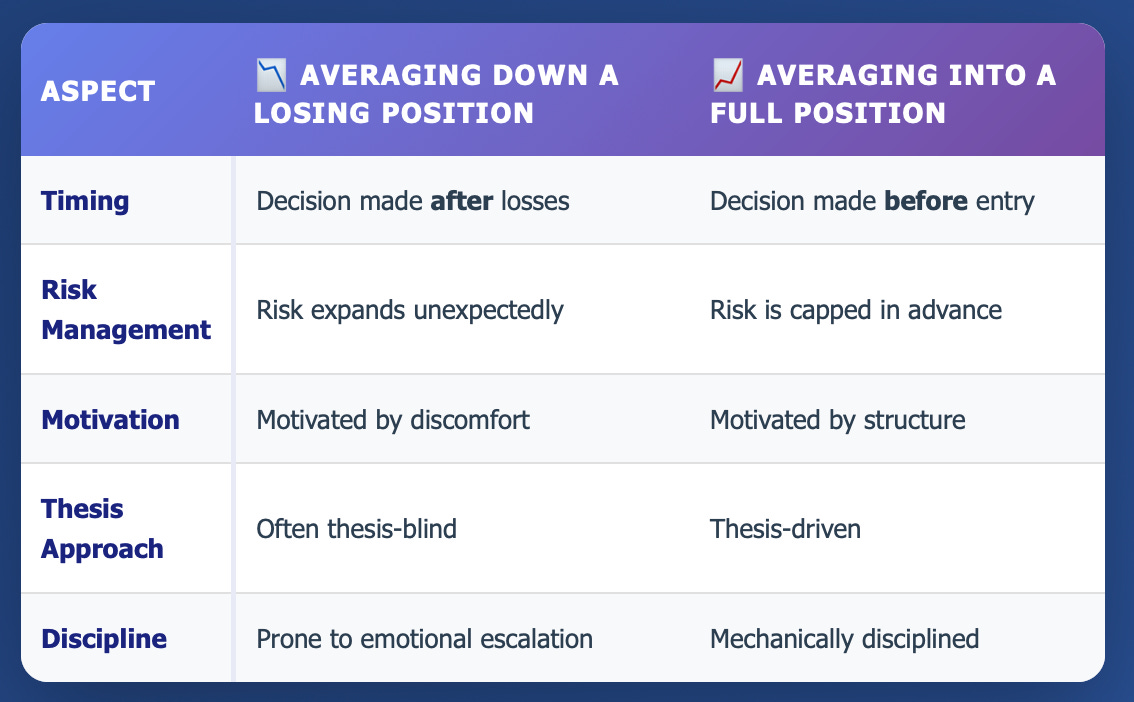

Averaging Down is not the same as Averaging Into a Full Position

Why One Is Risk Management and the Other Is Often Self-Destruction

There are two types of averaging downs

Averaging down a losing position

Averaging down into a full position

Averaging Down a Losing Position

Averaging down a losing position usually happens after you’re already fully exposed.

You bought your intended size.

The market moved against you.

You’re now adding more capital because the trade is red.

This is not risk management.

The key characteristics:

The original thesis is already under pressure

Your maximum risk is increasing, not decreasing

Position size is being dictated by price movement, not probabilities

The decision is often framed as “this can’t go much lower”

Lowering your cost basis feels productive, but it does nothing to improve the probability of the trade working. If anything, it amplifies the consequences of being wrong.

This is how small losses quietly turn into portfolio-level damage.

Averaging Down Into a Full Position

Averaging down into a full position is fundamentally different because the decision happens before the first buy.

You are not “adding because it’s down.”

You are executing a planned exposure across multiple price levels.

The defining traits:

Maximum position size is predefined

Capital is deployed incrementally

Risk is calculated on the full position, not the initial entry

Price moving against you is expected, not surprising

This is position construction, not damage control.

Professional investors do this constantly:

Scaling into volatility

Building exposure into illiquid assets

Structuring entries where timing precision is impossible