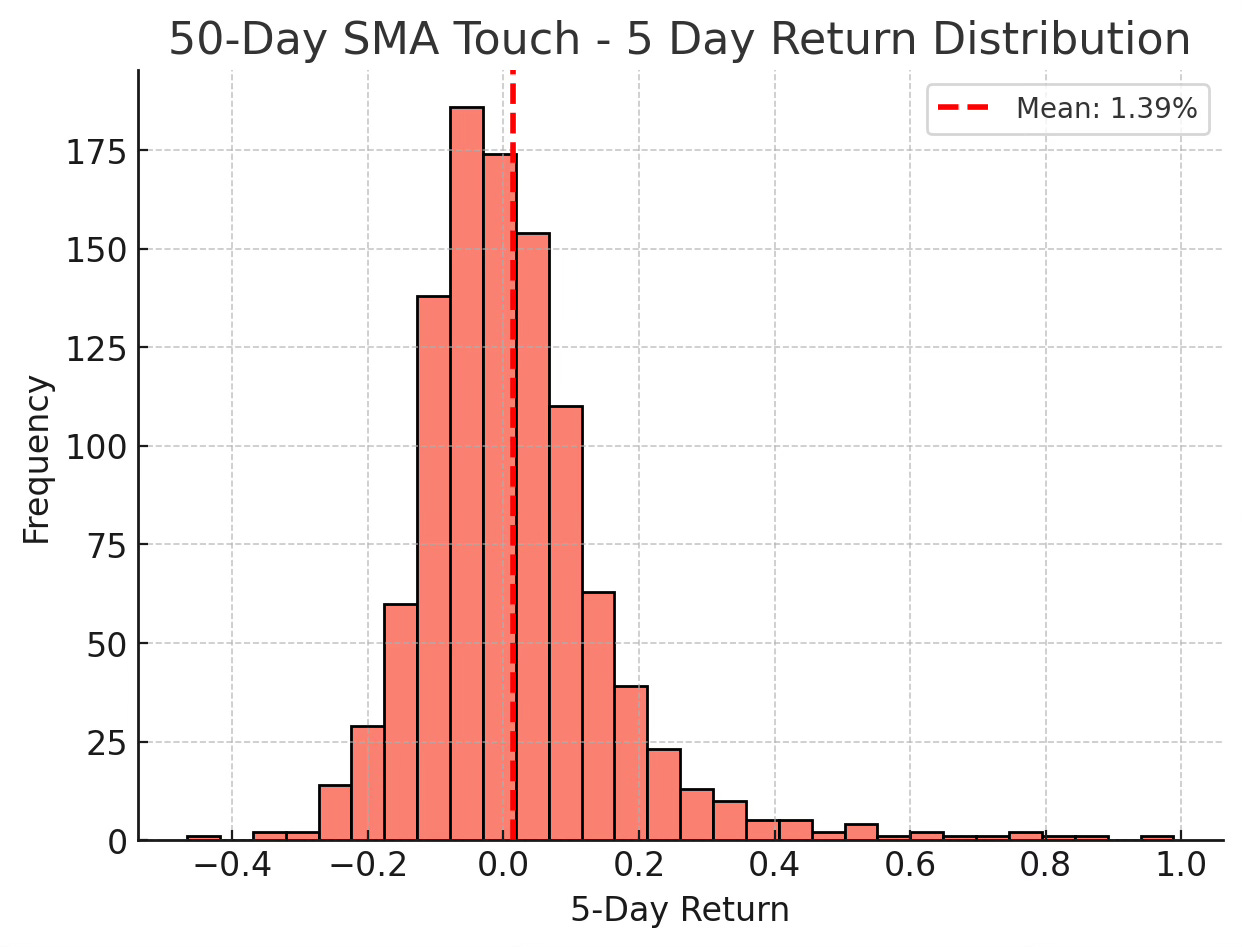

50-Day SMA

Occurrences: 1,046

Average next-day return: +0.01% (flat)

Average 1-week return: +1.39%

1-day outcomes: 43% positive / 57% negative

1-week outcomes: 48% positive / 51% negative

Median days to revert: 3

Average days to revert: ~8.6

Avg VIX level at touch: ~18.5

Signals happen ~28 times per year. They linger longer, with mean reversion stretching toward 2 weeks.

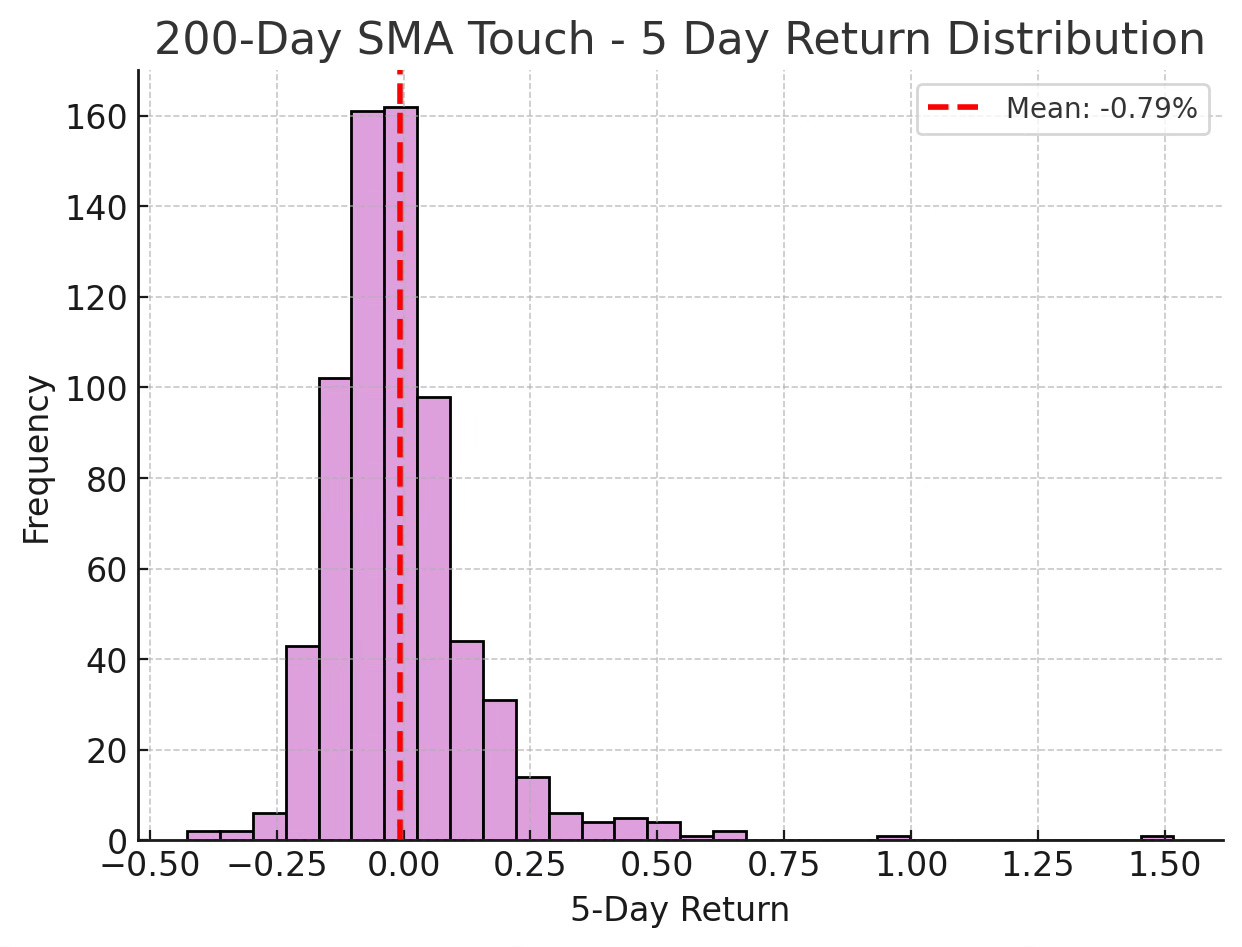

200-Day SMA

Occurrences: 689

Average next-day return: –0.33%

Average 1-week return: –0.79%

1-day outcomes: 43% positive / 56% negative

1-week outcomes: 39% positive / 61% negative

Median days to revert: 3

Average days to revert: ~12.7

Avg VIX level at touch: ~18.3

Rare — only about 19 per year. These touches usually occur when VIX is calm. Reversions are the slowest, averaging over 2 weeks.

Can Traders Use This Information?

Not as a trend signal. Unlike stocks, where moving average touches can signal momentum, the VIX’s touches mainly highlight its mean-reverting nature.

Next-day predictability is weak. None of the SMAs show more than ~46% positive outcomes; the VIX is nearly a coin flip the next day.

One week later: There’s a slight bias toward negative outcomes, especially at the 200-day SMA, where the VIX is lower about 61% of the time.

For traders, these signals are best viewed as context about market fear returning toward normal, not as actionable “buy volatility” opportunities.