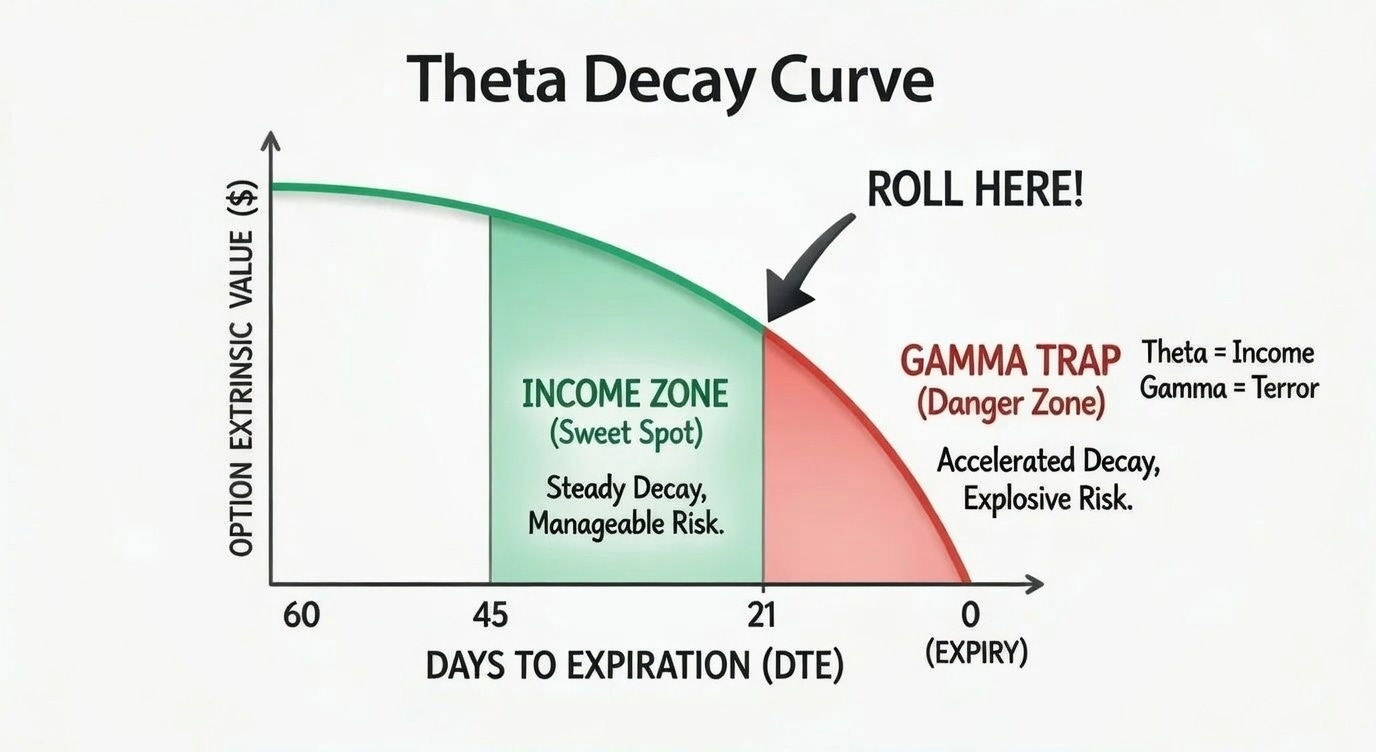

Time decay, or theta, measures how much an option’s value erodes each day as expiration approaches, assuming all else (like underlying price and volatility) stays constant. Theta is typically negative for long options (buyers lose value over time) and positive for short options (sellers gain from decay).

The key feature of theta is that it’s non-linear. Decay starts slow when there are many days to expiration (DTE) and accelerates dramatically as expiration nears.

Here is the classic visualization of this curve: